Headline Developments

Microsoft (MSFT) has lifted the lid on Microsoft Mesh, their holographic vision for the future of communications. Utilising Microsoft’s HoloLens AR ‘glasses’ users can dial into calls and have colleagues, family, friends, tutors, doctors etc join them via a holographic avatar. The end game, however, is to have people appear live - as themselves - in hologram form via “holoportation”. But it’s not just work meetings and education that makes this interesting. Imagine being front center for a Rolling Stones gig in AR….or joining Call of Duty side-by-side (or in opposition) with “holoported” friends.

Twitter (TWTR) is launching a super follower function that will allow users to charge for access to exclusive content. Under the plan, users would be able to charge monthly subscriptions for content including subscriber-only newsletters, videos, deals and discounts; with users paying a monthly subscription fee to access the content. Another coming product, “Revue,” will let people publish paid or free newsletters to their audience. There’s also “Twitter Spaces,” a Clubhouse competitor that lets users participate in audio chats and, last but not least, beta testing of e-commerce links to include ‘shop’ buttons and product details within tweets.

Amazon (AMZN) had a slight hiccup in its branding this week, very quickly pulling its new app icon (which was meant to “spark anticipation, excitement, and joy”). With a resemblance to a certain German dictator (below left), it’s fair to say that the spark of joy missed the mark! The updated icon is on the right.

Other Developments

Lordstown Motors (RIDE) are putting their electric truck on the big stage, entering a race-ready version of its Endurance Beta truck in the SCORE World Desert Championship’s San Felipe 250 on April 17th. The race will ideally prove that the Endurance is the "toughest, most robust" truck on the planet even as it cuts emissions, company chief Steve Burns claimed.

They’re not the only ones showcasing their offroad capabilities though! Rivian (private) released a video during the week from a test run in North America’s largest cold-weather testing facility in Minnesota. Cold weather, particularly the extremes faced in regions like Minnesota, have a significant impact on battery cell efficiency. In these tests, engineers adapt self-heating strategies to keep the batteries ‘warm’ when unplugged outside, maintaining optimal battery performance.

Goldman Sachs (GS) is restarting crypto trading, dealing in bitcoin futures and non-deliverable forwards, beginning next week. They are also reported to be exploring a Bitcoin ETF (along with many other investment banks).

Uber (UBER) which for the past six months has been actively streamlining its business, is spinning it’s Postmates autonomous delivery service into a separate startup called Serve Robotics. The business was acquired by Uber last year as part of its acquisition of the food delivery service for $2.65b. According to Bloomberg, Uber will invest $50m in its Series A round, making it a minority stakeholder in the unit.

IPOs

Rocket Lab (private), a SpaceX challenger which started life in New-Zealand, is going public via a SPAC (VACQ) in a deal valuing the company at $4.1bn. The company’s Electron rocket can carry small payloads into orbit and is designed to cater to the growing small satellite market. They have a backlog of clients, including the US Government, with expectations of being EBITDA positive in 2023 and cash flow positive in 2024. Along with the SPAC announcement, Rocket Lab also announced plans for a new larger reusable rocket, called Neutron, for satellite constellations (and capable of human space flight). Kiwi innovation at its finest.

Fresh from a Congress grilling over its role in the meme stock chaos, it’s reported that Robinhood (private) are setting their eyes on the public markets later this month, with IPO paperwork to be submitted to the SEC shortly. The company, which saw a surge in demand during lockdowns, is expected to have a valuation in excess of $10bn.

Coinbase (private) has filed its prospectus with the SEC ahead of an expected listing in the coming weeks. The company will undertake a direct listing (with existing shareholders selling shares directly on the market as opposed to issuing new shares). Based on share sales by USV in 2020, the last implied value was $7-$8b, however, expectations are of a price tag well above $10bn. According to the prospectus, Coinbase has 2.8m Monthly Transacting Users and 43m Verified Users in 2020, generating $1.14b in revenues (up 60% YoY) and $322m in Net Income.

