Headline Developments

A significant breakthrough with IBM (IBM) unveiling the world’s first chip on 2 nanometer (nm) technology. In a nutshell, the nm represent the distance between transistors on a chip. The less distance between transistors, the more density, performance and power efficiency. This means ‘edge’ devices like earphones and watches become more efficient. At present, the world’s leading chip fabs, like TSM and Samsung (an IBM partner), are churning out 5nm (as we ‘see’ in Apple’s M1 chip). Another interesting fact to get your head around - a DNA double-helix is ~10nm wide. So this is seriously advanced tech at the very pointy end of Moore’s Law.

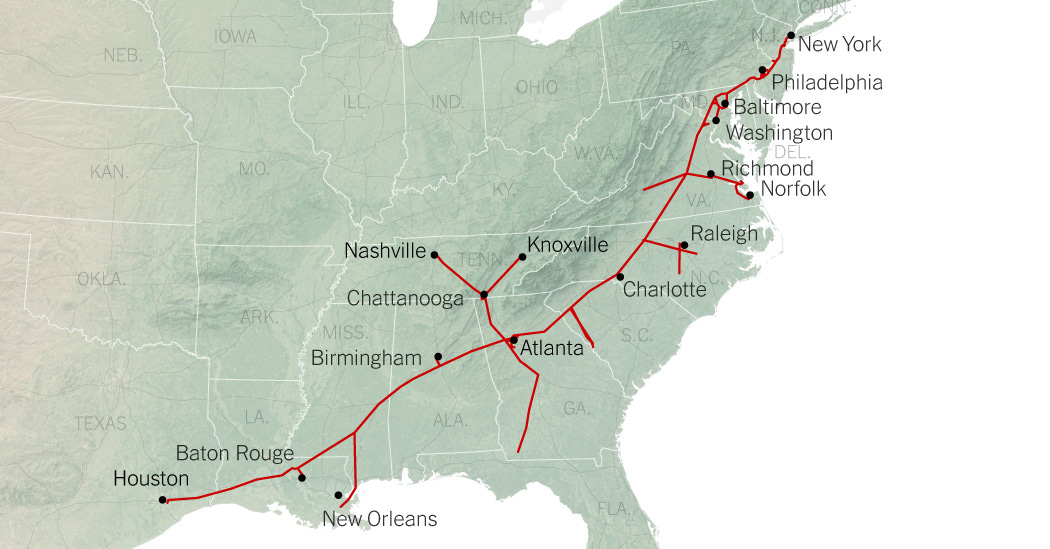

The largest fuel pipeline in the USA, the Koch Industries (part) owned Colonial Pipeline, was hacked by a ransomware gang called DarkSide this week. This caused the pipeline (below) to shut down. This is big because that pipeline carries half of the aviation and auto fuel in the northeast and south of the USA. Interestingly, DarkSide took somewhat of a conciliatory tone in the aftermath saying "our goal is to make money, and not creating problems for society"! What is certain is that these sort of attacks will only escalate, playing right into the hands of companies like Crowdstrike (CRWD), Palo Alto Networks (PANW) and the recently listed Darktrace (DARK) - not to mention consultants like Accenture (ACN).

Harley Davidson (HOG) is making their electric vehicle unit LiveWire (below) a standalone brand after a mixed debut last year. The initial release of LiveWire, meant to appeal to a younger user, didn’t entirely hit the mark (partly due to the $30k price tag). LiveWire’s most notable competitor is Zero Motorcycles (private) with a 124mph top speed (vs 110mph for LiveWire) and 223-mile peak range (vs LiveWire’s 146 miles).

Bose (private) is moving beyond the consumer audio market and into hearing aids. The SoundControl Hearing Aids, which are the first FDA-cleared, direct-to-consumer hearing aids will be available for $850 without a hearing test or prescription. This considerably undercuts rival Eargo (EAR) whose more discreet Neo HiFi hearing aids start at $2,950 per set.

Other Developments

Desktop Metal (DM) is now printing wood. The company’s new Forust process upcycles waste byproducts from wood manufacturing and paper printing to 3D print everything from architectural accents, furniture, bowls and flower pots. The technology uses DM’s single-pass binder jetting additive manufacturing (AM) technology and also creates a digital grain across each layer to create the desired look for the end-product. With 15 billion trees harvested each year (and 84m tonnes of sawdust generated), it’s easy to see the impact these innovative solutions can have. Further developments in lab-grown wood (being developed by MIT) could have an even greater positive impact on the environment.

