Headline Developments

Amazon (AMZN) founder Jeff Bezos is stepping down as CEO to become Executive Chairman of the group, enabling him to focus on his various other ventures. Andy Jassy, the CEO of AWS, is slated to replace Bezos in 2H21. In a letter to staff, Mr Bezos said, “As Exec Chair I will stay engaged in important Amazon initiatives but also have the time and energy I need to focus on the Day 1 Fund, the Bezos Earth Fund, Blue Origin, The Washington Post, and my other passions." Back in 1996 (at IPO time) Amazon had sales of just $16m - a sum the company now makes every 20 minutes! The company’s 2020 sales hit $386b (up a staggering 37% YoY) with Net Income almost doubling to $21b.

Alphabet (GOOG) has surpassed expectations this week, showing quarterly revenue of $57bn (EPS came in at $22.30 v analyst estimates of $15.90). The company broke out its cloud revenue for the first time, with sales there up 47% YoY to $3.83b for the quarter. Another stellar result was ad revenue at subsidiary YouTube, soaring 46% YoY to $6.89b (Google search ad revenue ‘only’ grew 17% YoY). Google is threatening to withdraw its search engine in Australia if the government proceeds with a new code that would force it (and Facebook) to pay media companies for the right to use their content.

The UK Government is tightening the regulations around buy-now-pay-later companies such as Klarna (private) and AfterPay (APT.AX) who operate under Clearpay in the UK. Under the revisions, BNPL companies will come under the supervision of the Financial Conduct Authority (FCA) and be required to conduct affordability checks before lending to customers. Such regulatory evolution is a positive for the sector with Clearpay saying “consumers will be best served by products designed with strong safeguards and appropriate industry regulation”.

SpaceX (private) has announced plans to send its first “all-civilian” crew to space at the end of the year, in a charity mission led by Jared Isaacman, founder of Shift4 Payments (FOUR). The mission, named Inspiration4, will launch from SpaceX’s 39A launch site at NASA’s Kennedy Space Center in Florida atop the company’s Falcon 9 rocket. The four crew members will spend up to five days in the Crew Dragon Capsule (below) as it orbits the earth every 90 minutes. If you donate to the St.Jude’s Children’s Research Hospital you’ll automatically go in the running for one of those four seats! The aim is to raise $200m for the hospital’s research work. Reuters reported that SpaceX could be valued in the range of $60-90 billion as it finalises its latest funding round (up from $46 billion in August 2020).

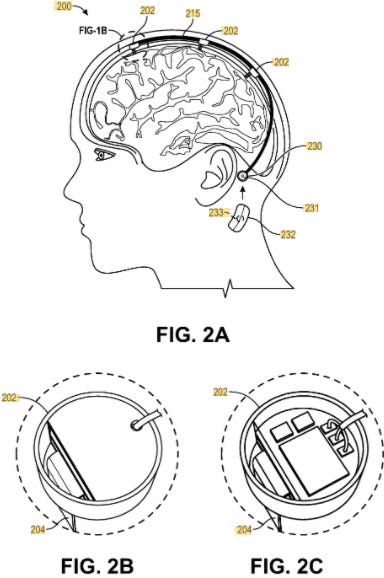

Elon Musk, in a press conference on brain-controlling company Neuralink (private), claimed they have implanted the wireless chip in a monkey’s brain that enabled the monkey to play Pong with its mind. "We've already got like a monkey with a wireless implant in their skull and the tiny wires, who can play video games using his mind. And he looks totally happy. He does not look like an unhappy monkey," Musk said. Musk’s overarching goal is to create a direct neural connection between the brain and computers, which would be processed at the “speed of thought”. A patent for the brain implant was published this month, with human trials expected for later in the year. Although Musk touts the benefits for brain disease, the ethical considerations are overwhelming!

The SolarWinds (SWI) hack has taken another turn, with Reuters reporting that Chinese hackers have also breached a vulnerability in the platform to access thousands of records on Government employees. This is in addition to the alleged Russian hack which reportedly compromised up to 18,000 SolarWinds customers including federal agencies and Fortune 500 companies.

