Headline Developments

Clubhouse (private), the audio chat social network, has had a slight kerfuffle this week. The Stanford Internet Observatory (SIO) said Chinese software developer Agora (API), who provide backend infrastructure to the app, have access to the Clubhouse and chat room IDs and likely raw Clubhouse audio. The SIO researchers said they found metadata from a Clubhouse room “being relayed to servers we believe to be hosted in” the People’s Republic of China, and found that audio was being sent to “to servers managed by Chinese entities and distributed around the world.” As of last week, Clubhouse is now banned in China (as users were talking about Tiananmen Square and other sensitive issues!) and as of now, Clubhouse is implementing additional layers of encryption.

China’s Global Times, after earlier reporting that ByteDance (private) is in preliminary discussions to list TikTok (private) on the NYSE, has now denied that rumour! Given the pushback (from both Republicans and Democrats) to TikTok and a number of Chinese companies being blacklisted under the previous administration, we would be surprised if such a listing would gain the approval of the current administration. However, given US advertisers are now running back to the platform, perhaps now is an opportunistic time to go public. If anything, it will be a good early glimpse of Biden’s China strategy.

Tata Motors (TTM) subsidiary Jaguar Land Rover (private) will become an all-electric car brand within 5 years, with Land Rover targeting six EVs by 2025. The company will also start testing hydrogen fuel cell electric prototypes on British roads this year. “By the middle of the decade, Jaguar will have undergone a renaissance to emerge as a pure electric luxury brand with a dramatically beautiful new portfolio of emotionally engaging designs and pioneering next-generation technologies”, said JLR CEO Thierry Bollore. Below is a virtual concept Jaguar launched in 2019 for the video game Gran Turismo.

Disney (DIS) Plus will launch Star, a new entertainment platform for adults, in non-US markets next week, and will increase its subscriptions fees by 33% in those regions including Australia, New-Zealand, Europe, Singapore and Canada. Star will offer content that is updated weekly from Disney Television Studios, FX, 20th Century Studios and Touchstone. There are literally hundreds of TV shows and movies including 24, Grey’s Anatomy, Michael Keaton’s miniseries Dopestick, Jeff Bridge’s The Old Man, American Dad, Buffy the Vampire Slayer, Family Guy, The X-Files, Braveheart, The Colour of Money, Conan the Barbarian, Deadpool, Die Hard, Planet of the Apes…...the list goes on.

MicroStrategy (MSTR), a software company turned Bitcoin fund, is borrowing up to $690m (via convertible notes) to buy more bitcoin. As of 8th Feb, MSTR owns 71,079 bitcoins, worth $3.55bn as at today’s prices. It’s ‘core’ enterprise software platform (which is stagnating) generates ~$480m in revenues which, applying a generous 4x multiple, would value that core business at around $2bn. Accounting for net debt (~$600m) and you’re looking at a back of envelope Net Asset Value (NAV) of ~$5bn. It’s trading at almost double that! Meanwhile, the Grayscale Bitcoin Trust (GBTC) trades at a ~9% premium to NAV. Let’s see what happens when the tide goes out.

However, if you’re risk appetite doesn’t allow for crypto, then perhaps you’d like to look at NVIDIA (NVDA). The world leader in graphics cards (alongside AMD) is releasing a card just for crypto mining. The cryptocurrency mining processor (CMP HX), removes display outputs which, according to NVIDIA, increases airflow so the cards can be more densely packed. The cards will also have lower peak core voltage and frequency, making mining more efficient.

NASA’s Perseverance rover has landed on Mars this morning. The mission, costing $3bn, puts the SUV sized rover on Mars to collect three to four dozen samples, hoping to identify signs of bygone microscopic life. The samples will be retrieved by a fetch rover in 2031. To get to the surface, NASA had to perform a series of highly complex preset manoeuvres, first blasting over 12k miles/hour through Mars’ atmosphere and culminating in a decent stage (below) from a sky crane.

Other Developments

Hyundai (005380.KS) have provided a glimpse of a new portable autonomous vehicle called the Tiger X-1. The X-1 concept is about the size of a carry on bag and can be dropped into locations from a drone. It can carry a small payload (i.e. medicine, field equipment, ammunition), drive autonomously, crawl and step over obstacles. With Hyundai’s recent acquisition of Boston Dynamics from Softbank (9984.JP), it’s easy to see the future they’re looking to carve out.

Security concerns aside, Elon Musk has inviting Russian President Vladimir Putin to join him for a chat on the social media network, tweeting “Would you like to join me for a conversation on Clubhouse?”. The Kremlin told reporters that “this is, of course, a very interesting proposal, but we need to understand what is meant, what is being proposed….first we need to check, then we will react”.

The Bank of Italy is tapping into Twitter (TWTR) to help guide the country’s monetary policy, analysing millions of tweets to accurately track consumer sentiment. Researchers found their indicators, based on millions of tweets, not only tallied with final inflation read-outs and existing measures of price expectations by Italy’s national statistics office, financial markets and other forecasters but were also in real-time and provided more granular detail.

