Headline Developments

NASA has chosen SpaceX (private) to build the lander as part of their mission to return humans to the moon; beating Leidos’ (LDOS) Dynetics and a consortium comprising Jeff Bozos’ Blue Origin (private), Lockheed Martin (LMT), Northrop Grumman (NOC) and Draper Labs (private). In 2020, each of the teams were asked to devise an innovative Human Landing System (HLS), under the Artemis program, to ferry humans down to the moon’s surface. This is a precursor to the establishment of the Artemis Base Camp at the South Pole of the Moon, where partners will establish the “infrastructure, systems and robotic missions that can enable a sustained lunar surface presence”.

That was the good news for Musk, then there’s the bad news - that fatal Tesla crash in Texas. Respondents to the crash reported that neither of the two males were behind the wheel, with a possible scenario that they engaged the Autopilot or Full Self Driving feature of the automaker. This is the sticking point. So far, Musk says autopilot was not enabled (per data logs) and safety features (i.e. requirement to have hands on the wheel) would have been engaged had Autopilot been on. The reality - there’s no such thing as full self-driving. It may be in parts of the journey (i.e. freeways/lane changes), however, we’re still many years away from end-to-end self-driving capabilities - the type where you can safely put your kids in a driverless car and send them off to their grandparents.

A bit of a bump in the road for Nvidia (NVDA) after the UK’s Competition and Markets Authority (CMA) announced that they will look into the competition, jurisdiction and national security impact of the company’s planned acquisition of UK-based ARM Holdings (private). A report is due by July 30. This shouldn’t be news to anyone considering the potential competition issues at play here (i.e. the biggest chip maker in the world owning the predominant chip architecture and potentially squeezing out competitors). I struggle to see how Nvidia can claim to run ARM independently so it will be interesting to see what undertakings the CMA put forward and whether these will be addressable and impactful.

TikTok (private) is being sued by former children’s commissioner for England Anna Longfield, representing “millions of children in the UK and EU”. Longfield alleges that TikTok is a data collection service that is thinly veiled as a social network" that has "deliberately and successfully deceived parents". The law firm Scott and Scott, representing Longfield, believe the data collected is “a severe breach of UK and EU data protection law”

Other Developments

Has Netflix’s (NFLX) subscriber growth peaked? It appears so, which is why the stock was sold off by about 10% after releasing their latest numbers (highlighted in the chart below). In 1Q21 they added 4m new subscribers (v 6m forecast); a stark change from the Covid peak which catalysed 16m new subscribers (2x forecast) in 1Q20. In fact, 2021 isn’t just looking like a poor year, it’s looking like the worst year for new subscribers since 2017. The issue here is multi-pronged. Firstly, Disney did way better than Netflix would have hoped! Secondly, the others (HBO Max, Amazon Prime, YouTube) are lifting their game (i.e. I can pay ~$5 to watch almost anything on YouTube/Google). Third, 2020 was a difficult year for production (i.e. shows like Stranger Things 4 had huge delays). All of these factors will weigh on Netflix and put a high risk on subscriber churn. Still, I wouldn’t rule them out. There’s a pipeline of original content (and deals with the likes of Sony) that will keep them at the top of the pedestal (for now).

This week it’s Apple’s (AAPL) turn to excite the market with a number of announcements at their ‘Spring Forward’ event. Highlights include the new iMac, powered by their M1 chip, one of the worst-kept secrets with Tile competitor “AirTags” (below) to help you track down any valuable items (umbrellas, bikes, laptops…..or…..elderly parents and children?!), updates to Apple TV (with HDR and Dolby), iPad Pro (with the M1 chip) and Podcasts (with subscriptions). All of this is expected, all of this is cute…..but is any of it truly innovative……?

Let’s provide an update on EVs!

Toyota (7203.JP), for a while the laggard in the EV space (despite being early pioneers), has announced an EV strategy that will see 70 new models, including 15 new battery-electric vehicles, on the road by 2025. The new EV vehicles, under the Beyond Zero (BZ) brand, will start rolling out this year with the release of the BZ4X (below) with other models being powered by hydrogen fuel cells and gas-electric hybrids.