Cybersecurity startup SentinelOne (private) is looking to IPO at a potential valuation of over $10bn. The company, last valued at ~$3bn in Nov 2020, has raised over $700m from investors such as Sequoia, Tiger Global, Third Point Ventures and Insight Partners. SentinelOne provides endpoint security software that “defends every endpoint against every type of attack, at every stage in the threat lifecycle”. Note that competitor Crowdstrike (CRWD), which IPOd in 2019, now has a $49bn valuation (40x 2022e sales).

M&A | Cap Raise | Earnings

Aurora (private), the autonomous vehicle company backed by Amazon (AMZN), Hyundai (005380.KS) and Shell (RDSA.AS), has acquired 5D LiDAR startup OURS Technology (private) to help scale the company’s current LiDAR activities (part of a 2019 acquisition of LiDAR peer Blackmore). We expect this technology to be scaled more rapidly via existing partnerships with Toyota (7203.JP), Uber (from which they purchased their self-driving car unit ATG) and auto-component leader Denso (6902.JP).

Cardlytics (CDLX), an advertising platform in banks’ digital channels, is acquiring Dosh (private), an advertising platform that offers cash-back rewards, for $275m. Dosh enables financial institutions, fintechs and neobanks to embed the wallet offering “Powered by Dosh” into their websites and apps. Cardlytics plans to combine Dosh’s technology with its platform to let advertisers engage with consumers through Dosh’s clients including FinTechs Venmo, Betterment and Ellevest.

Okta (OKTA), a leading identity and access management platform, is buying cloud identity startup Auth0 (private) for a whopping $6.5bn. Auth0 helps developers embed identity management into apps across a range of industries including finance, healthcare and retail.

Website-building platform Wix.com (WIX) has acquired ordering and payment technology provider SpeedETab (private) to further grow its Wix Restaurants platform. Wix Restaurants has grown sharply over the last year as restaurants shifted focus to virtual ordering, delivery and pickup options. Wix recently surpassed over 200m registered users globally after adding 31m users in 2020.

Atlassian (TEAM) is acquiring Chartio (private) to add a new data analysis and visualisation element to its suite of products. Chartio has reported that 280K users of its software have created 10.5m charts for 540K dashboards sourced from over 100K data sources. “Atlassian products are home to a treasure trove of data, and our goal is to unleash the power of this data so our customers can go beyond out-of-the-box reports and truly customise analytics to meet the needs of their organisation”, said Zoe Ghani in an Atlassian blog post.

Leading mobile game developer Zynga (ZNGA), the company behind Zynga Poker, Farmville and Words with Friends, is further bolstering its portfolio with the acquisition of Echtra (private). This deal will see them diversify away from pure-mobile and into cross-platform experiences with games such as Torchlight III one of the core assets under Echtra’s umbrella.

PayPal (PYPL) in talks to buy Curv (private), a crypto wallet architecture. Rumours doing the rounds suggest PayPal are eyeing a $500m acquisition of the company. Curv’s wallet infrastructure does not use private keys and instead utilises proprietary multi-party computation (MPC) protocols that leverage independently generated shares of cryptographic material.

Accenture (ACN) is rolling up their sleeves in robotics, acquiring Brazilan industrial automation company Pollux (private). The acquisition vertically integrates solutions under the Accenture umbrella, enabling the company to better service customers in the consumer goods, pharma and auto industries. Pollux has implemented more than 1,000 projects for manufacturing companies, primarily in Brazil. Many of the world’s largest pharmaceutical and food companies use technology solutions from Pollux in their Brazil operations, and a high number of vehicles made in the country involve Pollux’s solutions.

