Headline Developments

Facebook’s (FB) Reality Labs have provided a glimpse of a wrist-worn AR interface concept that would allow users to more fluidly interact with augmented environments, as in the video below. More specifically, the device uses electromyography (EMG) sensors to interpret nerve signals and interact with the environment. Whilst still in very early/conceptual stages, it provides further insight into the future state of ubiquitous computing which Facebook, along with Microsoft and Google, are trying to lead.

NASA tested its most powerful rocket ever, the Space Launch System (SLS), with four RS-25 engines (below) firing for over 8 minutes (known as a hot fire test). This is a critical milestone for the agency’s Artemis 1 mission which will send an unmanned Orion spacecraft around the moon and back, and is a precursor to sending humans back “to the moon’s surface - and beyond”. The Boeing (BA)-built SLS is fueled by liquid hydrogen and oxygen tanks built by Aerojet Rocketdyne (AJRD) which is currently being acquired by Lockheed Martin (LMT). Raytheon (RTX), a big customer of Aerojet, are challenging that acquisition (as may Boeing).

Intel (INTC) are doing their bit to secure chip supply, and grow shareholder value, investing $20b in two new Arizona factories as part of its Integrated Device Manufacturing (IDM) 2.0 strategy. Important as well, the much delayed 7nm chips (Meteor Lake) will have their design finalised in 2Q this year, with the chip shipping a year behind schedule in 2023. They also touched a little on their new Intel Foundry Services unit which aims to manufacture chips for Amazon, Cisco, IBM, Microsoft and, perhaps (?), Apple. There is scepticism from many as to whether Intel, which can’t even hit its internal timelines, can reliably supply others!

Other Developments

Google’s (GOOG) YouTube is rolling out enhanced features which will automatically detect products within videos and provide e-commerce links, advertising features and other relevant information which will, again, add further value to advertisers within Google’s universe. YouTube hasn’t specified just what platforms this will be available upon, simply stating that it “will be visible to people watching videos in the US.”

Nintendo (7974.JP) are teaming up with Pokemon GO developer Niantic (private) on a Pikmin AR game. Similar to Pokemon Go, the aim of the app is to interact with the Pikmin characters in the real world with the use of AR technology. Niantic also announced that those interested in the app can pre-register for it via their website.

Meanwhile, Qualcomm (QCOM) has been rumoured to be working on an Android-powered console similar to Nintendo’s Switch, and powered with Qualcomm’s Snapdragon chipset. If rumours are correct, the device will launch in 1Q22.

Sticking with gaming, Discord (private), the leading VoIP app in the gaming market, is reportedly putting itself on the market, with Microsoft’s (MSFT) name being thrown in the ring as a potential acquirer. The business, valued at over $10bn, is used by millions of gamers for low-latency voice-chat and other communications. The program currently offers instant messaging, chat rooms, voice and video calls, Xbox Live integration and the ability to join up to 100 servers simultaneously.

Rivian (private) is building its own charging network in the US as it prepares for delivery of its R1T pickup and R1S sport utility vehicle. Charging stations will be installed along interstates and at popular hiking, mountain biking and kayaking spots to directly appeal to the more adventurous demographic they’re targeting. The high-speed DC charger will be capable of up to 140 miles in about 20 minutes.

Volvo-owner Geely (175.HK) is launching a new brand, Zeekr, which aims to take on Tesla (TSLA). The new brand will highly likely be built on Geely’s Sustainable Experience Architecture (SEA) platform (below), an open-source EV chassis base announced last year. This is an ambitious project by Geely, to push them into the premium category taking on, not only Tesla but China’s own Nio (NIO), Xpeng (XPEV) and Li Auto (LI).

UK-based digital bank Revolut (private) has filed a draft application for a banking license in the USA. “A US banking licence would ultimately enable us to provide US customers with all the essential financial products and services they can expect from their primary bank including loans and deposits,” Revolut co-founder and CEO, Nik Storonsky says. “We’re on a mission to build the world’s first global financial super-app, and pursuing a US banking licence is an integral part of the journey.”

IPOs

Chinese ride-sharing company Didi (private) is looking to shun HK for a US-listing, eyeing a valuation north of $100b. According to Reuters, Didi’s preference for the US boils down to concerns that an HK IPO application could run into tighter regulatory scrutiny over Didi’s business practices such as the use of unlicensed vehicles and part-time drivers. Other advantages include a more predictable listing pace and a deeper pool of capital. Did has a target of serving 800m monthly active users globally by 2022 and, like Uber and Tesla, is investing heavily in autonomous technologies with a vision towards driverless ride-hailing services.