Google Pay (GOOG) users in the US can now send money to India and Singapore thanks to the tech conglomerate integrating with Western Union (WU) and Wise (pending listing). By the end of the year this service will expand to more than 200 countries through WU and more than 80 through Wise.

Spain has passed new rules requiring gig-economy workers for delivery startups like Glovo (private) to be made employees. The rule came into force immediately with companies given 90 days to comply. This is one of the first such regulations globally, setting a precedent for other countries grappling with labour models for the gig economy. Uber (UBER), Deliveroo (ROO.LN), Delivery Hero (DHER.XTRA) and DoorDash (DASH) are just some of the companies exposed to regulatory risk from such moves.

It didn’t take long for eBay (EBAY) to go from pondering to executing with NFT’s! According to this community update from the company, they want to continue being the destination for collectors of all kinds - physical or digital and are therefore updating their policy to include the sale of NFTs. In the short term NFT inventory will be provided by ‘trusted sellers’ across categories like trading cards, music, entertainment and art, powered by a suite of tools to be rolled out in the ‘coming months’. We’re already seeing some NBA Top Shot collector cards (below) being sold via NFTs.

Tencent (700.HK) is looking to keep its 40% stake in both Fortnite developer Epic Games (private) and League of Legends developer Riot Games (private) after ongoing discussions with the Committee on Foreign Investment in the United States (CFIUS) since last year. Some notable Tencent foreign investments include Sea Limited (SE, 23%), Netmarble (0251270.KS, 18%), Snap (SNAP, ~12%), Spotify (SPOT, 8.7%) and Afterpay (APT.AU, 5%).

Separately, the US has removed Chinese tech company Xiaomi (1810.HK) from a Government blacklist; another sign of further easing of restrictions (and tensions) with China.

As mentioned last week, Clubhouse (private) has now gone live with their Android app, testing initially in the US before a wider roll-out in the UK and other English speaking countries (i.e. Canada, Australia, New Zealand, Singapore).

Rotten Tomatoes are getting into streaming. The movie review site, ultimately owned by Comcast (CMCSA) and AT&T (T), announced that The Rotten Tomatoes Channel will produce 10 originally produced shows and tons of long and short-form TV and movie videos for free. The channel is currently available on Roku (ROKU) in the US.

As usual, Iet’s wrap up with a little update on autos.

Citroen, owned by Stellantis (STLA.BIT), the newly merged Fiat Chrysler and PSA Group, has released a tiny EV called Ami which will set you back a cool $6k. The car will come to the US as part of the group’s Free2Move car-sharing service - a subscription that gives users access to a fleet of vehicles including insurance, assistance and maintenance. The new addition to that service - Ami - will have a 44 mile (71kms) range and a maximum speed of 28mph (45km/h). Say goodbye to those speeding fines!

Subaru (7270.JP) has teased its first EV - the Solterra - coming to the US, Canada, Europe and Japan in 2022. Very little was shared other than the below image and a mud-splattered badge, hinting that the new car will target the more adventurous Forester and Outback users (with more slick aesthetics compared to incumbent petrol models). Subaru is 20% owned by Toyota Motors (7203.JP).

Electric truck startup Nikola (NKLA) has signed a letter of intent with Total Transportation Services Inc (TTSI) to purchase 100 of Nikola’s Tre models from late-2022 (30 powered solely by batteries and 70 longer-range versions with a hydrogen fuel cell system).

Ultium Cells (private), a JV between General Motors (GM) and LG Chemical’s (051910.KS), will be partnering with lithium battery recycler Li-Cycle (PDAC), to send Ultium scrap to Li-Cycle’s plant in New York. Li-Cycle, which is in the process of a SPAC merger, claims to recover 95% of battery material through a proprietary shredding and separating process. Amazon (AMZN)-backed Redwood Materials (private) claim a similar recovery process and both companies have the potential to gain rapid support with the ever-growing demand for EVs and price/supply constraints for raw materials.

IPOs | SPACs

Ginkgo Bioworks (private) is going public via a merger with SPAC Soaring Eagle Acquisition Corp (SRNG), valuing the business at $15bn. The company, backed by Bill Gates, was started by a group of MIT scientists who are building ‘made-to-order’ microbes that enable customers to grow rather than manufacture products - everything from biotech, to building materials, fertiliser and animal feed to beauty products and textiles. Ginkgo works much like a semiconductor foundry, converting designs from industry partners into end products by programming DNA. Current partners include Cargill, Moderna (MRNA), Sumitomo (8053.JP) and Ajinomoto (2802.JP). The below snip from their investor presentation highlights the company’s expectation of being at ‘cost parity with traditional processes.

