Headline Developments

Microsoft (MSFT) is teaming up with General Motors (GM) AV subsidiary Cruise (private) to help accelerate commercialisation of the unit. Microsoft is also contributing to a new funding round of $2b along with GM and existing investor Honda (7267.JP). As part of the deal, Cruise will use Azure’s cloud platform to help them scale Cruise into the mass-market.

Trump has used some of his final days in office to put further pressure on Huawei. This time, Trump’s administration has notified Huawei’s suppliers, such as Intel, that licenses to sell to the company will be revoked. According to Reuters, Japanese flash memory chipmaker Kioxia (private) had at least one license revoked.

Netflix (NFLX) is up ~17% as it beat subscriber number estimates. The company said they added 8.5m new subscribers in the December 2020 quarter, hitting 203.66m subscribers in total. That’s 2m more than expected and represents ~4% quarterly growth. Impressive, but nothing compared to the numbers Disney+ are hitting. They grew ~18% (to 86.8m) in the two months to 2nd Dec alone. Add to that Disney’s Hulu numbers (38.3m) and ESPN+ (11.5m) and the combined subscriber numbers are at 137m. The next update on Disney’s numbers is likely at their 1Q21 webcast on 11th Feb. Amazon Prime are believed to have ~150m global subscribers.

Other Developments

Richard Branson’s Virgin Orbit (private), carrying a cluster of nanosatellites, has reached space after being released from the wing of a Boeing 747 (it failed in its first attempt eight months ago). The aim of the Virgin Orbit program is to be front and centre of a huge wave of companies putting nanosatellites into orbit (such as Australia’s Fleet Space and Myriota). Competitor Rocket Lab, has deployed 96 payloads in 17 launches. One of Virgin Orbit’s key differentiators is that it can be deployed from any major airport in the world (as opposed to a dedicated launch facility).

Meanwhile, OneWeb (private) has secured $400m in funding from Softbank (9984.JP) and Hughes Network Systems to deploy 648 low orbit satellites to provide broadband internet to underserved areas. Its current fleet consists of 110 satellites - 500 short of its 2022 target.

Search engine Duckduckgo (private) has surpassed 100m daily search queries for the first time since launching 12 years ago. This compares to over 5 billion daily search queries for Google but does show a glimpse of light that there is momentum in alternative platforms, particularly for platforms like Duckduckgo who prioritise user privacy as well as user experience. This comes at the same time that other ‘privacy-first’ platforms like Signal and Telegram hit record numbers.

Porsche (PAH3.DE) backed LiDAR startup Aeva (private) has struck a deal with Japanese auto-component major Denso (6902.JP). Under the arrangement, the companies will collaborate to “further develop Frequency Modulated Continuous Wave (FMCW) LiDAR, bring it to the mass market and create a society free from traffic accidents”. As opposed to AM LiDAR, used by Velodyne (VLDR) and Luminar (LAZR), FMCW sends out a constant stream of light and changes the frequency of that light at regular intervals. This, according to Aeva, allows them to determine the location of objects and precisely measure their velocity. Aeva is currently in the process of listing via a SPAC - InterPrivate Acquisition Corp (IPV).

Uber (UBER) is planning to spin out Postmates X, the robotics division of the on-demand delivery startup Postmates that Uber acquired last year for $2.65bn. They then plan to retain ~25% stake in the new startup. The deal is in line with Uber’s streamlined business strategy. In 2020, Uber offloaded shared scooter and bike unit Jump, sold a stake worth $500 million in its logistics spinoff Uber Freight and divested its autonomous vehicle unit Uber ATG and its air taxi play Uber Elevate. The Serve robot (see below), an autonomous sidewalk delivery bot, will be the centrepiece of Postmates X.

Chinese automaker Geely (175.HK), the owner of Volvo (VOLV-B.ST), have announced a partnership with Tencent (700.HK) to develop features for smart cars, along with AV tech. Tencent said in a statement that they would work on mobile apps, multiscreen interactions, smart services and intelligent speech. This follows last week’s announcement by Geely of a tie-up with Baidu (BIDU) on EVs.

BlackBerry (BB) settled its lawsuit with Facebook (FB) after the former claiming that WhatsApp and Instagram, infringed on BlackBerry messaging app patents. This follows BlackBerry and Amazon Web Services signing a deal in Dec 2020 to develop and market BlackBerry's intelligent-vehicle-data platform (Ivy) to help automakers create in-vehicle services. BlackBerry shares have gained 94% so far this year, touching a 2.5-year high.

