Headline Developments

In a staggering breach, hackers have managed to hide malicious code in a software update of SolarWinds (SWI) called SolarWinds Orion. The hackers, believed to be sponsored by the Russian government, injected the malware into updates between March and June 2020. This allowed the hackers into customer networks and gave them the ability to spy on emails. Here’s the most astounding thing - Orion customers who may have been hacked include The Pentagon, the army, the navy and the Department of Veteran Affairs. Prior customers include the National Institute of Health, DHS and the FBI! SolarWinds is off 25% this week as a result!

China’s anti-trust regulator has fined Alibaba (BABA), Tencent (700.HK) and logistics company SF Holding (002352.SZ) for failing to disclose acquisitions of smaller competitors. “The online economy has become increasingly concentrated by market share, with resources fast concentrating in leading platforms,” the regulator’s anti-monopoly bureau said. “Complaints about platform monopoly have been increasing day by day, indicating competition risks and problems in the online economy.” The specific companies fined are Alibaba Investment, China Literature ( 59% owned by Tencent) and Shenzen Hive Box Technology (partly owned by SF Holding).

Oracle (ORCL) follows HP Enterprise (HPE) and Tesla CEO Elon Musk in relocating to Texas. In a statement provided to TechCrunch, Oracle said they believe “these moves best position Oracle for growth and provide our personnel with more flexibility about where and how they work”.

Business Insider reported that Amazon (AMZN) are on the cusp of scaling their internal telehealth service to other large companies. Currently only available to select Amazon employees, the service has a mobile app to provide in-person and online doctor visits. This, in conjunction with its shift into pharmaceuticals and vast economy of scale, is a worry for competing telehealth platforms such as Teladoc (TDOC) which fell sharply (by 7%) once the Business Insider article went live.

Other Developments

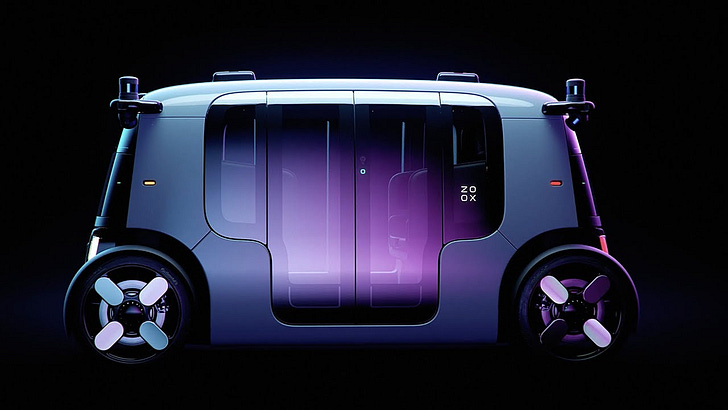

Amazon’s (AMZN) recently acquired AV unit Zoox revealed a prototype of its robotaxi that could one day spend 16 hours a day offering rides in cities, thanks to a battery 2x size of traditional EVs. The Zoox vehicles, with no steering wheel or brake pedal, are intended for ride-hailing services, however, due to the added complexity of regulations (with no safety driver) we expect roll out to lag that of market leaders Waymo, Lyft and Cruise (to name but a few).

The Hyundai (005380.KS) and Aptiv (APTV)-backed AV unit Motional (private) is aiming to launch a fully autonomous ride-hailing service by 2023, leveraging the network of Lyft (LYFT). This is the first time Motional have specified a launch date for the service and, despite joint testing in Las Vegas, is the first time a formal long-term partnership has been formalised.

Collaborative Robot (cobot) company Universal Robots (UR), owned by Teradyne (TER), just sold its 50,000th UR cobot, purchased by a German manufacturer to enable higher productivity and improved employee safety. Unlike traditional industrial robots which tend to be locked inside cages, cobots are designed to interact with people in a shared work environment. Cobots are the fastest-growing industrial automation segment, projected to grow at a CAGR of ~30% between 2020 to 2025.

