Headline Developments

It’s a bad week for crypto, with bitcoin off ~30%. Firstly, Elon Musk has done a U-turn, now not accepting bitcoin as payment for Tesla due to environmental concerns. He may also wind down the company’s position in the asset. Secondly, three Chinese industry bodies have banned financial institutions and payment companies from providing services related to cryptocurrency transactions. These services would include registration, trading, clearing and settlement. The statement also highlighted the risks of crypto trading, saying virtual currencies “are not supported by real value” and hence should not be used in the real economy as money. Of course, this does not include China’s Digital Yuan which will inevitably give China more granular control and oversight of its financial system.

However, a good week for Colonial Pipeline’s hackers DarkSide who are reported to have received $90m in bitcoin before shutting down (including $5m from Colonial). DarkSide operate(d) what’s known as Ransomware-as-a-Service, selling their ransomware tools to other criminals. A great use-case for crypto and a perfect example of why we will only see increased regulation in the space.

Roblox (RBLX) has replaced the word ‘game’ with ‘experience’ across its entire platform. The games tab is now the discover tab and the term ‘max players’ has been replaced with ‘max people’. Why is this important? Well, firstly, Roblox says the term ‘experiences’ is “consistent with how we’ve evolved our terminology to reflect our realisation of the metaverse”. Secondly, that Epic v Apple case. In that case, Epic’s Fortnite is defined as a game and, as such, cannot operate its own in-game store. Roblox, however, is allowed to operate an in-game store. Why? Because Apple considers Roblox an app - not a game. Apple’s marketing head Trystan Kosmynka justifies this position by defining games as having “a beginning, an end (and)….challenges in place” while he sees Roblox as similar to Minecraft in that there are maps, worlds and “boundaries in terms of what they’re capable of”. So much of this case hinges on such tenuous definitions and, no doubt, Apple wishes they had a time machine to properly define a metaverse and protect future app-store revenues.

China has landed a rover (called “Zhurong”) on Mars for the first time, making it the second country behind the USA to complete the task. Zhurong is part of the Tianwen-1 Mars mission which set off last July, the same month as NASA’s mission. As opposed to NASA’s significantly more advanced Perseverance, Zhurong is much more bespoke, using spectroscopy to analyse surface material and radar to analyse structures up to 100m underground (10x the Perseverance radar) with the hope of uncovering water ice. It’s certainly an exciting new era for space exploration being led by the US and China across many fronts.

Google (GOOG) has penned a deal to install SpaceX (private) Starlink terminals at its cloud data centres around the world. This will allow Starlink customers to utilise a leading cloud service with their Starlink a/c whilst giving some of Google’s enterprise cloud customers access to a global satellite constellation for boosted internet and connectivity. Google has invested ~$900m into the space company to date, with this step further solidifying the partnership between the two companies.

Other Developments

Google (GOOG) had its dev-centric I/O 2021 event this week where they announced a bunch of new products and features such as:

Project Starline (below) uses high-res cameras to project a real-time 3D model of a person “sitting” opposite you

Android watches are set for a boost with Google’s Wear OS and Samsung’s Tizen joining forces

Google Maps (150k/km bike lanes, fuel-efficient routes and the ‘safest’ route)

AR (Live View will let you point the camera to see restaurant reviews, street signs, tourist sites)

Privacy (private photos can be stored in a ‘locked’ folder)

Digital Car Keys (so you can unlock your car with your phone)