Leading 3D printing company Velo3D (private) will list via the Serena Williams-backed SPAC Jaws Spitfire (SPFR) in a deal valuing the company at $1.6b. Velo3D is one of the leading developers of 3D metal printing technology, with 48 patents relating to their various product innovations, including the Sapphire Metal AM Printer, laser powder bed fusion printer (LBPF) and advanced software systems and platforms. Per the investor presentation, the $1.6b valuation puts it on an implied 61x 2021e P/S (or a more sensible 3x 2025e P/S). Its closest competitor, Desktop Metal (DM), is currently trading at 44x 2021e P/S. Customers of Velo3D currently include SpaceX, Honeywell, Raytheon, Lam Research, Aerojet Rocketdyne and many many more (below).

Ironsource (private), a platform to optimise and monetise mobile apps, is merging with SPAC Thomas Bravo (TBA) at a valuation of ~$11.1b. The Israeli startup saw revenue grow 83% in the past year, to $332m and is expected to see strong sustained growth as it increases its impact within specific categories such as mobile gaming where it has a strong position, powering the growth of 87% of the top 100 mobile games. There’s an example below showing mobile gaming UX optimisation.

AppLovin (private), another platform to optimise mobile games and apps, is looking to raise $1b via an IPO. The company, which started as a mobile games advertising platform in 2012, has three primary products - AppDiscovery which targets the most active users for your apps/games, Max which optimises game ARPU; and SparkLabs which developers creating advertising solutions for apps like playable ads, video and display.

Deliveroo (private) is set for a $12bn debut on the LSE, making it the largest tech debut in the UK in a decade. Meanwhile, Amazon (AMZN), which own 15.8% of the company, will sell down to ~11.5% - valuing their stake at $1.1b. Deliveroo founder Will Shu is retaining his 6.3% stake but will have 57.5% of the voting rights of the company because of a dual-class share structure, something which is quite new for UK-listed companies (and implemented to retain tech startups in domestic markets). Another interesting feature of this listing is that customers of Deliveroo (who are UK-based) can participate in the raise via a community offer.

Coursera (private) have priced their IPO within a range of $30-$33 - valuing the company at $3.9b - $4.3b. The company, which saw revenue rise 60% last year, gets a lion's share of its revenue from direct-to-consumer courses but is seeing 80% growth in enterprise (used by AXA, P&G, Infosys) and almost 100% growth in their online degrees programs (like computer science, public health and various business degrees). Assuming a more modest 40% revenue growth next year would imply a 10.5x fwd P/S. Competitor 2U (TWOU), which focuses more specifically on online degrees, is trading at a more modest 3x fwd P/S (with revenue growth expected to be 20% from 2020-2021).

Cloud infrastructure provider DigitalOcean (DOCN) dropped 10% on its debut. The company, which provides cloud services to (predominantly) SMEs has seen revenue grow 25% p/a over the last two financial years (lagging AWS). If we assume the same growth rate for 2021, the implied fwd P/S is 11x.. Microsoft, Amazon and Oracle, despite not being ‘pure-play’ cloud providers, are trading at 11x (16% rev growth), 3.3x (24% growth) and 4.8x (2% growth) respectively.

M&A | Cap Raise | Earnings

Cloud storage provider Box (BOX) are exploring options for a sale, after intense pressure from hedge fund Starboard. The fund was disappointed the company did not optimise value during the pandemic and, as a result, threatened to launch a board challenge against Box unless it took steps to boost value for shareholders. In saying that, from March market lows to early Jan, it still returned 38% vs Dropbox’ (DBX) 27%, however, lagged Microsoft’s (MSFT) 46% return. In any case, it's worthwhile shopping around and, who knows, it may even draw some eyes closer to Dropbox (which would be another good takeover target).

Chinese autonomous vehicle platform Momenta (private) has raised $500m from SAIC (600104.CH), Toyota (7203.JP), Bosch (private), Daimler (DAI.DE), Tencent (700.HK) and Singapore sovereign fund Temasek. The company has created a platform including deep learning software, HD maps and data-driven path planning to enable full automation. All of this is based on three core pillars - large scale deep learning, big data (22k crowdsourced vehicles and >1bn annual labels) and model optimisation.

Australian fintech unicorn Airwallex (private) has added $100m to its Series D round (now totalling $300m). According to TechCrunch, the new funding will be used to push the service into North America this year and expand its payments coverage to new regions like the Middle East, Africa, Eastern Europe and Latin America. The current raise values Airwallex at ~$2.6bn.