The Royal Air Force Capabilities Office provided updates regarding their forthcoming 6th generation fighter dubbed "Tempest." BAE Systems (BA.LON) is the aircraft lead. Some anticipated capabilities include the use of artificial intelligence to assist the pilot, manage drones in support of the fighter, and all the advancements that came along in the 5th generation, including stealth and data fusion. The below graphic from BAE sheds more light on the Tempest system.

EchoStar (SATS) unit HughesNet, one of the largest satellite internet providers in America, has entered a $250m three-year contract with UK-based OneWeb (private) to develop and manufacture ground system technology for its satellite LEO constellation. LEO will compete with SpaceX’s Starlink system and Jeff Bezos’ Project Kuiper. Under the arrangement, Hughes engineers will design OneWeb’s gateways (that sit between the satellite and the end-user). OneWeb is aiming for a constellation of 48,000 satellites v a 12,000 target for Starlink. Kuiper currently has approval for ~3,200 satellites which, this week, announced its new antenna design (below) capable of streaming 4K-quality videos from space.

Virgin Galactic (SPCE) stock fell 20% this week after the company cut short its latest spaceflight test mid-launch on Saturday. After being released from its mothership, SpaceShipTwo’s onboard computer lost connection with the rocket motor. This triggered a fail-safe scenario that intentionally halted the motor’s ignition. Despite the setback, the company expects to repeat the spaceflight attempt from its operating base at Spaceport America in New Mexico.

Zoom Video Communications (ZM) said it would expand its presence in Singapore by opening an R&D centre hiring hundreds of engineering staff. Zoom will also double its data centre capacity in Singapore. Last month Singapore announced a new visa for foreign executives of technology firms while at the same time clamping down on broader immigration to placate fears over foreign competition for local jobs.

IPOs

Gaming company Roblox (RBLX) and fintech Affirm (AFRM) have delayed their IPO plans to 2021. The move comes after Doordash and Airbnb jumped 86% and 112% on their respective stock market debuts. The hot IPO market makes it difficult for issuers to price public offerings correctly so as not to leave money on the table. Both Roblox and Affirm will consider sellers a larger proportion of their shares and change the mix of stock to be sold by the company, employees and other shareholders to mitigate the initial pop's magnitude according to the WSJ.

ContexLogic (WISH) on the other hand, pushed ahead with its IPO, setting a price of $24 to raise ~$1.1bn. The company shares closed down 5% on its first day of trade. With 100 million monthly active users in more than 100 countries, Wish says it is the most downloaded shopping app, with more than 500k merchants selling 150m items to customers. About 1.8 million items are sold daily.

Online shopping startup Tokopedia (private) is in talks to merge with SPAC Bridgetown Holdings (BTWN) backed by billionaires Richard Li (of PCCW) and Peter Theil. In the deal, Tokopedia, backed by SoftBank and Alibaba, would be valued at $8-10bn.

Healthtech company Certara (CERT) closed up 72% on its first day of trading post its IPO. Certara, backed by PE firm EQT, uses computer models to simulate how drugs will behave in patients. The software company’s technology has been used to aid the fight against COVID-19 in optimizing dosing, speeding up the development process and therapy development.

Desktop Metal (DM) announced its completed SPAC transaction. DM is the only publicly traded pure-play Additive Manufacturing 2.0 company, offering the fastest metal 3D printing technology in the market. The additive manufacturing industry is estimated to grow from $12 billion to $146 billion this decade as it shifts from prototyping to mass production. Legendary technology investor Leo Hindery, Jr., joined the Desktop Metal’s board.

Upstart Holdings (UPST), which sells AI technology to banks, rose 47% in its market debut this week. Upstart’s AI platform enables banks to offer higher approval rates and experience lower loss rates while simultaneously delivering a digital-first lending experience. Upstart’s model has reportedly seen 75% fewer defaults (at the same approval rate) and a 173% increase in approvals (at the same loss rate).

