Headline Developments

It’s a big edition this week, so settle in!

Elon Musk’s Boring Company (private) broke ground this week, shooting Tesla (TSLA) passengers through a high-speed tunnel under Las Vegas. The loop comprises 2.7km of tunnels, built 30 feet under the Las Vegas Convention Center. Musk’s vision is to have 60 fully autonomous Teslas sending 4,400 people per hour through the loops at 240km/h. Expansion plans are in the works (to the new Resorts World and Encore hotels) with TBC ultimately aiming for 40 ‘stations’ covering the entire strip.

One of the more hotly anticipated EVs, the Rivian (pending listing) R1T Launch Edition will be delayed by a month with deliveries now expected to take place in July instead of June. The delay was due to a number of factors including the semiconductor shortage, however, they stressed that they are less impacted than other OEMs. Lordstown’s Endurance truck is on track for September deliveries, whilst Ford’s F-150 and Tesla’s Cybertruck are likely due in 2022.

In other news, Rivian has selected underwriters (GS, JPM, MS) for a targeted $70bn IPO later this year, according to Bloomberg. This would put them snugly between Ford (F) at $58bn and General Motors (GM) at $86bn.

Now that you’re fascinated with EVs and high-speed loops, it’s time to get into some regulatory news! A bit more dull, but important nonetheless.

Late last week, the US Senate passed the U.S. Innovation and Competition Act - a $250 billion package to increase the level of domestic investment in innovation. Senate Majority Leader Chuck Schumer, who co-wrote the bill, said the country is “potentially falling behind the rest of the world in the technologies and industries that will define the next century”. Of the $250 billion, $54 billion is earmarked for the semiconductor, microchip and telco industries.