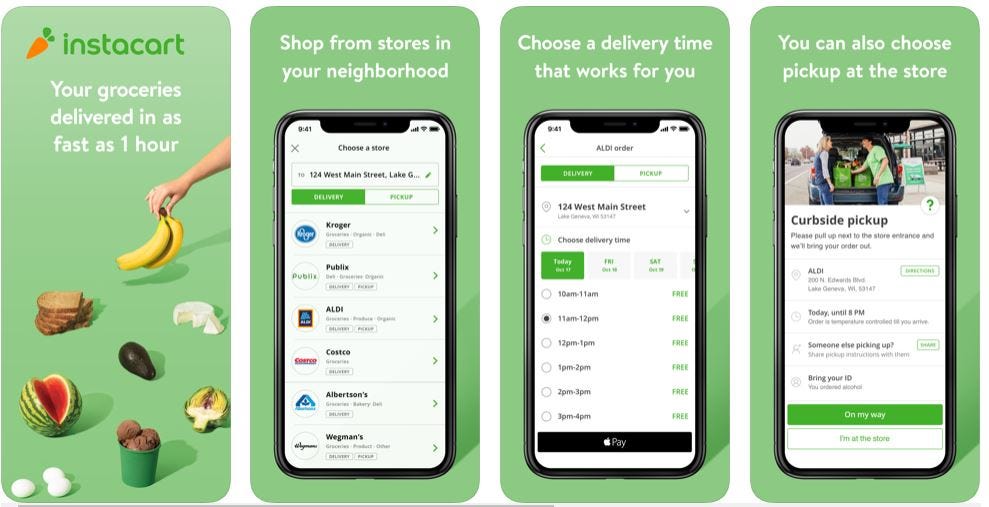

Leading grocery delivery startup Instacart (private) is now valued at a whopping $39bn after a fresh $265m funding round from existing investors (Andreessen Horowitz, Sequoia, D1 Capital, Fidelity, T. Rowe Price). Instacart expects to boost employees by 50% this year and invest in services like Instacart Marketplace, which connects customers and retailers. Instacart currently has 600 retailers (7-Eleven, Walmart, ALDI, Costco, Kroger) representing 45,000 stores across North America, reaching more than 85% of US households and 70% of Canadian households. Instacart is also expected to list this year, with an even higher (i.e. $70bn) valuation being very well within the realms of possibility given the current listing pandemonium.

US drone technology company Skydio (private) has raised $170m in Series D funding, led by Andreessen Horowitz, IVP and Next47, giving the company a price tag in excess of $1bn. Skydio, which has benefited greatly from the US Government’s ban on Chinese drone manufacturers (i.e. DJI) is building advanced autonomous capabilities for commercial, public sector and enterprise organisations.

Gitai (private), a Japanese robotics startup aiming to provide cheap robotic labour in space, has raised $17.1m from a group of local investors including Daiwa (8601.JP), Dai-ichi Life (8750.JP) and SPARX Innovation. Their mission is to be an equal partner with the world’s leading space launch companies, providing cheap and safe labour to build cities and space colonies on the moon and Mars.

Zoom (ZM) delivered a very strong set of results this week. The company reported a 369% increase in quarterly revenue, to $882m (vs $811m estimates) and has forecast ~$900m of revenue for the current quarter (vs $829m street estimates). Free cash flow for the prior quarter was $378m vs $27m this time last year. These stellar results are off the back of huge demand for the video conferencing service catalysed by lockdowns and work from home.

Micron Technology (MU), a leading manufacturer of memory (DRAM, NAND, SSD) for 5G, auto, IoT and server markets, has updated its guidance for the quarter, now expecting revenue to be $6.2-$6.25bn (vs analyst estimates of $5.86bn). The company has seen a greater demand for its products due to the pandemic and an uptick in 5G adoption.

Sea Limited (SE) also reported earnings (and also fell marginally off the back of them!). The Singaporean tech company with big exposure to e-commerce (Shopee), gaming (Garena) and finance (Sea Money) saw quarterly revenues jump 102% YoY to $1,567m. However, behind these numbers, it’s been a very busy 2021 for Sea Limited. In the last 90 days, they’ve launched Sea Capital, acquired a bank in Indonesia, launched Shopee in Mexico, launched food delivery in Indonesia, taken BNPL to Malaysia, received a banking license at home in Singapore and launched it’s AI lab. If this is a barometer for innovation, Sea is certainly one to keep a firm eye on!

Have a great week.

Charlie and Vishal

LinkedIn or E-Mail (cnave@granitebaycap.com)

Granite Bay Capital is an innovation focussed investment company with a deep focus on the companies at the leading edge of innovation across major themes such as AI, ubiquitous computing, sustainability, automation and longevity. Any views expressed in this article are those of the author(s) and do not constitute financial advice.