Nintendo (7974.JP) will launch the beta for Pokemon Unite next month - it’s multiplayer online battle arena (MOBA) format of the franchise. Pokemon Unite pits two teams of five players against each other with the ultimate goal of taking control over multiple points across the map. Nintendo also announced a plethora of new releases as part of its Nintendo Direct conference, including The Legend of Zelda: Skyward Sword, Pokemon Snap, Splatoon 3, Capcom Arcade Stadium (i.e. Street Fighter), Fall Guys, DC Super Hero Girls, The Outer Wilds, Smash Ultimate and, most importantly, Mario Golf: Super Rush ⛳(below) with speed golf mode.

General Motors (GM) released a couple of new Chevy EVs - a Bolt EV hatchback and a Bolt EUV (Electric Utility Vehicle). The range comes in at 250 miles (at the lower end of the milage market) and there are some nifty upgrades to ‘one-pedal driving’, allowing the driver to slow to a stop without the use of a brake pedal and ‘Energy Assist’ - the integrated app which syncs with EvGo (private) and ChargePoint (private) charging points across the US. There is also hands-free driving on 200k miles of ‘Super Cruise’ compatible roads across North America.

IPOs

JD. com’s (JD) shipping and delivery arm, JD Logistics (private) is planning an IPO in Hong-Kong in a deal that could value the business at $5bn. This would make it the third publicly-traded unit of JD behind JD Health (6618.HK) and online grocery Dada Nexus (DADA).

US-FinTech Marqeta (private) are following suit, targeting an IPO in April, valuing the payment card startup at around $10bn. Marqeta enables companies to issue branded and customised credit and debit cards, either in physical, digital or tokenized versions. Current clients include Affirm, N26, Doordash, Uber, Square and Klarna.

Sharecare (private) is going public, in a deal expected to be worth ~$3.9bn. Sharecare was founded by Jeff Arnold, the founder of WebMD, who will stay on as chairman and CEO. The platform provides individuals with personalised health information, programs and resources (i.e. 200k Q&As and 40k videos) and provides access to over 6k medical and health professionals. The company are targetting a 24% annual revenue growth rate over the next few years.