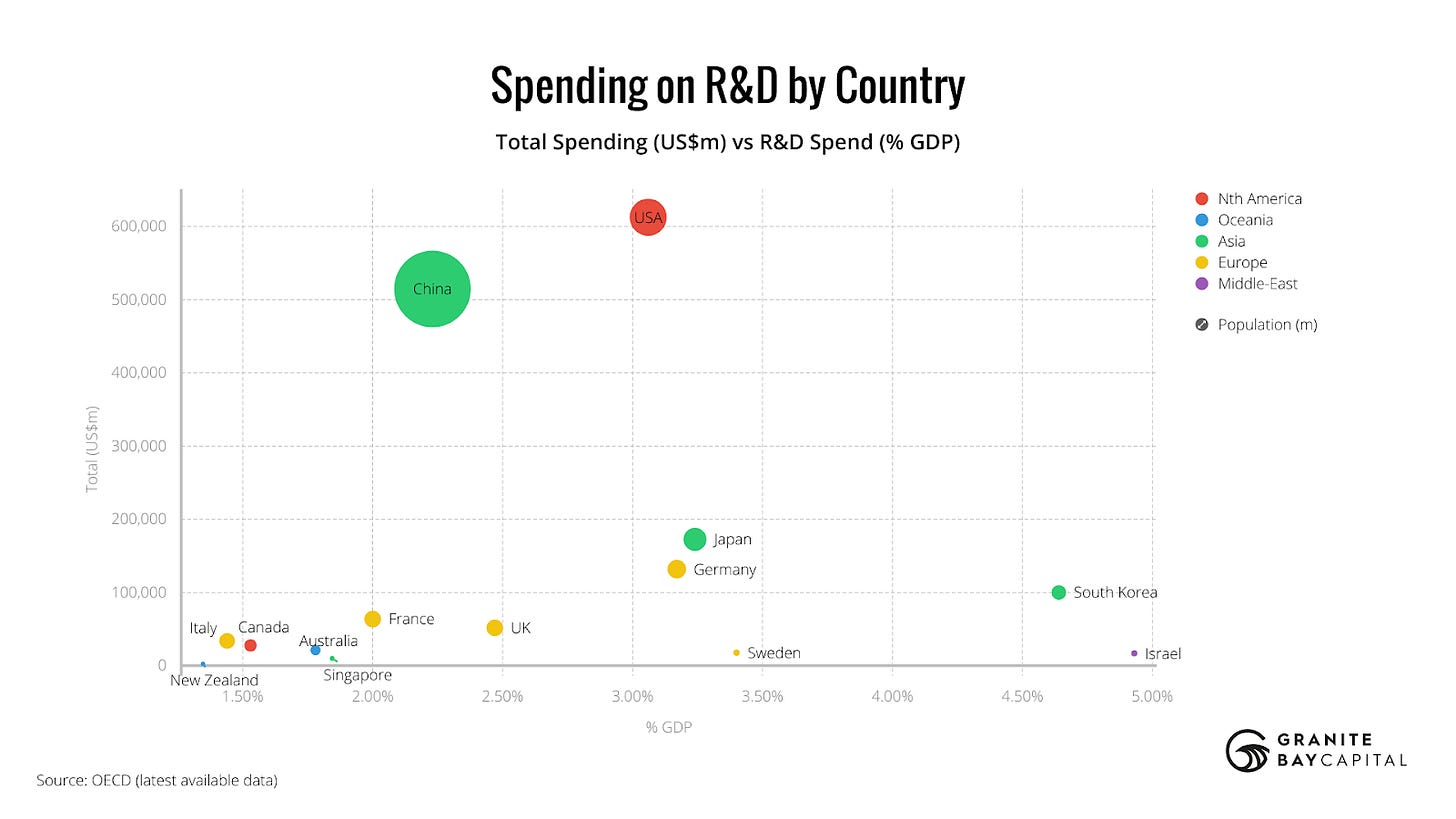

China has a target of 2.5% of GDP for its R&D spend (which it is nearing) and this new injection from the US is aimed to maintain their lead in both total spend and spend as a proportion of GDP. According to the latest OECD figures, Israel and South Korea are the biggest spenders on R&D relative to the size of their economy.

Separately, Senate Republicans have responded to Joe Biden’s $2 trillion infrastructure investment plan, effectively shrinking the budget by 50% and reducing the $174bn targeted at EV investments to just $4bn (denting the President’s strategy to combat climate change). As part of the original plan, the President had vowed to install over half a million EV charging stations across the country by 2030 and provide tax incentives for EV buyers. Another proposal under the package, to retrofit millions of homes to boost energy efficiency, is also at risk as both sides of the Government seek a middle ground between ‘traditional’ infrastructure spend and progressive infrastructure spend.

Over to Europe, with Germany this week giving the thumbs up to Autonomous Vehicle laws, allowing AVs on the road by 2022. According to the legislation, “in the future, autonomous vehicles should be able to drive nationwide without a physically present driver in specified operating areas of public road traffic in regular operation”. This is particularly good news for Argo AI, backed by VW and Ford, who have their European HQ in Munich and are soon to launch a test site with VW in the country.

Clearly, there’s quite a high correlation between progressive legislation and a country's R&D spend!

Other Developments

7-Eleven Inc, which became wholly owned by Japan’s Seven & i Holdings (3382.JP) in 2005, are ramping up their exposure to EVs, installing 500 (wholly-owned) direct-current fast charging ports at 250 locations across North America by the end of 2022. Seven & i have 9,800 7-Eleven stores in North America (24% owned / 76% franchise) with current gross profit split roughly 20% to fuel and 80% to merchandise. They currently have an 8.5% share of the North American convenience store industry (including the recent acquisition of Speedway) and, as consumers slowly shift from gas to electric, such investments in EV infrastructure will enable the group to maintain edge over a highly fragmented industry.

The world’s fastest AI supercomputer, called Perlmutter, has been switched on at the National Energy Research Scientific Computing Center (NERSC) in Berkeley, California. The computer will help ~7,000 researchers piece together a 3D map of the universe, probe subatomic interactions for green energy sources and much more. The architecture is based on Hewlett Packard Enterprise’s (HPE) CRay “Shasta” platform, featuring 1,536 GPU-accelerator nodes, each containing four NVIDIA (NVDA) NVlink-connected A100 Tensor Core GPUs and one 3rd Gen AMD (AMD) EPYC processor. What does this mean? Well, according to NVIDIA, it will allow NERSC to capture and analyse years of data from the Dark Energy Spectroscopic Instrument (DESI) - which can take a photo of 5,000 galaxies in a single exposure - in just days, instead of weeks or months.