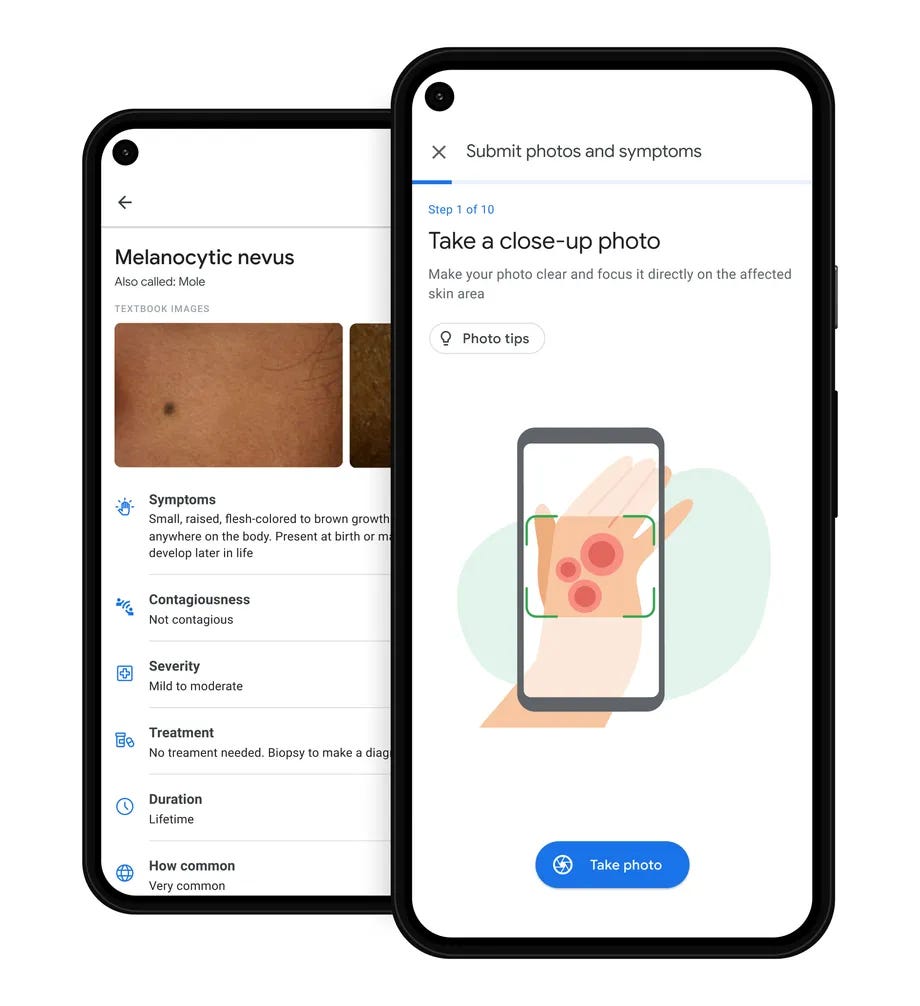

Health (AI will help identify possible skin conditions from a set of 288 its been trained to recognise)

Pinterest (PINS) is testing a very logical product evolution, with live-streamed events kicking off this month with 21 creators including Jonathan Van Ness. Users will be able to comment to interact with creators during the stream and purchase any tagged products during the Livestream. For example, if the ‘’morning routine’’ below includes a certain face wash; you’ll be able to buy that directly during the stream, significantly amplifying Pinterest’s ad revenue and e-commerce potential. Other creator experiences being tested include styling workshops with Rebecca Minkoff, cooking with Dan (“Grossy”) Pelosi and Peter Som, vision boards with Women’s Health magazine and at-home spa nights with Hannah Bronfman.

Spotify (SPOT) are also joining the “live”-stream party, rolling out virtual pre-recorded concerts starting this month with The Black Keys, Rag ’n Bone Man, Leon Bridges, Bleachers and girl in red (below). Tickets cost $15 and can be purchased through this link. Another nice product upgrade from Spotify. The question is whether users will engage for pre-recorded gigs they can easily stream from other providers at a lower cost (i.e. where’s Spotify’s edge here?).

Twitter (TWTR) is reported to be working on a subscription service that would cost $2.99/month. According to app researcher Jane Manchun Wong, the service will be called Twitter Blue and will initially allow users to undo tweets and bookmark collections. Based on Twitter’s recent acquisition of ad-removal product Scroll, it’s a reasonable assumption that subscribers will also scroll ad-free.

