Headline Developments

Coinbase (pending listing) have announced stellar ‘estimated’ 1Q21 earnings ahead of their direct listing on 14th April. In the release, they highlighted 56m verified users, 6.1m Monthly Transacting Users (MTUs) and $223b in platform assets (representing an 11.3% crypto market share) - roughly half of that being from institutions. Revenues were $1.8b for the quarter, implying $295 average revenue per user for the quarter. For full-year 2021, the company represents three scenarios (7m, 5.5m and 4m MTUs) which, on the upper end would imply 2021 revenues just shy of $8b. Despite being in a different asset class, popular online broker Interactive Brokers (IBKR) trade on 12x fwd P/S (with 71% YoY commission growth). This multiple would imply a market value of $96b - a 40% premium to the $68bn Coinbase was valued earlier in the year in a private transaction.

Tesla (TSLA) posted record deliveries of 184,800 vehicles for 1Q21, 4% above street estimates and above last quarter’s record numbers of 180,570. Demand was dominated by the Model 3 and Y, accounting for 99% of all deliveries (the company only sold 2,000 of the model S and X).

Romeo Power (RMO) surged 60% during the week after inking a deal to provide battery packs, modules and battery management systems to Paccar (PCAR) - one of the world’s largest truck manufacturers and the parent company of DAF, Kenworth and Peterbilt trucks. Under the agreement, RMO will be a battery supplier for Peterbilt 579EV (below) and 520EV in the US and Canada through to 2025, with production ramping up this year. Pre the RMO announcement, Paccar had estimated a 150-mile range for the 579EV, with 3-4 hours charging time. This means, on a Melbourne to Sydney trip (545 miles) the driver would have to recharge 3 times, adding 10.5 hours to the 9-hour haul! By comparison, Tesla’s Semi is expected to have a 500 mile range (but we’re yet to see this beyond a couple of test track runs!).

