Headline Developments

Aptera Motors (private), backed by Alphabet (GOOG) and NRG Energy (NRG), have unveiled their ‘Never Charge’ EV that boasts a range of 1,600 km; open for pre-orders here. That’s a trip from Melbourne to Brisbane or from Vancouver to San Fran! This is achieved via a built-in solar array, comprising ~3sqm of solar panels, combined with advanced lightweight materials and incredible aerodynamics.

Elon Musk’s unmanned Starship SN8 prototype, which he believes can take passengers to Mars within six years, had a successful test flight…..and an unsuccessful test landing this week! The Starship hit the desired 8-mile altitude before free-falling back to earth as planned. However, touchdown velocity was a little high once engines reignited, causing a less than smooth landing. Skip fwd to the 1hr 48:00 mark in the below video for takeoff, or (if you want to jump to the explosive ending) go straight to 1hr 54:40! Despite the landing, Musk was immensely satisfied with the result (perhaps a lesson in embracing failures on the path towards innovation!).

China has claimed the fastest quantum computer in the world, called Jiuzhang. The computer is reportedly 10bn times faster than Google’s (GOOG) Sycamore. The key difference is that Jiuzhang’s technology uses optical circuits whilst Sycamore uses superconducting materials on a chip. Prof John Martinis, a former Google quantum physicist, says there are many questions surrounding the paper and “it’s not quite clear they can claim this big computational complexity”.

Trust in Huawei (002502.SZ) takes a further hit as news surfaced that the telecom equipment provider has tested facial recognition systems that could be used to detect members of a minority Muslim group (Uighurs). According to IPVM and the Washington Post, Huawei tested the AI software of the Macquarie (MQG.AU), Alibaba (BABA) and Foxconn (2354.TW) backed MEGVII (private) on its video cloud infrastructure. If the system detected the face of a member of the mostly Muslim minority group, the test report said, it could trigger a “Uighur alarm” — potentially flagging them for police in China. This is bad timing for Huawei who are trying to convince major nations that they can be a trusted, independent provider to 5G networks. This also surely brings into question Macquarie’s (and others) ethics when it comes to assessing potential investments…?!

Chinese oil major CNOOC (883.HK) and semiconductor major SMIC (981.HK) have been added to a US blacklist of companies owned or controlled by the Chinese military. Other additions include the private China Construction Technology and China International Engineering. This takes the list to 35 companies which US investors will be banned from investing in from late 2021.

The Monetary Authority of Singapore (MAS) has approved four organisations to be the country’s first digital banks. The companies include a Digital Full Bank (DFB) - comprising Grab Holdings (private), SingTel (Z74.SGX) and Sea Ltd (SE) - and a Digital Wholesale Bank (DWB) - comprising Ant Group (private) and a mix of HK and China State-Owned financial institutions. It is expected that the new banks will start operating from early 2022.

Other Developments

Bosch (private) have begun plans for full-scale production of distributed power stations based on 18%-owned Ceres Power’s (CWR.AIM) fuel cell technology. Under the plans, Bosch will scale up Ceres’ Solid Oxide Fuel-Cell technology (SOFC) production for use in distributed power stations and aligned industries - power stations, cities, factories, data centres, and EV charging infrastructure. As shown in the video below, this is quite a significant technology and is positioned extremely well to drive emission reduction targets.

QuantumScape (QS), a battery tech company backed by Volkswagen (VOW3.DE) and Bill Gates, said its solid-state battery could charge to 80% in 15 minutes, or about half the time required for Tesla’s (TSLA) newest Superchargers. "Seeing these performance numbers is almost unheard of: roughly 50% improvement in volumetric energy density is incredible when we are used to seeing single-digit per cent per year, and that was hard to achieve and a great outcome," Tesla co-founder JB Straubel said. "Jumping to something like 50% is game-changing."

Denmark’s Government is showing real leadership, passing a tax plan that should see at least 750k electric vehicles on the road by 2030. The plan envisions a gradual increase in taxes and charges for cars with a combustion engine and lower taxes for EVs and charging. In principle, the parliament wants to link the amount of tax to CO2 emissions rather than mileage. Countries like Australia are doing the opposite!