Actually, DESI kicked off a couple of weeks ago on a 5-year quest to “unravel the mysteries of dark energy” by gathering light from “some 30-million galaxies”. I’m not even going to try and explain this one, but you can try by following the link here!

A big boost for Japan’s chip industry, with twenty companies getting Government backing to collaborate with the world’s leading fab Taiwan Semi (TSM). According to Nikkei, TSM is expected to pay half the cost ($337m) of a local research facility which they (TSM) say “aims to leverage more expertise in the field of materials to bring value to the industry”. Companies benefiting from the collaboration include Ibiden (4062.JP), Asahi Kasei (3407.JP), Shin-Etsu Chemical (4063.JP), Nagase & Co (8012.JP) and Shibaura Mechatronics (6590.JP).

A high-steaks cyberattack this week with one of the world’s largest meat producers (slaughters), Brazil’s JBS (JBSS3.SA), seeing its servers attacked, impacting systems in Australia and North America. According to the White House, this was a ransomware attack “from a criminal organisation likely based in Russia”. In Australia, JBS operates 47 facilities, with the Queensland meatworker’s union saying up to 4,000 workers may lose out on a week’s worth of wages due to the attacks.

This follows the recent pipeline attack in North America and plays right into the hands of companies like Crowdstrike (CRWD) who published this fascinating piece on ransomware-as-a-service.

IPOs | SPACs

Australia’s Tritium (private), a leading manufacturer of DC charging stations (like those being rolled out by 7-Eleven) is merging with Nasdaq SPAC Decarbonization Plus Acquisition Corp (DCRN). To date, the company has sold over 4,400 chargers in 41 countries, with the units charging up to 20 miles of range in 1 minute (vs over 47 minutes by AC). The company are forecasting average revenue growth of 74% over the next six years and aims to be free-cash-flow positive in 2023 (with a FCF/Rev margin of 20% in 2026). Per the investor presentation, it’s trading ~4x 2026e EV/EBITDA and 0.9x EV/Rev vs 19.3x and 3.2x for its nearest competitor Chargepoint (CHPT).

Wejo (private), a connected vehicle data platform, is merging with SPAC Virtuoso Acquisition Corp (VOSO) giving them a post-deal EV of ~$800m. According to the investor presentation, the company ingest 14.5 billion data points every day from a supply base of 50m vehicles, pulling that data (i.e. location, vehicle status, environment) into a central repository (like Confluent below) from which they create monetizable and actionable insights. Key competitors in the space include Otonomo (SAII) and the Audi/BMW/Daimler controlled Here Technologies (private).

Sticking with SPACs, fintech disruptor Acorns (private) announced that they’ll be merging with Pioneer Merger Corp (PACX), valuing the business at $2.2bn. The company’s most popular product allows customers to automatically round up purchases to invest that spare change into index funds. Since that first product, it’s expanded into what is now effectively another challenger banks with education, banking products, retirement accounts and a debit card.

Confluent (private), a leader in what they call “data in motion”, is hitting the markets. The platform effectively acts as a central nervous system/repository of all a company’s data across various channels providing ubiquitous real-time connectivity and powering real-time applications across the enterprise. So, the mess of apps, data warehouses, databases, SaaS platforms across the organisation and cloud are more fluidly plugged into the central nervous system called Confluent. Knowing the mess in many organisations, this service is taking off - not only for Confluent but Amazon (AMZN), Microsoft (MSFT), Cloudera (discussed below), Fastly (FSLY), Domo (DOMO) etc. In terms of numbers, they’re seeing 51% YoY revenue growth from over 2,500 customers (560 of which having over $100k in ARR). Certain reports put a price tag of $4.5b on the company, however, assuming they maintain a similar growth rate (which is a decent ask) you could see a price tag as high as $10bn. Punchy, but that’s in line with the P/S multiples of “peers” on similar growth trajectories - like Datadog (DDOG), MongoDB (MDB) and Palantir (PLTR).

China is pushing for the country’s largest online audio platform, Ximalaya FM (private) to ditch plans for a US-listing in favour of Hong Kong, as it seeks greater control over domestic media and internet businesses, according to the Economic Times. The company, backed by Tencent (700.HK), Xiaomi (1810.HK), Baidu (BIDU) and Sony (6758.JP) is currently in discussions with the Cyberspace Administration of China (CAC) and is likely to decide on it’s listing venue in the coming weeks. Ximalaya (Himalaya) has ~250m MAUs and 5.2m active content creators which have helped generate $620m in revenues and $304m in Gross Profit.