Apple (AAPL) Music will be releasing lossless audio with support from Dolby (DLB) Atmos. The new feature will be available at no additional cost starting next month and has catalysed Amazon to waive additional charges on their lossless HD tier. Later this year Spotify (SPOT) will be releasing a lossless streaming tier called HiFi. No doubt Spotify are crunching the numbers to see if they can match the ‘no additional cost’ of competitors (something they’re less capable of doing given the balance sheet constraints vs Apple and Amazon!).

Good news and bad news for New Zealand’s Rocket Lab (private) following its 20th Electron launch on 15th May. Starting with the bad news, the second stage engine shut down shortly after ignition, resulting in a loss of the vehicle and its payload - an Earth observation satellite for “satellite-imaging-as-a-service” startup BlackSky (private). The good news - the rocket’s first stage (containing nine of their Rutherford engines) has been recovered (below) and a new stainless steel heat shield (instead of aluminium) also functioned according to plan. Once Rocket Lab nail the deployment of the Electron (the 18m rocket), all eyes will then shift towards their Neutron rocket - 40m in height with a payload capacity of 8,000kg (vs 300kg for Electron).

Advanced Micro Devices (AMD) now have the freedom to procure 14nm+ chips from fabs outside of GlobalFoundries (private), the fab it spun out in 2008. In an updated wafer agreement, AMD has agreed to buy a minimum volume of product from GF, estimated to be worth ~$1.6b, from 2022-2024. This comes on top of expansion plans for GF, spending $1.4b on expansion in the US, Singapore and Germany, ahead of a planned IPO this year. The company also announced a $4bn share repurchase (it’s first since 2001) in a very clear sign of confidence in the company.

The SEC is undertaking a “fact-finding inquiry” on EV startup Canoo (GOEV). The investigation covers its recent SPAC merger plus its “operations, business model, revenues, revenue strategy, customer agreements, earnings and other related topics”. The investigation comes on the heels of executive exits (i.e. co-founder Ulrich Kranz) and a new strategy, under new CEO Tony Aquila, to shift away from engineering services (likely killing a Hyundai deal) and into commercial vehicle sales. This starts with the $34,750 - $50,000 lifestyle van (below), the delivery vehicle and pickup truck which all, as of this week, are open for preorders.

EV startup Fisker (FSR) and electronics giant Foxconn (2354.TW) are teaming up to churn out mass-market EVs by late 2023. The project, called PEAR, aims to sell a small five-passenger EV for $30,000. Fingers crossed this doesn’t go pear-shaped, otherwise journalists will have a field day.

The Plastic Waste Makers Index was released this week, highlighting that twenty firms are responsible for producing 55% of the world’s plastic waste - including ExxonMobil, Dow and Sinopec. These companies are ‘enabled’ by investors like Vanguard and Blackrock as well as banks like Barclays, HSBC and Bank of America. It also showed that Australia (below) is generating more single-use plastic per person than anyone! The overarching message, a drastic shift from policymakers, investors and all within the supply chain, is one we’ve heard countless times, however, it’s also a timely tip of the hat to sustainable packaging solutions. Companies like Avantium (AVTX.AMS), Biome Bioplastics (private), Good Natured (private), NatureWorks (private), RWDC Industries (private), Triple W (private) are just some of the companies leading the way here.

IPOs | SPACs

Card-issuing platform Marqeta (private) has published its prospectus, ahead of a much-anticipated listing. In a nutshell 🥜, Marqeta provides one-stop access to a modern payment ecosystem, generating ~$350m in revenue (off Q4 run-rate) with 100% revenue growth and >200% dollar-based net revenue retention (a massive number). They’ve done this off the back of 320m cards issued (physical, virtual and tokenised) for companies like Doordash, Instacart, Square, Klarna, AfterPay and J.P.Morgan. This listing is refreshing in that it offers a unique fintech platform that is clearly differentiated from the hordes of neobanks, insurers, lenders and BNPLs in the market. The figure below highlights the growing Total Processing Volume (TPV) across its network.