M&A | Cap Raise

Electronic Arts (EA) counterbid to buy Codemasters (CDM.LN) for around $1.2bn. Codemasters, the maker of racing car games Dirt, Grid and Formula 1 had earlier agreed to a $970m deal with Take-Two Interactive (TTWO). EA owns the Need for Speed franchise, so buying Codemasters would give it a stranglehold over the racing game market. Take-two said it is considering its position in relations to Codemasters and may well table an improved offer.

Vista Equity Partners announced it was acquiring Pluralsight (PS) for $3.5bn. Pluralsight is an online training company that helps educate IT professionals such as developers, operations staff, data and security staff with a suite of online courses. It's fair to say that the pandemic has supercharged demand for edtech, particularly in the IT sector where demand for software engineers is outstripping supply.

Hot on the heels of Slack’s acquisition by Salesforce, The Information laid out Dropbox (DBX), Box (BOX), New Relic (NEWR) and MongoDB (MDB) as potential high-profile takeover targets. In particular, Dropbox is speculated to be a potential target for the likes of Google, Oracle, IBM, SAP or ServiceNow.

Despite delaying its IPO, Roblox is not remaining idle. The company acquired Loom.ai (private) during the week, whose technology brings expressive and interactive 3D loomie avatars into mobile messaging, video conferencing, games, entertainment, AR/VR, live streaming, online education and training. Loom.ai will enable Roblox developers to build next-generation avatars showing facial expressions and emotions.

Reddit (private) is buying short-form video platform Dubsmash (private) becoming the latest social media firm to take on ByteDance’s TikTok (which is expected to hit 1bn users in 2021). This follows from Snapchat (SNAP) rolling out Spotlight in November and Facebook (FB) launching Instagram Reels in August.

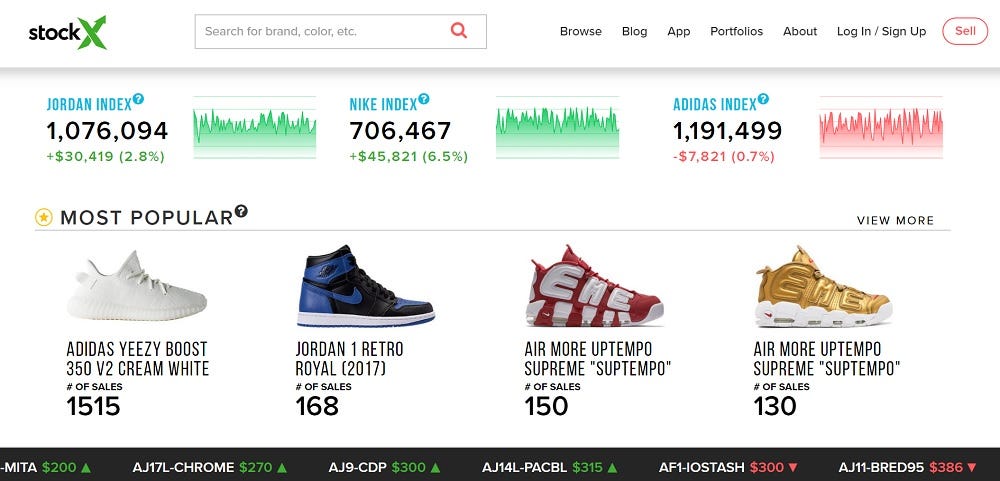

StockX (private) raised $275m in Series E funding, valuing the retailer at $2.8bn. The company intends to use the proceeds to accelerate international expansion and product development and expand StockX’s categories. There are also suggestions that this round is positioning the company for an IPO in 2021. StockX started as a platform for buying and selling sneakers via a ‘stock market’ bid/ask UX. Unlike other e-commerce platforms, StockX stands in the middle, authenticating all products (through global authentication centres) before shipping. After proving the model in sneakers, they’ve since expanded to streetwear, collectables, watches and handbags.

Have a great weekend.

Charlie

LinkedIn or E-Mail (cnave@granitebaycap.com)

Granite Bay Capital is an innovation-focused investment company with a deep focus on the companies at the leading edge of innovation across major themes such as AI, ubiquitous computing, sustainability, automation and longevity. Any views expressed in this article are those of the author(s) and do not constitute financial advice.