Finance ministers and central bankers from the G7 strongly supported the need to regulate digital currencies, the US Treasury Department said in a statement on Monday after a virtual meeting of the officials. German Finance Minister Olaf Scholz, speaking in regards to Facebook’s (FB) Libra (now Diem) currency, said “a wolf in sheep’s clothing is still a wolf” and that “ It is clear to me that Germany and Europe cannot and will not accept its entry into the market while the regulatory risks are not adequately addressed."

So, as the G7 democracies align with digital currency regulation, China continues to push forward with its digital currency roll-out. JD.com (9618.HK) became the first online platform to accept China’s digital currency during the week. As part of the ongoing trial/roll-out, 100k citizens of Suzhou will receive (via a lottery) up to 200 yuan ($30) in ‘red packets’ via an app. Those who receive the red packet will be allowed to spend on JD.com’s shopping platform.

The National Security Agency (NSA) say Russian state hackers are compromising multiple VMWare (VMW) systems in attacks that allow the hackers to install malware, gain authorised access and maintain a persistent hold on widely used remote work platforms. We believe, companies such as Crowdstrike (CRWD) and Okta (OKTA) - purpose-built for the cloud and “platformification” - will continue to gain significant market share in the endpoint and access markets as state-led hacking (from China, Russia and Iran in particular) grow in scale and severity.

Palantir (PLTR), which has tripled since its October IPO, rallied 25% this week after confirming a $44m contract with the US Food and Drug Administration (FDA). According to Reuters, the three-year contract covers data and analytics services to the FDA’s Center for Drug Evaluation and Research (CDER) to speed its review of potential new medicines.

Enterprise analytics company Microstrategy (MSTR) is raising $400m to buy more bitcoin - the company’s primary treasury reserve asset. This would increase the company’s holding in bitcoin from 40,824 to 62,847 (equating to $1.14b or ~43% of its market cap). This means the non-bitcoin market cap is $1.5bn, putting the core enterprise business on 3x P/S v Alteryx (16.5x), DataDog (54x), Salesforce (10x) and Elastic (24.3x). It appears cheap, however flatlining growth of the core business is likely hindering a higher valuation. Also worth noting Microstrategy v Grayscale Bitcoin Trust (GBTC), a major listed bitcoin proxy. GBTC trades at ~19% premium to its actual crypto holdings, which seems a tad daft! They hold ~3.37% of all outstanding supply.

The Federal Communications Commission (FCC) have announced the 180 beneficiaries of a $9.2b 10-year fund to connect those in regional communities. The big winners were Elon Musk’s Starlink (private) with $885m and Charter Communications (CHTR) with $1.22b.

AT&T’s (T) WarnerMediaannounced it will release all 17 movies it has slated for 2021 to its streaming service HBO Max at the same time these films will debut in movie theatres. This follows an earlier announcement to release Wonder Woman on Christmas Day on HBO Max and in cinemas simultaneously. This move will continue to put pressure on cinema chains who have been hard hit by the pandemic. HBO Max currently has ~12.6m active subscribers v 73m for Disney+ and ~195m for Netflix.

IPOs

A HUGE week for IPOs as a handful of companies hit the market before year-end, taking advantage of surging demand for tech listings. Doordash (DASH) and C3.ai (AI) kicked things off with the two companies surging 85% and 120% respectively on their market debut. Softbank (9984.JP) will reap ~$10bn from its DoorDash stake! Airbnb (ABNB) was next off the blocks, rallying 113% on day one. This puts Airbnb on a 9.5x 2021 P/S v Booking Holdings (BKNG) at 8.5x and Expedia (EXPE) at 2.5x. All companies have 2021-22 expected revenues growth rates of between 35-40%.

Macquarie sponsored Australian technology company Nuix (NXL.ASX) completed a $1.8 billion IPO on the ASX. On debut the shares were up ~50%, re-rating from 9x EV/FY21e Revenue to ~15X. Nuix sells intelligence software to organisations such as law enforcement agencies and professional services firms that help them process and analyse large, unstructured data sets (e.g. hard drives, emails, chat messages, internet browsing histories and financial records).