Bird (private), the electric scooter company that operates in more than 100 cities across the US, Europe and the Middle East, is planning a merger with SPAC Switchback II (SWBK). This follows competitor Helbiz who recently merged with GreenVision (GRNV). According to the company’s investor presentation, they’re looking to grow rides from 18m (in 2020) to 170m in 2023 and swing to an EBITDA of $144m that year from -$180m EBITDA in 2020. A slide from that presentation (below) shows some financial benchmarking vs ‘comparable’ transport startups and tech companies.

Softbank (9984.JP)-owned payments app PayPay (private) is being lined up for the public markets alongside another portfolio company SB Payments Service. PayPay has acquired close to 40m users since launching in October 2018 through aggressive rebates as Japanese consumers rapidly shift away from cash to digital payments.

M&A | Cap Raise

Not the biggest M&A and cap raise week (which is a blessing in disguise given how much other news there is to cover!). Let’s have a look at a few of the more notable transactions though.

Gojek (private) has received an additional $300m from Telkomsel (a unit of Indonesia’s largest telco Telkom) on top of $150m invested back in November last year. The cash comes as the SE Asian ride-hailing and payments company seeks to lock in a merger with Indonesian e-commerce leader Tokopedia (private). Gojek has raised $3.45b to date from the likes of Facebook (FB), Google (GOOG), PayPal (PYPL), Visa (V) and Tencent (700.HK).

Mythic (private) has raised $70m in funding from HP Enterprise (HPE) and Blackrock (BLK) ahead of what it hopes is the successful launch of a revolutionary AI processing technology. The company believes the platform they are rolling out will offer unique advantages for building AI applications on the edge, with superior latency, performance, scalability and ease of use. I won’t even try to explain how the technology works but if you’re game, check out their overview here. You’ve been warned!

Walmart (WMT)-backed Flipkart (private) is in early talks to raise $1bn according to India’s Economic Times. This comes as the company is contemplating an IPO and faces mounting competition from Amazon (AMZN) and Reliance-owned JioMart (private). According to earlier reports from Reuters, such an IPO would likely value the company at around $50bn!

Earnings Week - Winners and Losers

Another big earnings week and unless a company has considerably surpassed earnings forecasts, they’re getting sold off - in some cases, considerably (and despite some otherwise quite impressive results)!

Why? Well, 2020 was an absolutely stellar year for many innovators, with adoption of digital solutions (SaaS, streaming, e-commerce, delivery) leapfrogging a few years, however, as we very slowly get back to ‘the new normal’ those growth rates are reverting to pre-covid levels and a lot of the ‘fat’ built into valuations is getting trimmed to more sensible levels. There are also wider macroeconomic concerns weighing on tech (some of that warranted, some unwarranted).

The Trade Desk (TTD), a platform to buy and sell digital ad campaigns, dropped a staggering 25% despite earnings beating forecasts (apparently Google and Facebook set too high a benchmark for ad revenue surprises, so anything in-line just isn’t good enough)

The RealReal (REAL), a luxury e-commerce platform, had results in line with market expectations. So, of course it’s sold off considerably! Headline numbers - GMV up 28% QoQ to $327m, Revenue up 27%, orders up 20%, avg. order value up 6%

Workhorse (WKHS) slid as revenue completely missed the mark, catalysing the company to slash it’s annual production targets. Like many OEMs, those semiconductor shortages are causing a serious headache. They also took a hit in profitability after reducing the fair value of its investment in Lordstown (RIDE), in which it has a 9.3% stake

Roblox (RBLX) investors were mildly impressed with the company’s results after revenue rose 140% YoY to $387m and Free Cash Flow (FCF) surged 4x to $140m for the quarter. Daily Active Users (DAUs) were 42m (up 79%) led by a 111% surge in users over 13 (not a stat you hear often!)

Have a great week.

Charlie

LinkedIn or E-Mail (cnave@granitebaycap.com)

Granite Bay Capital is an innovation focussed investment company with a deep focus on the companies at the leading edge of innovation across major themes such as AI, ubiquitous computing, sustainability, automation and longevity. Any views expressed in this article are those of the author(s) and do not constitute financial advice.

Hey guys - great stuff as always. Just to clarify something here. When companies talk about the nanometer process node, it is only a marketing concept these days. It simply represents the next generation of improvement in design and density. While it used to mean exactly what you said, the distance between transistors, it is not that way anymore. The most advanced process nodes are currently ~13-14nm in terms of actual gate distances. Just wanted to clarify that. There is actually a real debate in the industry if actual 10nm or 7nm geometries are even possible.