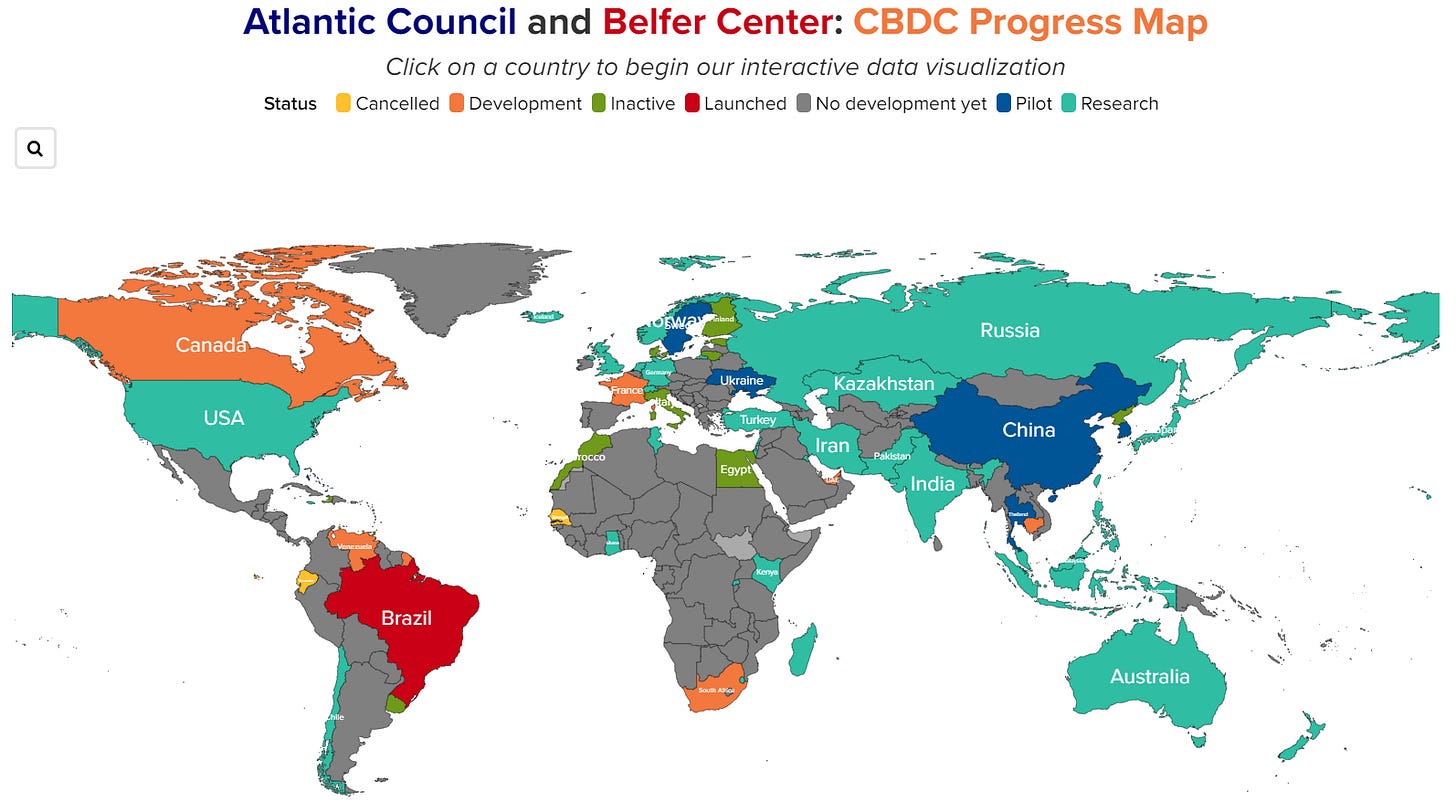

Japan’s central bank, the Bank of Japan (BOJ), has begun feasibility tests on issuing its own digital currency. The first phase of the tests, to be carried out over the next 12 months, will focus on testing the technical feasibility of issuing, distributing and redeeming the digital currency. Following this, there will be scrutiny of more detailed functions followed by a pilot program (if deemed necessary). Japan follows a growing list of nations who are testing digital currencies, although they are well behind China (Digital Yuan), Sweden (e-Krona) and Brazil who, per the Digital Currency Progress Map (below), are well ahead of other nations.

Other Developments

Renders have appeared of Spotify’s (SPOT) in-car gadget, the ‘Car Thing’, which was first announced by Spotify back in 2019. The images were uncovered within Spotify’s app code, matching quite closely to prior filings submitted to the FCC and patent filings for voice recognition personal media systems.

United Parcel Service (UPS) will be using a fleet of electric planes to help shrink its emissions. To do this, the company has struck a deal with Beta Technologies (private), developer of the ALIA eVTOL (electric Vertical Take-Off and Landing) aircraft. The aircraft has a range of 250 miles and can recharge in ~1 hour, the same time it is expected to take for unloading, reloading and flight planning.

Geely-owned EV company Polestar (private) said it is working on the world’s first “climate neutral” car - the Polestar 0, for launch by 2030. To achieve the target, the company say they will ensure renewable energy is used across its supply chain, and use climate-neutral and recycled materials. Polestar will also be adding sustainability declarations to all its future vehicles, starting with the Polestar 2 with total production carbon emissions of 26 tonnes.

There are reports on the street that Twitter (TWTR) was looking to buy Clubhouse (private) in recent months for $4b. This also happens to be the valuation Clubhouse are throwing around for a reported capital raise, which would be ~4x what it was worth during a $110m raise in January this year!

Separately, the social media platform announced during the week that they are partnering with Stripe (private) to allow creators to pull in direct payments. According to a blog post from Clubhouse, users will be able to tap on the profile of a creator and tap “send money”, with 100% of the proceeds going to the creator. In the same week, Pinterest (PINS) announced their $500k creator fund, with a particular focus on supporting underrepresented communities and compensating them with budget for content creation and ad credits. It’s only a matter of time until Pinterest offer a similar direct-payment tool for their creatives.