Daimler (DAI.XTRA) owned Mercedes has taken the wraps off their electric S-Class, the EQS (below). The vehicle is expected to have a range of 770kms on a single charge thanks to its partnership with Chinese battery producer CATL (300750.CH). This would put it ahead of Tesla’s Model S and a little behind the ‘expected’ range of CATL powered Nio (NIO), the LG Chem-powered Lucid (private) and Nikola (NKLA) - powered by a hybrid-electric and hydrogen engine.

From a regulatory perspective, Washington state has set a new gold standard (for America) passing the Clean Cars 2030 bill which would ban the sale of petrol cars after 2030 (California and Massachusetts have a similar bill that kicks in from 2035). Meanwhile…..Australian Governments (state and Federal) have no roadmap for EVs and will, in fact, tax you for owning one!

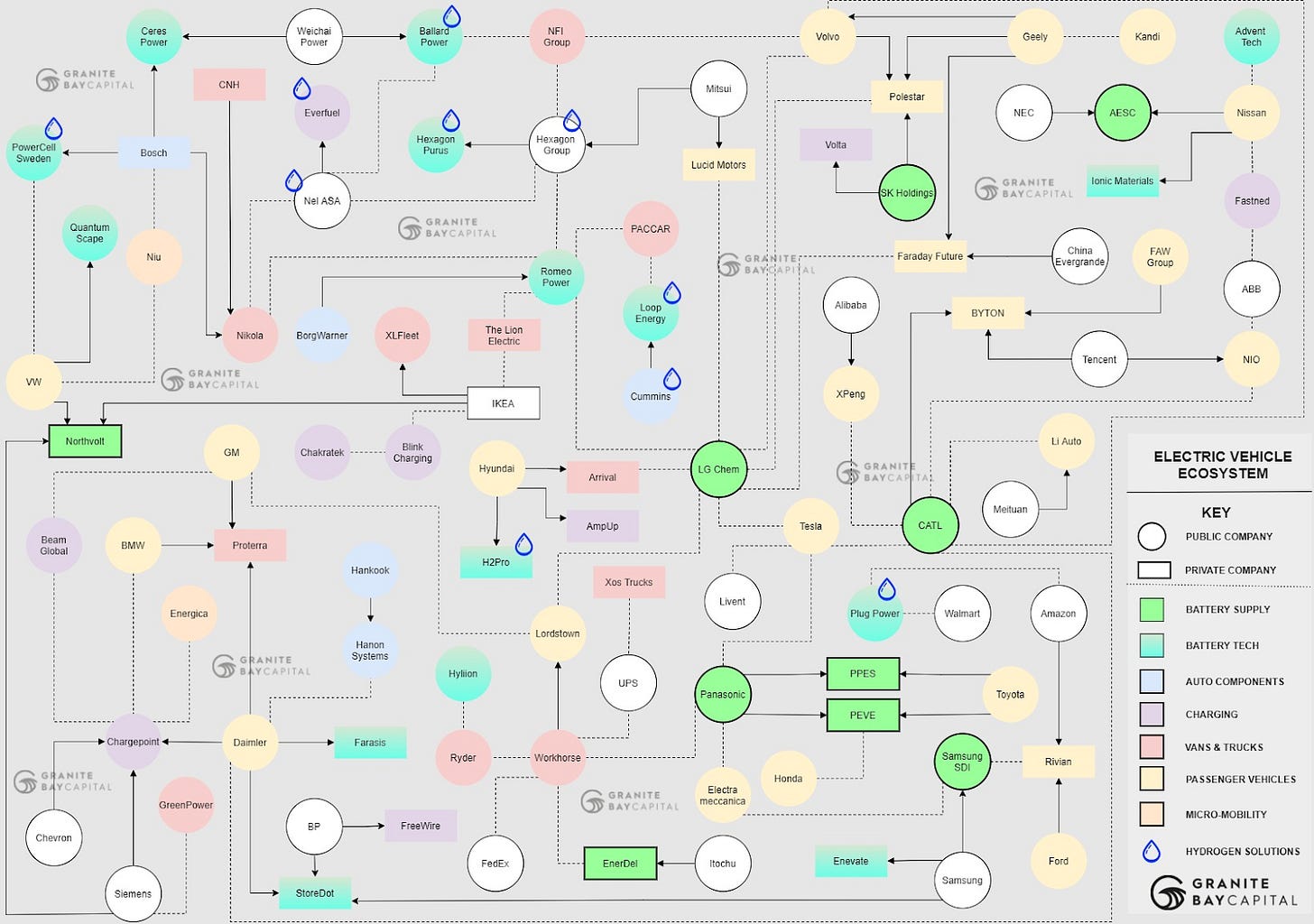

The EV ecosystem map below will give you a little more colour on how all of this (OEMs, battery suppliers etc) come together.

