Headline Developments

Nintendo (7974.JP) profit’s jumped a whopping 200% to $2.8 billion for the first half of the year, led by a surge in demand for gaming, specifically Switch, during the pandemic. Nintendo sold 12.5 million Switch devices from April to September, an 81% increase over the previous year. The company also boosted its full-year operating profit forecast by 50% led by Switch.

Fresh on the heels of its Match Group (MTCH) distribution, IAC Interactive (IAC) announced that they are considering spinning off their video unit Vimeo. Vimeo has proven to be a (more than!) steady investment for IAC over the years, and the parent has indicated that spinning the unit off is in Vimeo’s best interests to gain the necessary capital to achieve it’s growth ambitions. Market appetite was tested yesterday, with a $150 million equity capital raised from external investors, vaulting Vimeo at $2.75 billion. Vimeo’s Q3 revenue increased 44% off a subscriber base of 1.46 million.

Ant Group’s (private) much-anticipated IPO has been suspended by the Shanghai Stock Exchange, one day after Jack Ma and other top executives were pulled into private meetings with Chinese regulators. This meeting came following Jack Ma’s recent criticisms of China’s financial regulation and China’s recent implementation of measures to rein in the fintech sector, primarily focussed on improving and tightening regulation relating to small online loans and microfinance businesses.

Huawei (002502.SZ) are planning to build their own chips to beat US sanctions, according to a report in the FT. The plant will be run by a partner, Shanghai IC R&D Center, and assuming all goes well, will put Huawei on a more sustainable path with in-house fab capabilities. We believe this is an inevitable path for Huawei, however, is a path with extraordinary barriers relating to IP. World-leading fabs, Taiwan Semi (TSM) and Samsung (005930.KS) are already developing the most advanced semiconductors - 5nm - and reports indicate that Huawei will start their fab journey well behind the curve, with 45nm chips.

Uber (UBER) and Lyft (LYFT) had a win this week, with California voting to exempt the companies (and other ‘gig’ economy employers) from having to classify their workers as employees. Drivers will receive minimum hourly earnings, however, won’t get the full protections and benefits that come with employment such as sick leave, health insurance and worker’s compensation.

Other Developments

Apple (AAPL) announced a “One More Thing” event for the 10th November which, according to The Verge, will likely see the company announce its first Arm-based Macs that run on Apple Silicon chips instead of Intel processors.

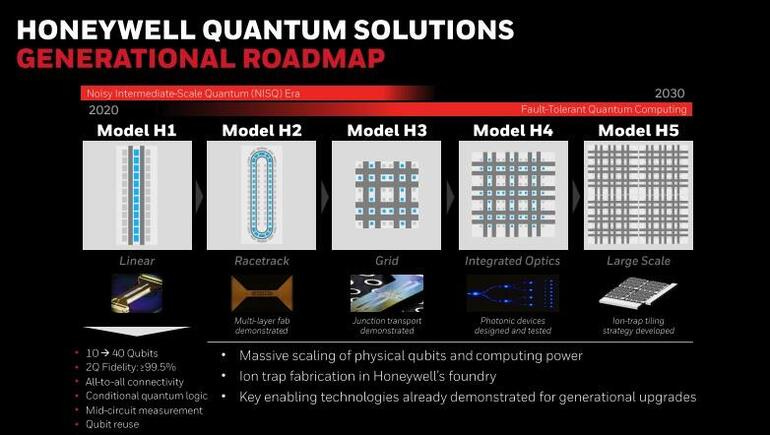

Honeywell International (HON) released its next-generation quantum computer - the System Model H1 - which is “twice as powerful as the next alternative in the industry”. The new computer can be accessed via a cloud API or Microsoft Azure Quantum and, due to current demand, slots to use the computer are booked (by the likes of DHL and Merck) through to the end of 2020. As you can see in the below diagram from Honeywell, the H1 is the first iteration of quantum solutions which, by 2030, will evolve from 10 to 40 qubits.