Other Developments

A bit of fun before diving into more innovation news. For those into mindfulness and Lego, then this is the news you’ve been waiting for! Lego (private) have released a White Noise album on Spotify (SPOT) with a number of hit singles including “Searching for the One (Brick)” and “The Night Builder”.

China is banning mobile phones in schools. The country’s Ministry of Education said the ban, applying to both primary and secondary students, is designed to crack down on “internet and games addictions” and help students focus their attention on study. The directive, effective immediately, is also aimed “enhancing student’s physical and psychological development”. Reports claim there are around 130m Chinese citizens under 18 with their own mobile phone.

On the topic of banning, India has announced that they are looking to introduce a law that would ban “all private cryptocurrencies” in the country, including Bitcoin. Instead, parliament would establish a “facilitative framework” for creating an official digital money format issued through the Reserve Bank of India. India would become the most significant economy to ban the “asset”, joining Afghanistan, Pakistan, Algeria, Bolivia, Bangladesh, Macedonia, Saudi Arabia, Qatar, Vanuatu and Vietnam. Countries like China (who are advanced in the development of their own digital currency) do not recognise cryptocurrency as legal tender.

China’s Geely (0175.HK) and Foxconn are in talks to provide contract manufacturing for EV maker Faraday Future (private). Geely will offer technology and engineering support and has also become a minority investor in Faraday Future’s upcoming listing. Faraday Future will go public via a merger with SPAC Property Solutions Acquisition Corp (PSAC) valuing the combined entity at $3.4bn.

General Motors (GM) have (kind of) waged a battle against Norway - the world’s top-selling electric vehicle market per capita. In an upcoming Super Bowl ad, they’ve recruited Will Ferrell, Kenan Thompson and Awkwafina to go to Norway in GM’s upcoming GMC Hummer and Cadillac Lyriq crossover to “crush those lugers”.

At long last, Exxon Mobil (XOM) are jumping on the climate change bandwagon, announcing an investment of $3bn over the next five years in energy projects that lower emissions. This is around 3-5% of their annual expected EBIT. The company said the first area it would work on is capturing carbon dioxide emissions from industrial plants and storing the gas so it does not enter the atmosphere, where it contributes to global warming. A separate business unit - ExxonMobil Low Carbon Solutions - is working on 20 carbon capture projects around the world.

Ford (F) has announced that millions of its vehicles will run on Google’s (GOOG) Android platform starting in 2023. That means Google’s voice-activated Assistant, Google Maps, and other automotive-approved Android apps will be available in Ford’s cars without requiring the use of an Android smartphone. As a result, Ford will be swapping their current backend provider Blackberry (BB) QNS with Android. Ford will also be using Google’s cloud as its preferred provider for the connected vehicle service. All of this is a bit of a preview into future platformification of autonomous vehicle systems and a turf war between the likes of Google, Amazon (AMZN), Microsoft (MSFT) and Chinese tech companies Baidu (BIDU) and Alibaba (BABA).

The NFL has signed a multi-year deal with online gaming platform Skills (SKLZ). Under the arrangement, the two organisations will partner to develop a league-branded multiplayer mobile title. “Mobile gaming continues to be an important platform to reach and engage new and existing fans,” said Rachel Hoagland, the NFL’s VP of Gaming & Esports in a release. “Our agreement with Skillz provides access to a trusted platform and a highly engaged player base, making Skillz an ideal partner long term.”

Contest winners will get the NFL brand attached to their title, which Skillz CEO Andrew Paradise said in an interview could be a potentially hugely valuable differentiator.

The first Amazon (AMZN) One palm readers are officially being rolled out to more retail stores in Seattle. The readers are completely touchless, reading the lines on the palm of your hand to identify you for checkout. The sign-up process involves a credit card swipe followed by a wave of your palm. The devices allow for a more seamless shopping experience and will help grow Amazon’s market share through their Amazon Go retail stores.