Whether they like it or not, HK may not be too bad a destination given last week’s successful listing of JD Logistics (2618.HK) which saw the supply chain and logistics conglomerate trade up 17% from its issue price. JD.com (JD) retains a 65% stake in the business which is generating ~$11.5b in revenue p/a (with 50% growth last year and 29% growth pre-covid). Much of their ongoing logistics growth will come from - predominantly FMCG, apparel, electronics and fresh produce.

The Full Truck Alliance (or Manbang in China) is also readying for an IPO on the NYSE (but not being held back by authorities!) - a listing that would value the company at ~$20bn. The company operates what they call the “World’s Largest Freight Platform” with a network of 2.8m truckers and 1.3m shippers across the country according to the prospectus. The platform works much like Uber, but instead, enables shippers to seamlessly connect with truckers to fulfil ~70m orders p/a. The platform currently serves 20% of the country’s heavy and medium-duty truckers and has what they claim is a 64% share of the digital freight network. However, the company’s revenue only grew 2% from 2019 to 2020, seeing Net Loss swell from $238m to $529m over the course of the year.

M&A | Cap Raise | Earnings

Sweden’s Smart Eye (SEYE.ST), which develop driver monitoring systems has paid $73.5m for “emotion detection” startup Affectiva (private), based in Boston (and spun out of MIT Media Lab in 2009). Affectiva has developed software that can “understand human emotion” or, more accurately, utilise machine learning to assess certain facial expressions or environmental conditions (yawning, sleeping, distraction, phone usage etc). At present, Smart Eye has 84 production contracts for its system with 13 OEMs including BMW and GM. Australia’s Seeing Machines (SEE.LN) are another company in this sector doing incredible things which will contribute greatly to improved driver safety.

Leading mobile games platform Skillz (SKLZ) rocketed an astonishing 27% overnight after announcing the acquisition of Aarki, a platform for creating engaging/gamified mobile ads. Bringing this together with Skillz, whose platform hosts >2 billion casual esports tournaments each year, helps bridge a monetisation gap in ad revenue which has, justifiably, seen a very positive response from the market.

Cloud computing and data analytics group Cloudera (CLDR) have agreed to a $5.3bn takeover from a group of PE investors led by KKR. The company has been under pressure for some time since activist investor Carl Icahn built an 18.4% stake in the company, forcing two associates onto the company’s board as a result. The company surged 24% on the back of the announcement.

Along the same theme, activist investor Elliot Management has become the largest shareholder in Dropbox (DBX), with a reported 10%+ stake according to the WSJ. Dropbox was up nearly 7% off the back of the news. There is a lot of logic behind Elliot’s move as Dropbox growing YoY Revenue at a very healthy clip (and beating forecasts consistently). Now they’ve got a sizeable position on the register they may push for some board seats in parallel to pushing a change of strategy and/or reorg of the company to extract further shareholder value. Elliot are notable for their activism with Comcast and Twitter and, in Australia, being a thorn in the side of the world’s biggest miner - BHP. This is good news for shareholders who have, for a while, seen their stock significantly underperform vs the wider tech sector.

Zoom (ZM) reported some whopping earnings, with total revenue up 191% year-on-year to $956m for the quarter, whilst Net Income hit $227m (or 74c/share), up from $27m (9c/share) this time last year. However, this was only marginally better than what the street had expected

Resolve (private), a company spun out of Affirm (AFRM) focussing on B2B BNPL, has raised $60m. Unlike Affirm, which focuses on the consumer, Resolve is exclusively focused on B2B billing by automating the process of billing and purchasing on credit (i.e. businesses are paid upfront whilst customers are given 30, 60 or 90 days to complete payment).

Have a great week.

Charlie

LinkedIn or E-Mail (cnave@granitebaycap.com)

Granite Bay Capital is an innovation focussed investment company with a deep focus on the companies at the leading edge of innovation across major themes such as AI, ubiquitous computing, sustainability, automation and longevity. Any views expressed in this article are those of the author(s) and do not constitute financial advice.