Daimler (DAI.DE) and Volvo (VOLV-B.ST) are establishing a joint venture to sell fuel cell systems. Under the agreement, Volvo Group, controlled by China’s Geely, will acquire 50% of the partnership interests in Daimler Truck Fuel Cell for about $700 million. The joint venture will develop a system with several power stages, including a twin system with 300-kilowatt continuous power for heavy-duty long haul trucks.

Nidec (6594.JP) announced plans for a $2 billion electric vehicle motor factory in Serbia, according to Nikkei. The new plant will have an annual output of up to 300,000 units by 2023. Overall, sales in the auto segment are expected to double YoY, bringing it in line with Nidec’s more traditional motor segments within appliances and ‘small precision motors’. We’ve attached below a snippet from Nidec’s 2Q20 presentation which outlines their supply forecast for the E-Axle (their electric drive solution). It’s not the cleanest slide but highlights the tremendous growth potential Nidec sees off the back of EVs.

General Motors (GM) CEO Mary Barra said in an interview with Bloomberg TV that talks with EV company Nikola (NKLA) are ongoing. An initial $2 billion manufacturing and licensing deal between the two companies, announced in September, was put on hold following a short sell report suggesting Nikola’s founder and former executive chairman Trevor Milton had committed fraud and deceived investors.