MediaTek (2454.TW) will use Taiwan Semiconductor Manufacturing Co’s (TSM) 6-nanometer chip technology for its newest chips aimed at high end 5G smartphones. MediaTek is one of a small group of companies with technology to connect phones to mobile data networks competing against Qualcomm (QCOM) and Samsung Electronics (005930.KW)

IPOs

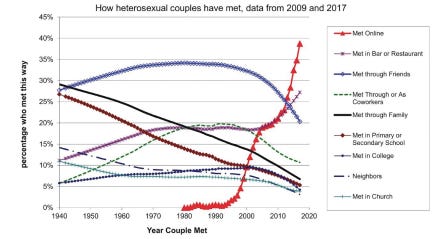

Online dating app Bumble (BMBL) filed for IPO, seeking a valuation of around $8bn. The company said it had 42m monthly active users as of 3Q 2020 and 2.4m paying users Sep 2020 YTD. The company’s primary competitor will be Match Group (MTCH), who own the online dating apps Tinder, Hinge, okcupid, Plenty of Fish and others. Bumble also own the dating app Badoo, which has large appeal in Latin America (Brazil, Mexico) and Europe (France, Spain and Italy).

Krafton Inc (private), the video-game studio behind cult game PlayerUnknown’s Battlegrounds (PUBG) is planning an IPO in 2021. The IPO could value the startup at ~$27.2 billion. PUBG is one of the most successful games of all time, with PC and console sales of more than 70 million copies and more than 600 million mobile downloads. Krafton had revenue of more than $1.1bn in the 9 months to Sep 2020. The company plans to release three more games by 2022, all of which will be based on or related to PUBG (including one that portrays the PUBG universe 300 years into the future).

Online payments specialist, Payoneer (private) is in talks to go public via a merger with SPAC FTAC Olympus Acquisition Corp. The transaction is slated to value the combined entity at more than $2.5bn. Payoneer, founded in Israel in 2005, operates in more than 200 countries. It provides cross border payments for customers including Airbnb, Amazon, Google and Walmart.

M&A | Cap Raise

EV company Rivian (private), backed by Amazon (AMZN) and General Motors (GM), raised a further $2.65b, led by T.Rowe Price, with further funding from Fidelity, Coatue, D1 Capital and Amazon’s Climate Pledge Fund. Since 2019, the company has raised $8bn! Later this year the company are expected to release their first two EVs - the R1T pickup truck (below) and the R1S SUV.

Leading project management platform Wrike (private) is being acquired by Citrix Systems (CTXS) for $2.25b. According to Wrike’s founder, Andrew Filev, the deal will allow Wrike to “scale our product and accelerate our roadmap to deliver capabilities that will help our customers get more from their Wrike investment”. Wrike are reported to be earning $140m in ARR at a 30% annual growth rate; putting the deal on a ~16x P/S multiple.

EV charging platform Volta (private) has raised $125m in new funding, backed by Energize Ventures. Volta has charging stations, built within 55-inch digital advertising displays, installed across 23 states in the US. Volta does not charge consumers for charging, instead, generating revenue from advertisers.

Deliveroo (private) has raised $180m (£132m) from shareholders including Amazon. The latest funding round values the takeaway delivery company at more than $7bn. The London based company plans to use the funds to improve the business for “consumers, riders and restaurants”. The company plans to expand its network of so-called “dark kitchens”, grocery delivery and subscription services. Deliveroo will also enable more restaurants to take orders via their own websites. Will Shu, Deliveroo’s founder and CEO confirmed that the company was working on plans for an IPO.

Desktop Metal(DM) announced that it is buying fellow 3D printing company EnvisionTEC (private) for in excess of $300m. Founded in Germany in 2002, EnvisionTEC specializes in photopolymer additive manufacturing, complementary to Desktop Metal’s existing technology which is based on metal and composites (e.g. using carbon fibre). Desktop Metal will target expansion in the dental vertical (from restorations to same-day, full-arch implants), where EnvisionTEC already has around 1000 customers.

Protolabs (PRLB), a manufacturer of custom prototypes and on-demand production parts,has acquired online manufacturing platform, 3D Hubs. 3D Hubs provides customers with instant pricing and design feedback, and order fulfilment through a global network of 240 premium manufacturing partners in over 20 countries worldwide. 3D Hubs’ 2020 revenue is approximately $25 million and has growth at a compound annual growth rate of over 200% since 2017.

Have a great week.

Charlie

LinkedIn or E-Mail (cnave@granitebaycap.com)

Granite Bay Capital is an innovation focussed investment company with a deep focus on the companies at the leading edge of innovation across major themes such as AI, ubiquitous computing, sustainability, automation and longevity. Any views expressed in this article are those of the author(s) and do not constitute financial advice.