Facebook (FB) users will now be able to listen to Spotify (SPOT) songs and playlists within the Facebook ecosystem without being externally linked to the music app. This means Instagram, Facebook and (presumably) Messenger and WhatsApp will enable a more seamless experience in integrating music and podcast material within their posts. It’s a particularly good feature for creatives who can keep their followers engaged in one platform.

That’s not the only audio update from Facebook though, announcing a Clubhouse (private) clone (below) where users will be able to participate in Live Audio Rooms across both Facebook and Messenger. The feature will be released to all users by mid-year.

PayPal’s (PYPL) mobile payment service Venmo is the latest to start accepting cryptocurrency. According to a statement from PayPal, the platform will allow its 70m+ customers to buy, hold and sell crypto directly within the app - starting now with Bitcoin, Etheremum, Litecoin and Bitcoin Cash.

Cerebras Systems (private) has released a supercomputer processor with record-setting 2.6 trillion transistors and 850k cores - for use in the company’s AI computer (dubbed the industry’s fastest). What does this mean and how do they do this? Well, they take a big piece of silicon and, instead of breaking this down into hundreds of separate chips (like everyone else does - for phones, computers, data centres etc), they make one massive chip. Furthermore, they can cram more on the chip because it uses the 7nm process (which means the width between circuits is seven billionths of a meter). Below you can see a side-by-side of Cerbaras vs the NVIDIA Ampere GPU. However, if you do the maths, there’s 17% more bang (transistors) for buck (mm3) in NVIDIA’s chip than Cerbaras. Still extremely impressive though!

IPOs | SPACs

Alternative dairy company Oatly (OTLY) has filed documentation for its upcoming IPO, in which they’ve highlighted a doubling in revenues (from $204m to $421m) from 2019-2020 and increasing losses ($36m to $60m). The company is the exclusive oat milk provider to Starbucks whose founder, Howard Schultz, is on the Oatley shareholder list alongside Oprah and Jay-Z.

As mentioned in earlier editions, fintech Wise (private) - formerly known as TransferWise - is in talks with UK regulators ahead of a direct-listing in the country. The company plans to list in June, buoyed by strong growth ($421m revs to March 2020) and pre-tax profit ($28m in pre-tax profit).

M&A | Cap Raise | Earnings

Dutch powerhouse ASML (ASML), one of the leading suppliers to the semiconductor industry, reported a very strong 1Q, raising full-year guidance in the midst of a chip shortage. Sales growth for the full year is expected to be 30% (well ahead of the previous guidance of 10%). “Compared to three months ago, we are seeing a significant increase in demand across all market segments and our product portfolio” said CEO Peter Wennink. ASML is uniquely positioned to succeed off the back of an unwavering demand for chips over the coming decade(s) as their equipment is a critical component in the manufacture of all major chip types; up to the most advanced 7nm and 5nm process. You can see more in the video below.

Mastercard (MA) has acquired the digital identity platform Ekata for $850m, giving them a solution that can verify the online identity of a person making the transaction in real-time. It does this by assessing a series of signals, in the Ekata Identity Engine, to assess the likelihood that a user is or isn’t who they say they are (i.e. network signals, e-mail, address, IP distance from registered address etc).

Have a great week.

Charlie

LinkedIn or E-Mail (cnave@granitebaycap.com)

Granite Bay Capital is an innovation focussed investment company with a deep focus on the companies at the leading edge of innovation across major themes such as AI, ubiquitous computing, sustainability, automation and longevity. Any views expressed in this article are those of the author(s) and do not constitute financial advice.