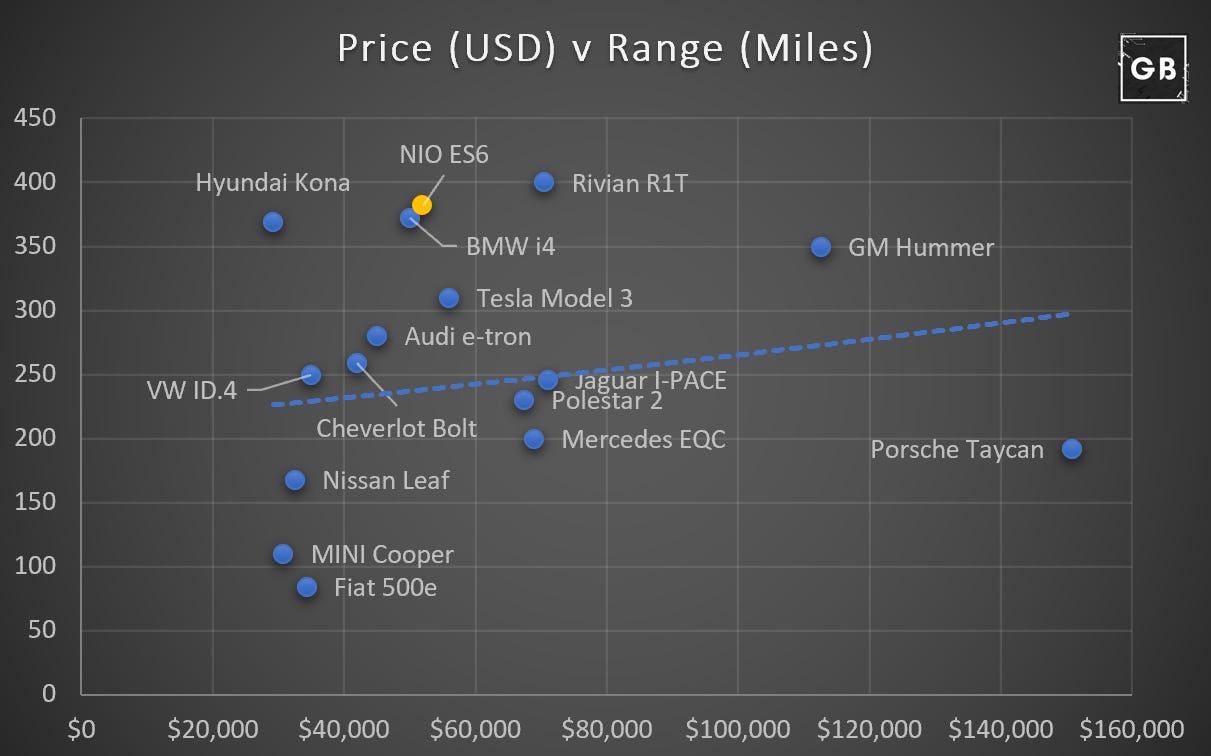

Chinese EV manufacturer NIO Limited (NIO) rallied over 30% during the week after they announced that sales of their vehicles doubled year-on-year to 31,430. The company’s best-seller, the ES6 crossover, starts at $52,000 with a range of up to 615kms. This puts it roughly in line with BMW’s i4 - similar price and mileage, but a slightly better acceleration of 0-60mph in 4 seconds NIO’s 4.7 seconds. The chart below highlights NIO (gold) across the EV landscape on quite a simplistic range v price.

Snap Inc’s (SNAP) Snapchat has shot up the charts in India, with a little help from the country’s TikTok ban. India is now Snapchat’s top market for downloads, comprising one-third of the app’s total monthly downloads. The United States is the second-largest market for Snapchat, with 18% of the monthly downloads.

Still in India, Facebook’s (FB) WhatsApp has received approval from Indian regulators to roll out their payments platform on the country’s UPI-payments infrastructure, built by a coalition of banks in the country. Although the rollout is small to start (20 million users), the scalability is significant, with an estimated 400 million WhatsApp users in India. At present, Google and Walmart have an 80% market share of UPI payments.

M&A | IPOs

Aeva (private), a LiDAR technology company backed by Porsche (PAH3.DE) and VC’s Canaan Partners and Lux Capital, is aiming to hit the markets in early 2021 through a merger with SPAC InterPrivate Acquisition Corp (IPV). Aeva, who build “LiDAR-on-chip” technology, joined fellow LiDAR companies Velodyne (VLDR) and Luminar (private) to follow the SPAC route to market.

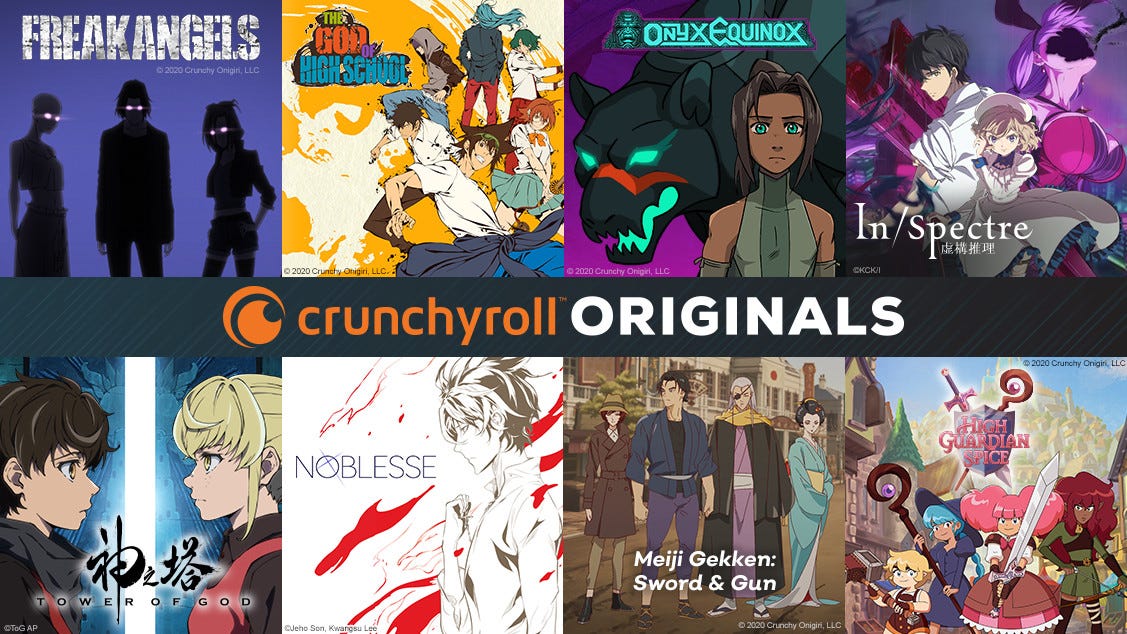

It’s rumoured that Sony (9758.JP) is seeking to buy anime streaming platform Crunchyroll off their current owners AT&T (T). The suggested price tag of ~US$1bn would give Sony access to over 3 million paying subscribers, 1,000 anime shows, 200 east Asian dramas and 50 manga titles. This would be added to Sony’s existing anime offering which includes a minority stake in China’s Bilibili (BILI) and the recently acquired Funimation, a speciality anime streamer with around 1 million subscribers.