Chinese e-commerce conglomerate JD.com (JD) has invested $800m in newly-issued shares of Dada Nexus (DADA), an on-demand delivery service in China. As a result, JD.com will end up holding a 51% stake in Dada. Lei Xu, CEO of its JD Retail business, said, "Our increased investment will facilitate both sides to promote the expansion of on-demand retail and delivery, as well as omnichannel collaboration."

Casino operator Bally’s (BALY) is furthering its push into online gaming, announcing the acquisition of UK-based Gamesy (GYS.LSE) for ~$3.5b. Gamesy’s portfolio includes online casino games Rainbow Riches, Virgin Games, Virgin Casino and Monopoly Casino (below). This follows a flurry of investments in online gaming, including the $108m offer for Allied Esports (AESE) and a $90m acquisition of Fantasy Sports Shark (private).

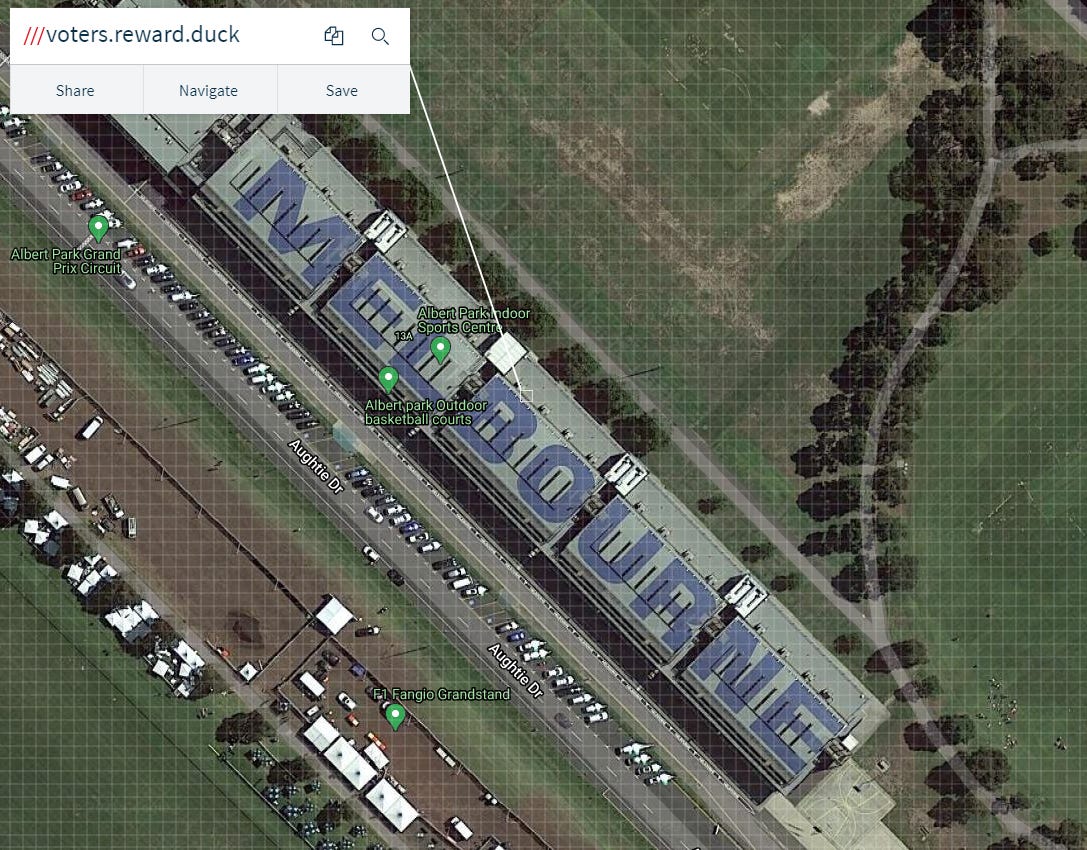

Not a very sizable investment, but an interesting one! Ingka Group (private), the owner of IKEA, has invested $16m in what3words (private). The London-based company is dividing the world into 3-meter squares, each with its own unique three-word code, to help logistics firms with their deliveries (i.e. to a specific side entrance, warehouse etc). For example, if someone were to deliver a few crates of Penfolds Grange to the UBS box on pit straight at the Melbourne Grand Prix - it would go to the 3 sqm box labelled “voters.reward.duck”.

Have a great week.

Charlie

LinkedIn or E-Mail (cnave@granitebaycap.com)

Granite Bay Capital is an innovation focussed investment company with a deep focus on the companies at the leading edge of innovation across major themes such as AI, ubiquitous computing, sustainability, automation and longevity. Any views expressed in this article are those of the author(s) and do not constitute financial advice.