M&A | Cap Raise

In line with an IPO rush, there’s also a substantial number of M&A deals being announced before the extended holiday break.

Noise around the potential merger of SE Asian ride-hailing and food delivery giant Grab (private) and GoJek (private) is getting louder. A deal between Grab, valued at nearly $15bn and Gojek, last valued at close to $10bn, would be the biggest tech merger in south-east Asia. The two startups have been urged to combine forces by investors, particularly SoftBank, after a fierce rivalry for market share.

It’s now confirmed that Uber (UBER) will merge their AV unit, Uber ATG, into Aurora (private). Under the arrangement, Uber will hand over Uber ATG to Aurora with $400m cash. In return, Uber will receive a 26% stake in the merged AV entity. Shareholders in Uber ATG (Toyota, Denso, Softbank) and key ATG employees will own ~14% in the merged entity. The other 60% will be owned by core Aurora shareholders, namely Amazon (AMZN), Hyundai (005380.KS) and Shell (RDSA.AMS). You can see Aurora/Uber ATG (in yellow) and the interconnecting ownerships in the bottom left quadrant of the below diagram.

Prior rumours of a Boston Dynamics (private) acquisition from Hyundai (005380.KS) became true. The deal is expected to be worth around $1bn and is set for approval at Hyundai’s December 10 board meeting.

Fresh on the heels of launching its US online pharmacy, Amazon (AMZN) are reported to be eyeing a $100m stake in India’s Apollo Pharmacy, part of the Apollo Hospital (APOLLOHOSP.BO) group. Apollo Pharmacy has over 3.5k pharmacies and claims to be Asia’s largest pharmacy chain.

Cisco (CSCO) has agreed to acquire IMImobile (IMO.AIM) for US$730m in cash. The deal equates to a multiple of 3x P/S and 11.5x P/GP. London-based IMImobile is a cloud communications software provider with a focus on Customer Interaction Management (CIM). The firm's platform includes automation, orchestration, and monitoring features for client engagement across different devices, social media channels, messaging, and voice applications.

Sino-American Silicon’s (5483.TW) unit GlobalWafers will buy Germany’s Siltronic (WAF.ETR) for $4.5 billion. The combined company is expected to have a market share of ~33%, making it the world's largest silicon wafer manufacturer.