Airbnb (private) plans to make its IPO registration public next week, according to a report from Reuters. This would set the company up for a listing next month.

TikTok parent ByteDance (private) is in talks to raise $2 billion, before listing some of its assets in Hong-Kong, according to Bloomberg. The report suggests Sequoia is part of the raise, which would put an implied value of $180 billion on the business.

Farfetch (FTCH) shares surged over 20% this week amid rumours of investment from Alibaba (BABA). According to reports in The Information, Alibaba is in advanced talks to invest nearly $300 million in the London-based online luxury retail platform. Like other leading e-commerce businesses, Fartech has seen a surge in volume during Covid, with total GMV up 48% YoY and Gross Profit up a whopping 87% YoY. Expect another strong set of results, and perhaps some clarity on the Alibaba investment when Farfetch releases Q3 earnings on 12th November.

Coupa Software (COUP) is buying supply-chain planning company Llamasoft (private) for ~$1.5 billion. Llamasoft’s software helps companies model, design and optimise their supply-chain networks using AI to map out scenarios and mitigate potential risks, according to the WSJ.

Ocado (OCDO.L), another UK-based retail innovator, has acquired two US robotics companies, Kindred Systems and Haddington Dynamics for $262 million and $25 million respectively. Kindred Systems builds robots that are used to pick and pack online orders, while Haddington Dynamics (below) creates robotic arms. Ocado is one of the world’s leading retail innovators, investing heavily in areas such as robotic picking, vertical farming, automated meal prep and 3D printing. They also work closely with grocers such as Coles (COL.AX) on their automated fulfilment capabilities.

Earnings

Qualcomm (QCOM) surprised the market, with earnings 24% above expectations. Much of Qualcomm’s future growth comes off the back of their 5G Snapdragon SoC which benefits from an expected shipment of 200 million 5G handsets in 2020 and 500 million shipments in 2021.

MercadoLibre (MELI) - the Amazon of LatAm - showed some massive results this quarter, surging to 28c/share earnings (compared to a loss of 97c/share a year ago). GMV was up 117% YoY and Net Revenues up 148% - led by a continued surge in demand in Argentina (below).

Match Group (MTCH), who owns dating sites Tinder and Hinge, reported 3Q revenue that beat expectations. Tinder reported a 15% YoY revenue increase while the ‘non-Tinder’ portfolio grew 23% YoY. One of the standouts, Hinge, saw app downloads up 82% since the start of the year! The following chart from their earnings release highlights how Tinder and Pairs have led the company’s growth over the past five years, as dating apps surged in popularity.

PayPal’s (PYLP) results were marginally above expectations, with total revenues of $5.46 billion for the third quarter. The company added 15.2m Net New Active (NNA) accounts; well off the 21.3m seen in the second quarter.

Square (SQ) had a stellar set of Q3 results, with gross profit up 63% year-on-year to $794 million. The result was driven by Square’s Cash App, which generated $2.07 billion of revenue and $385 million of gross profit, increasing 574% and 212% year over year, respectively! Seller Gross Profit snapped back to 12% growth, compared with a 9% decline in Q2. Square expects to have over 85 international product launches by year-end.

Have a great weekend.

Charlie

LinkedIn or E-Mail (cnave@granitebaycap.com)

Granite Bay Capital is an innovation focussed investment company with a deep focus on the companies at the leading edge of innovation across major themes such as AI, ubiquitous computing, sustainability, automation and longevity. Any views expressed in this article are those of the author(s) and do not constitute financial advice.