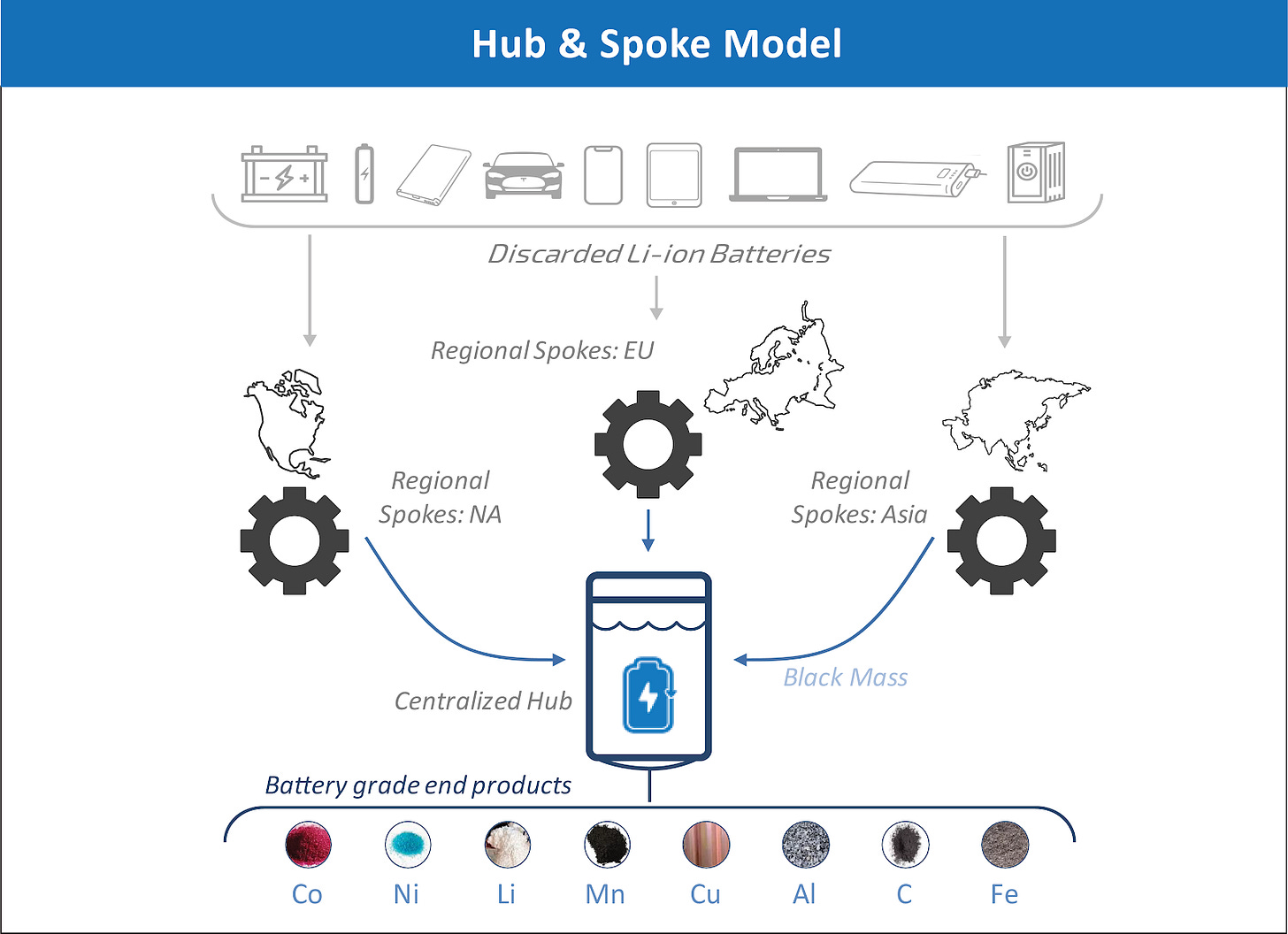

Li-Cycle Corp (private), a recycler of lithium-ion batteries, is looking to go public in a deal worth ~$1.7bn. The company’s “Spoke & Hub Technologies” take all types of lithium-ion battery and processes them into inert two main materials - black mass (lithium, nickel, cobalt, graphite) and mixed copper/aluminium. This black mass is then further processed at the hub, going through a hydrometallurgical circuit to produce lithium carbonate, cobalt sulphate, nickel sulphate and manganese carbonate of high purity.

South Korean e-commerce giant Coupang Corp (private) has filed for an IPO on the NYSE. The company’s revenue almost doubled from 2019-2020, hitting ~$12bn with free cash flows narrowing substantially from -$500m to -$180m according to the prospectus. Like Amazon, the company are investing heavily in technology and infrastructure to optimise the customer experience and offer next day or faster delivery on nearly 100% of orders. Valuation-wise, we expect sales growth to drop to sub 30% after a bumper 2020, putting it in line with the likes of Wish (WISH) and eBay (EBAY), but a substantial discount to market favourites like Shopify (SHOP) and Sea (SE) - owner of Shopee (private).

Lucid Motors (private), one of the most anticipated EVs on the market, is reportedly closer to a deal with Churchill Capital IV (CCIV) to go public, sending the latter’s share price up 30% this week. The report claims the deal will be inked at around the $12bn mark. Lucid’s first EV, the Lucid Air, comes in around the same price as the Tesla Model 3 but with significantly greater range (>500 miles) thanks to what they call the “world’s most advanced EV technology” developed by their unit Atieva, who have over 850 patents around thermal conductivity, flash cooling systems and state of charge.

US-based digital bank MoneyLion (private) is going public via a merger with Fusion Acquisition (FUSE), in a deal worth $2.4bn. The company has 4m ‘members’ who have access to standard banking features and other features such as rewards programs, no-fee checking, overdraft protection and fast-loan approval.

M&A | Cap Raise | Earnings

SpaceX (private) have raised $850m in fresh funding according to CNBC. According to the report, the new round would increase the value of the company by 60% to around $75bn. Last year the bulls had that price tag closer to $100bn, which would see it eclipse Lockheed Martin (LMT) and be nipping at the heels of Boeing (BA).

Locus Robotics (private) has raised $150m, led by Tiger Global and Bond. The company has a suite of robots which it sells or leases out (on a Robot-as-a-Service model) to the likes of DHL, Boots, Material Bank and Radial. According to the company, the robots improve fulfilment productivity by 2-3x. Zebra Technologies (ZBRA), a leading warehouse automation company, is one of the cornerstone investors in Locus (as well as Fetch Robotics and Plus One Robotics). They’re a company to keep an eye on!

Datadog (DDOG), a leading monitoring and security platform for cloud applications, has gone on a bit of an acquisition spree, buying cybersecurity startup Sqreen and observability company Timber Technologies. According to Datadog, the Sqreen acquisition will provide security and operations teams a unified platform for delivering secure and resilient applications. See below for a screengrab of Sqreen’s application security monitor.

BorgWarner (BWA) is buying Akasol (ASL.DE) a supplier of lithium-ion battery systems for use in buses, commercial, rail and industrial vehicles as well as ships and boats. The total acquisition price equates to $908m, with 59% of holders (including Morgan Stanley, Lansdowne and Schulz Group) agreeing to the deal.

Twilio (TWLO), which offers a suite of communications APIs and platforms, saw their share price jump 10% after reporting an extremely strong set of results. Quarterly revenue of $548m was 20% ahead of the street, whilst earnings came in at 4c/share vs an estimated 8c/share loss.

Have a great weekend.

Charlie and Vishal

LinkedIn or E-Mail (cnave@granitebaycap.com)

Granite Bay Capital is an innovation focussed investment company with a deep focus on the companies at the leading edge of innovation across major themes such as AI, ubiquitous computing, sustainability, automation and longevity. Any views expressed in this article are those of the author(s) and do not constitute financial advice.