Blackberry (BB) and Amazon’s (AMZN) AWS have launched the IVY Innovation Fund which will initially allocate up to $50m to invest in startups focused on developing data-driven solutions that can benefit from Blackberry IVY’s insights and support from Blackberry and AWS. This follows the December 2020 announcement of a multi-year global agreement between Amazon and Blackberry’s QNX platform to develop Blackberry IVY as a scalable, cloud-connected software platform for vehicles and all service providers within the data-driven AV ecosystem.

Gatik (private), an autonomous vehicle startup focussed on ‘middle mile’ delivery for companies like Walmart (WMT), is partnering with Isuzu (7202.JP) to develop Level 4 capable medium-duty trucks. For example, the AI will do the driving on freeways, but will require human engagement in urban zones, refuelling etc. The aim is for the first commercial operations to kick off in the US and Canada this year. This follows similar moves by Navistar (partering with TuSimple), Daimler (partnering with Waymo) and PACCAR and Volvo (partnering with Aurora).

IPOs

Sarcos Robotics (private) will merge with Rotor Acquisition Corp (ROT), valuing the company at $1.3b. Sarcos have developed a leading range of exoskeletons - the Guardian XO and XT - as well as the GT; a robot for use in more hazardous environments which is controlled remotely using AR. They also develop portable autonomous robots and a range of military and defence solutions. Upon completion of the transaction, Sarcos expects to have $496m in cash which it will use for the commercialisation and launch of XO and XT, ramping up production, development of its AI capabilities and making any aligned acquisitions. The company expect revenue to ramp up considerably over the coming years, growing from a low pre-production base of $8m p/a to $438m in 2024 and $1.2b in 2025. For more information, you can refer to their investor presentation here.