C3.AI (AI), the world’s leading provider of enterprise AI software, is making its next-generation predictive analytics application generally available. The application enables users to develop, extend, and generate AI-based insights without writing code. Businesses can quickly and flexibly access and refine petabytes of disparate data from sources such as Snowflake (SNOW), S3, ADLS and Databricks. They can use this data to build and manage AI models without writing code using an intuitive drag-and-drop interface.

Klarna (private) has announced its 15 millionth customers in the US, building on a strong year for the company where they’re seeing 1m Americans joining the platform each month since October 2020. The company has 3.5m MAUs as at the end of December, an increase of 204% YoY.

Xerox Holdings (XRX) has launched its first liquid 3D metal printer, the ElemX, made possible after it acquired Vadar Systems in 2019. The company has signed up with Naval Postgraduate School (NPS) to further develop the system which bypasses powder bed fusion (PBF) or inkjet preferred by competitors like Desktop Metal (DM). Instead, the ElemX melts metal wire in a crucible and then deposits it drop by drop.

IPOs

Edtech startup Nerdy (private), owner of popular tutoring business Varsity Tutors, is seeking to list through a SPAC. Nerdy will merge with TPG Pace Tech Opportunities (PACE). The transaction is expected to close in the Q2 and will value Nerdy at circa $1.7bn. Varsity Tutors is a two-sided marketplace that matches tutors to students in 1:1 or group environments. The platform covers more than 3,000 subjects.

Otonomo (private), the cloud-based software startup that helps companies capture and monetize connected car data, is set to list. The Israeli-based startup has agreed to merge with SPAC Software Acquisition Group Inc. II (SAII) with a valuation of $1.4 billion. Arrival (CIIG), Canoo (GOEV), Lordstown Motors (RIDE), Luminar (LAZR), ChargePoint (SBE), The Lion Electric (NGA) and Proterra (ACTC) are some of the transportation-related companies that have gone down the path of SPAC mergers in the past several months.

Genetic testing company 23andMe (private) is set to go public via a merger with VG Acquisition Corp (VGAC) - a vehicle set up by Richard Branson’s Virgin Group (private). The deal will capitalise the company with almost $1b which they will be able to use for product development, hires and growth. They were one of the first companies to debut at-home genetic testing for people to find out more about their DNA and potential health issues.

Astra (private), a startup that makes small rockets to send satellites into orbit, is going public via SPAC Holicity (HOL). The deal is expected to raise up to $500m in cash proceeds and value the combined company at $2.1bn. The company has yet to begin commercial operations although a December 2020 test launch of its Rocket 3.2 came very close to entering Earth's orbit. Astra is backed by Marc Benioff of Salesforce and Eric Schmidt, former CEO of Google.

Online payments firm Payoneer (private) has agreed to go public via a merger with FTAC Olympus Acquisition Corp (FTOC). The company provides online money transfer and digital payment services for companies like Airbnb (ABNB) and Amazon.com (AMZN) and is expected to generate $432m in revenue in 2021. They processed more than $44b in payments last year.

M&A | Cap Raise | Earnings

UiPath (private), the fast-growing robotic process automation (RPA) platform,has raised $750m in its latest funding round at a valuation of $35bn! The raise comes just months ahead of a planned IPO. The round was led by Alkeon Capital and Coatue with participation from Altimeter Capital Management, Dragoneer, IVP, Sequoia Capital, Tiger Global Management and T. Rowe Price. Founded in Romania, UiPath is a major RPA player, where software robots are used to automate repetitive back-office tasks.