Israeli work management platform Monday.com (private) has submitted its registration statements to the SEC ahead of a planned listing. The platform has a suite of products and templates to solve various problems across project management, marketing, CRM and HR (to name a few areas). Their annualised revenue run-rate sits at around $236m, with 85% YoY revenue growth from >127k customers. Revenue retention sits at 121% (with 10+ users). Customers include Peloton, Nautica, Hulu, Hubspot, Mars Wrigley, EA, Universal - you name it. You can see an overview of the platform below.

Three-year-old industrial automation startup Bright Machines (private) is setting its sights on the public markets via a SPAC merger. In (another) nutshell 🥜, the company sell modular factory automation products (for analysis, design, fabrication and assembly) for a range of sectors including auto and consumer which is seeing highly impactful results with up to 71% improvements in output/hour, 90% reductions in headcount and 88% declines in defect rates. In one of the case studies below, a networking equipment manufacturer saw their initial $1.4m investment paid back in just 11-months, with a 69% reduction in the cost per unit. The investor deck here is well worth a read.

M&A | Cap Raise | Earnings

AT&T (T) is spinning off WarnerMedia (three years after acquiring it), and merging it with Discovery (DISCA) to create a stand-alone media unit which they hope will put it in a better position to compete against Disney (DIS), Netflix (NFLX) and Amazon (AMZN). The deal will see AT&T shareholders receive stock representing 71% of the newco while Discovery shareholders will own 29%. A new name for the combined company will be announced shortly. Brands within the new company will include HBO, Warner Bros, Discovery, DC Comics, CNN, Cartoon Network, TNT, Animal Planet and sports rights to NBA, MLB, PGA and Tennis. Combined, it’s expecting around $52b revenue, $14b EBITDA (2023e) and $3bn in synergies. The deal presentation can be found here.

Amazon (AMZN) is rumoured to be eyeing off MGM (private) for $9bn as it seeks to maintain its position towards the top of the streaming table. If successful, the deal will add James Bond, Rocky, The Hobbit and Handmaid’s Tale (plus 4,000 films and 17,000 hours of TV programming) to an already solid lineup.

As expected Indonesia’s Gojek (private) and Tokopedia (private) will be merging into “GoTo”; creating a South-East Asian super-app across e-commerce, financial services and on-demand (delivery / ride-hailing). This will put it in a prime position to compete with regional leaders Sea Limited (SE), below, and Grab (pending listing) who are eyeing off a $40bn SPAC merger - around the same value GoTo are eyeing off for their inevitable IPO. Meanwhile, SEA’s market cap is currently sitting at around $120b.

Singapore’s Sea Limited (SE), who are leaders in gaming, e-commerce and digital finance in South East Asia (SEA) reported their earnings during the week highlighting a 147% YoY rise in total revenue (in-line) and EBITDA of $88m (vs $185m expected). Despite this miss, the stock was still up ~10%. Gaming unit Garena saw paying users up 124% YoY, e-commerce unit Shopee saw gross orders up 153% YoY and Sea Money saw total payment volume up 200% YoY. Despite the EBITDA miss what we saw was an overall stellar set of results which highlights the incredible growth trajectory of the South East Asian digital economy. With Grab about to list, you’ll soon have two excellent ways to gain exposure to this region. You can see the results here.

Have a great week.

Charlie

LinkedIn or E-Mail (cnave@granitebaycap.com)

Granite Bay Capital is an innovation focussed investment company with a deep focus on the companies at the leading edge of innovation across major themes such as AI, ubiquitous computing, sustainability, automation and longevity. Any views expressed in this article are those of the author(s) and do not constitute financial advice.