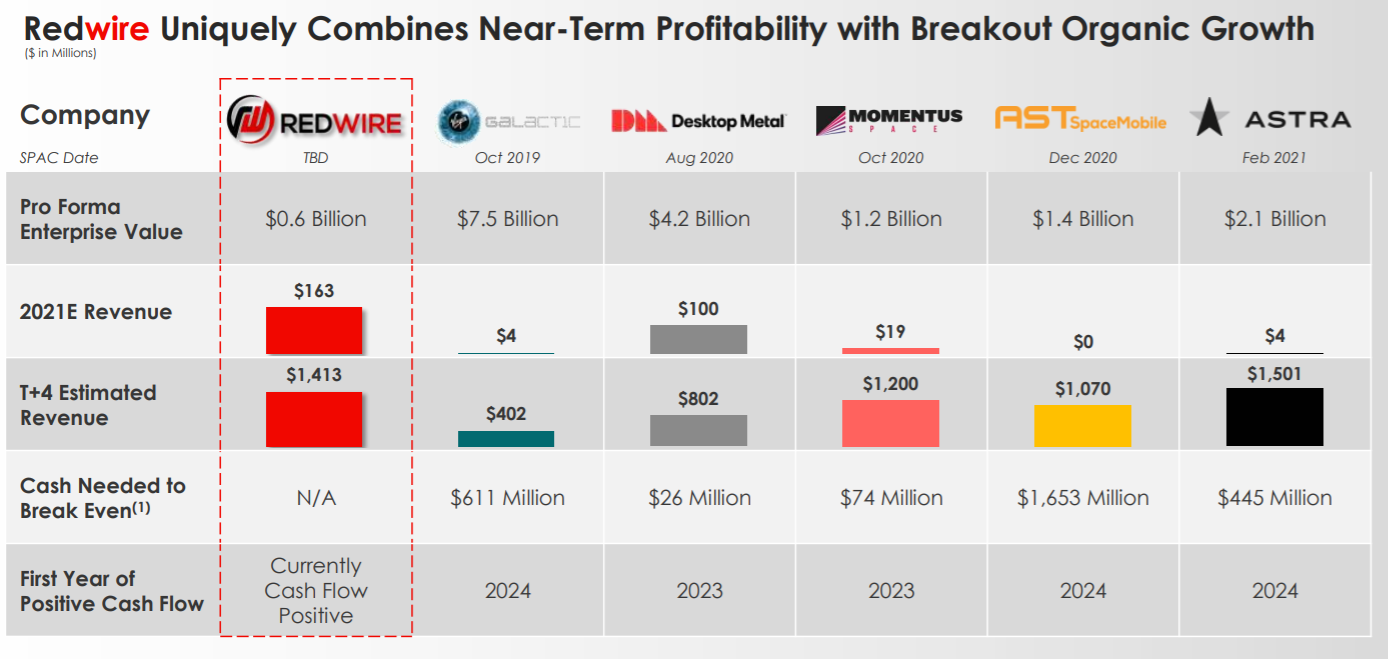

Space infrastructure company Redwire (private) will merge with Genesis Park Acquisition Corp (GNPK) in a deal valuing the company at $615m. The company manufacture a range of space infrastructures such as robotic arms, solar arrays, antennas, camera systems, sensors and next-gen spacecraft to enable human spaceflight (i.e. ISS and Orion) and Satellite launch. Financially, the company are also in a unique position with $163m in expected 2021 revenues, $20m in EBITDA and $17m in Free Cash Flow; all targeted to grow ~10x to $1.4b, $250m and $195m respectively by 2025. They’ve articulated this balance sheet advantage vs comparable SPACs in the below slide, part of the investor presentation.

Alkami (private), a provider of digital banking solutions for financial institutions, has filed its prospectus for an upcoming IPO. According to the filing, the company is generating $128m in Annual Recurring Revenue (53% growth) with a 117% Net Dollar Retention (i.e. revenue inclusive of SaaS upgrades, downgrades and churn). The platform (below) revolves around 8 core product categories - account opening, card experience, client service (chat/SMS), extensibility (APIs), financial wellness, fraud protection, analytics and money movement. The company currently has 151 financial institution clients, with no single client representing more than 5% of revenue.

Britishvolt (private), currently in the process of raising $3.6b for a manufacturing facility, has indicated an interest in merging with a SPAC. The company has ambitions to roll out 300k lithium-ion batteries each year by 2027, if it raises the necessary funds for the plant - planned for the port of Blyth in Northern England. The company has also applied for £1bn in funding from the British Government.

M&A | Cap Raise | Earnings

Softbank (9984.JP) is having a busy week, buying a 40% stake in Autostore (private) for $2.8b. The Autostore system (below) is effectively a giant Rubix cube, with hundreds of squares containing bins (220mm - 425mm in height), all coordinated by an autostore controller/robot. Current customers include Best Buy, Siemens, Boozt.com, ASDA, Adore Me, Lufthansa, NTCU FairPrice and Puma.

The Japanese conglomerate also lead a $1.2b investment in genetic testing leader Invitae (NVTA). The investment, in the form of convertible debt, will help the company expand its platform through in-house development and M&A - such as the $200m acquisition of sequencing platform Genosity announced during the week.

Pinterest (PINS) has reportedly held talks to buy VSCO (private), a photo and video editing app and community.. The deal would make a lot of sense for Pinterest, as they have few (if any) tools around image and video editing. Instead, Pinterest’s near-term focus has been on image recognition technology and e-commerce, which are key drivers for ARPU. Furthermore, VSCO membership (~$35/year) offers challenges and educational content which would be highly aligned to the creative community within Pinterest.

Australian design and publishing platform Canva (private) has seen its valuation double to $15b following an investment of $71m from Dragoneer, Blackbird Ventures, Skip Capital (backed by Atlassian co-founder Scott Farquhar) and T. Rowe Price. The company, which has seen demand surge during the pandemic, saw a 130% jump in annual revenue from an active user base of 55m globally.

Have a great week.

Charlie

LinkedIn or E-Mail (cnave@granitebaycap.com)

Granite Bay Capital is an innovation focussed investment company with a deep focus on the companies at the leading edge of innovation across major themes such as AI, ubiquitous computing, sustainability, automation and longevity. Any views expressed in this article are those of the author(s) and do not constitute financial advice.