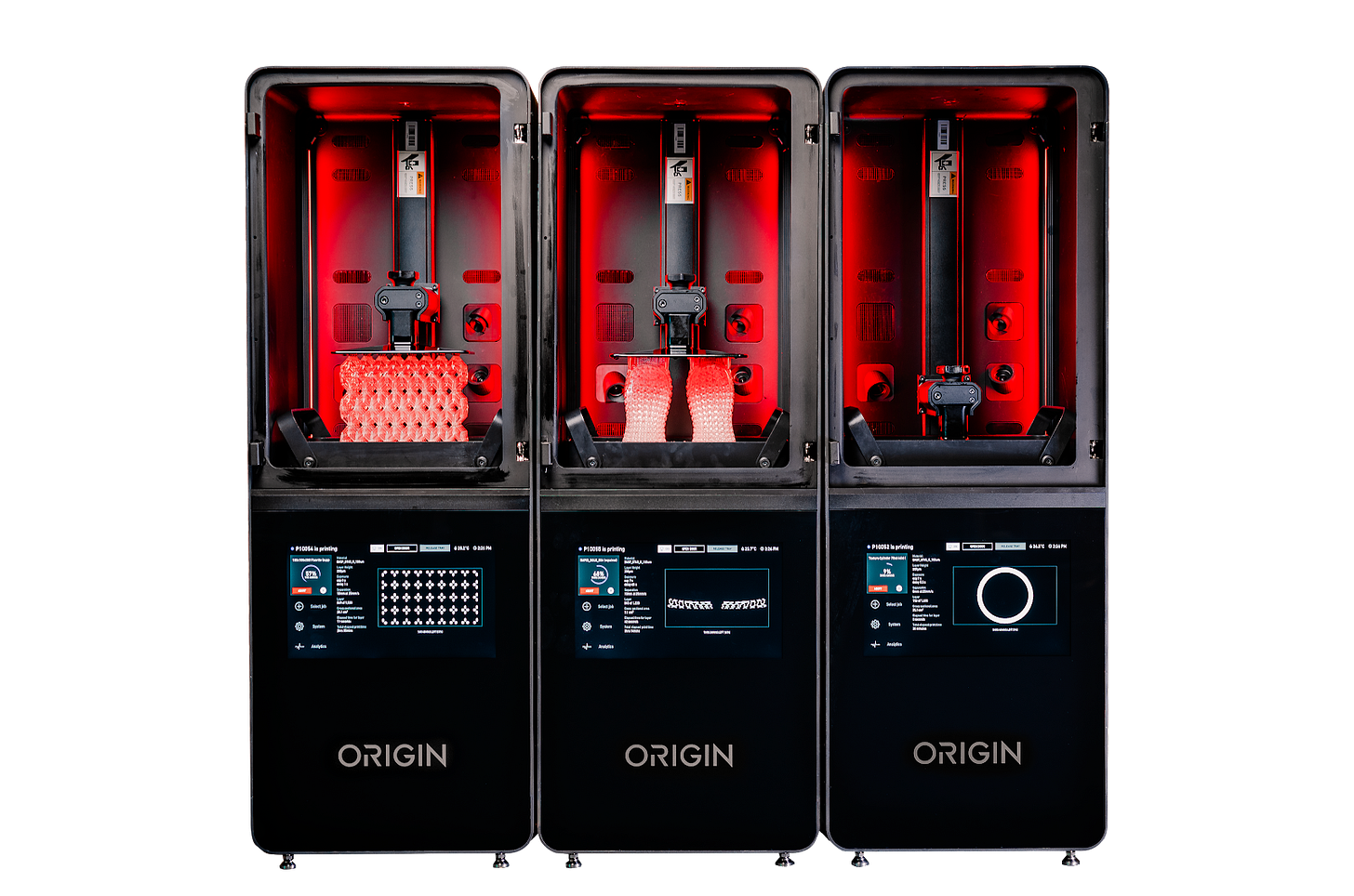

Israeli 3D printing company Stratasys (SSYS) are buying the open stereolithography (SLA) startup Origin (private) for $100m. Stratasys CEO Yoav Zeif said, “with our intended entry into powder bed fusion technology, the acquisition of Origin reflects another step in fulfilling our objective to lead in polymer additive manufacturing by offering comprehensive, best-in-class technologies and solutions to create a fully digital additive value chain, designed for Industry 4.0 integration.”

Softbank (9984.JP) is considering a new strategy to go private by gradually buying back its own shares. The unusual approach would likely take more than a year and require asset sales to fund successive buybacks. Masayoshi Son, who owns 27% of Softbank, would need to get to 66% ownership in order to compel remaining minority shareholders to sell their shares (potentially without paying a premium).

Earnings

MongoDB (MDB) , the leading document-based database platform, delivered a very strong quarter with $151M revenue (+38% YoY) vs $139M consensus (9% beat). MongoDB Atlas, the first cloud database to enable an application to run simultaneously across multiple cloud providers, grew 61% in Q3. Guidance was also ahead with $156M revenue for 4Q vs $146M consensus (7% raise).

Investors sent shares of Stitch Fix (SFIX), the personal styling online clothes store up 39% on Tuesday after it reported better-than-expected earnings of 9c EPS vs a loss of 20c expected.

Have a great weekend.

Charlie

LinkedIn or E-Mail (cnave@granitebaycap.com)

Granite Bay Capital is an innovation focussed investment company with a deep focus on the companies at the leading edge of innovation across major themes such as AI, ubiquitous computing, sustainability, automation and longevity. Any views expressed in this article are those of the author(s) and do not constitute financial advice.