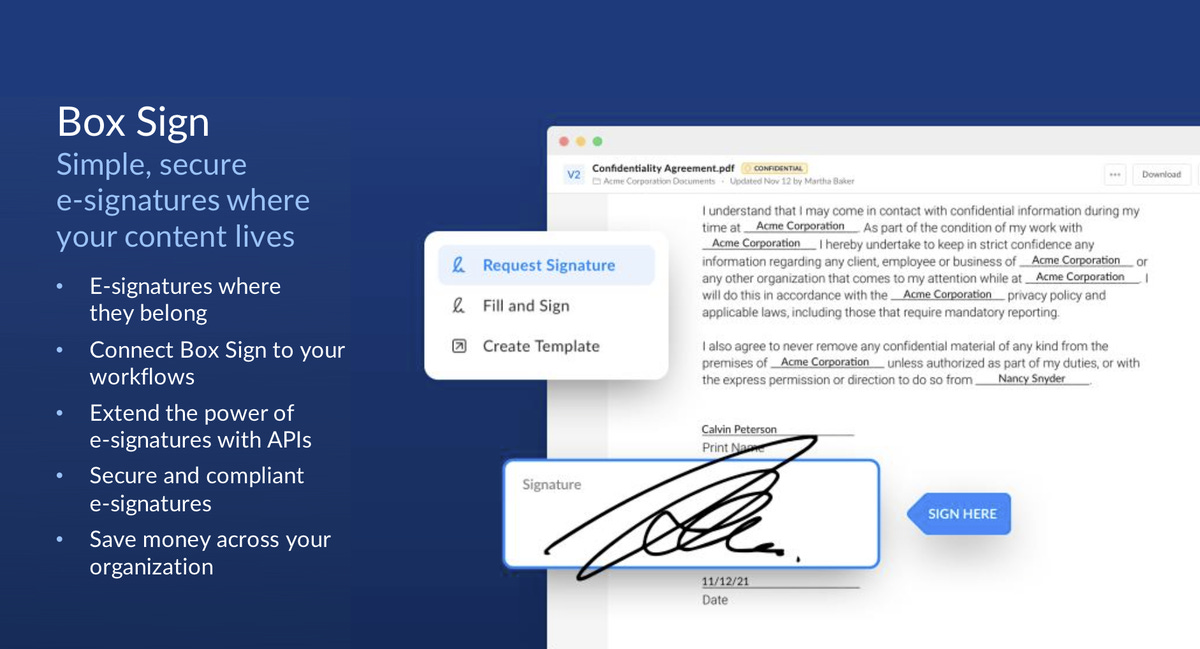

Box (BOX) is following Dropbox (DBX) in announcing a move into the digital signature space, announcing the acquisition of e-signature startup SignRequest (private) for $55m. The deal aligns with the upcoming launch of Box Sign.

Information technology contractor Perspecta Inc. (PRSP) has agreed to be acquired by Peraton in a deal worth $7.1 billion. Peraton is owned by private equity Veritas Capital who also bought Northrop Grumman Corps IT services business for $3.4bn (announced in Dec 2020). Perspecta, Peraton, and Northrop’s IT services brought in a combined $3.5 billion in IT obligations in fiscal 2020 which would have made it the No. 2 federal IT contractor last year.

Pinterest (PINS) has announced some incredible numbers with MAUs hitting 459m, revenue reaching $706m (up 76% YoY) and EPS coming in at 43c (35% higher than forecast). The company also, importantly, reported a Net Profit of $283m v $18m last year (a 17% profit margin). The company said in its letter to investors that it continued to see users engage with its app amid the ongoing Covid-19 pandemic that’s left people at home and in need of entertainment. The important ARPU numbers are also increasing steadily, with US ARPU up to $5.94 (from $4) and International APRU hitting 35c (from 21c). We expect a rapid acceleration of the e-commerce and ‘shopfronts’ platform to continue to drive ARPU appreciation in the coming years.

Apple (AAPL) hit their financial year running delivering their first $100bn+ quarterly revenue number with $111.4bn (+21.3%) in their Q1 (Dec quarter). The installed base of active devices surpassed 1.65bn devices globally with an iPhone installed base of over 1bn devices! No doubt the rollout of 5G around the world has helped boost these numbers with every new model of the iPhone 12 family being 5G compatible. Services revenue grew 24%, after Apple for the first time made available their bundled subscription package Apple One across the board.

Have a great week.

Charlie

LinkedIn or E-Mail (cnave@granitebaycap.com)

Granite Bay Capital is an innovation focussed investment company with a deep focus on the companies at the leading edge of innovation across major themes such as AI, ubiquitous computing, sustainability, automation and longevity. Any views expressed in this article are those of the author(s) and do not constitute financial advice.