Headline Developments

SpaceX’s (private) Resilience spacecraft successfully transported four astronauts to the International Space Station (ISS). SpaceX launches are projected to cost NASA ~40% less on a per astronaut basis than Russian Soyuz missions, freeing up agency funds for deeper exploration. The image below shows the docking of Resilience with the ISS.

Another piece of good news for Elon Musk this week, with the announcement that Tesla (TSLA) will join the S&P 500 next month. Thanks to that, Tesla stock jumped ~20% during the week. It’s up over 7x in the past 12 months!

Amazon (AMZN) is getting in on the pharmacy business, announcing the launch of their own digital pharmacy, including discounts of up to 80% on some prescriptions for Amazon Prime members. This move was on the cards ever since their acquisition of online pharmacy PillPack back in 2018. The news saw pharmacy businesses Walgreens (WBA), CVS Health (CVS), Rite Aid (RAD) & GoodRX(GDRX) fall 14%, 10%, 16% and 23% respectively.

Microsoft (MSFT) is creating a new security chip designed to protect future Windows PCs. The chip, called Microsoft Pluton, will be built directly into the CPU, as opposed to the current Trusted Platform Module (TPM) which is separate to the CPU. This more integrated solution is being developed in collaboration with Intel (INTC), Qualcomm (QCOM) and Advanced Micro Devices (AMD).

The US has approved Qualcomm (QCOM) to sell 4G mobile chips to China’s Huawei, a rare exemption to the US’ ban on selling to the Chinese tech major. If the chips were going into more advanced 5G devices, it’s reasonable to assume the exemption wouldn’t have been granted!

Meanwhile, Canada indicated that China, Russia, North-Korea and Iran are running state-sponsored cyber attacks that could try to disrupt power supplies. The report, from Canada’s Communications Security Establishment (CES), says they “may target critical Canadian organizations to … pre-position for future activities, or as a form of intimidation”.

Some good news for the environment! Boris Johnson has accelerated the UK’s ban on the sale of new fossil fuel vehicles from 2030 (ten years ahead of the initial target). This is part of a 10-point plan by the Government to tackle the climate crisis. Quebec introduced a similar target during the week, with a 2035 target. Meanwhile, South Australia emphasised Australia’s laggard position with plans to introduce an EV tax (based on mileage) to reclaim lost fuel subsidies!

Rolls Royce (RR.L) is planning to build 16 mini-nuclear plants in the north of England (below). The Small Modular Reactor (SMR) technology is a collaboration with Rolls Royce, Laing O’Rourke (private), Assystem (ASY.PA), Royal BAM Group (BAMNB.AS) and the National Nuclear Laboratory (private). Each plant is expected to produce 440mw of electricity and would each cost ~GBP2 billion to build (after design and engineering hurdles are met). For context, 1mw powers ~100 homes. All 16 plants would be enough to power Birmingham and Nottingham.

Other Developments

Alphabet’s (GOOG) Google Pay is relaunching with a suite of new features under 3 tabs, “Pay” (peer-to-peer payments and tap-to-pay), “Explore” (discounts, offers) and “Insights” (connecting to a user’s bank accounts). There will also be a service called Plex which will offer fully online checking and savings accounts in partnership with existing banks. Pulling all of these services within a unified app seriously shakes up the fintech industry, from payment leaders such as PayPal (PYPL) and Square (SQ) through to the vast ecosystem of ‘challengers’ and open banking intermediaries.

Brazil’s central bank has launched its instant payments platform “Pix” which is expected to speed up and simplify transactions as well as increase competition in what is a highly concentrated banking system. The central bank has been in talks with Google (GOOG) and Facebook (FB) to enter the Brazilian payments market, with Whatsapp payments expected to launch soon.

Uber (UBER) may sell its self-driving car division Uber ATG (private) to Amazon (AMZN), Hyundai (005380.KS) and Shell (RDSA.AS) backed Aurora (private), according to TechCrunch. Uber ATG is backed by Toyota (7203.JP), Softbank (9984.JP) and Denso (6902.JP) and would close quite a challenging chapter for the ride-sharing major (which has included pedestrian fatalities and escalating R&D costs). In our AV map below (which changes daily!) we’ve circled Aurora in red and Uber ATG in green.

Motional (private), a JV between Hyundai (005380.KS) and Aptiv (APTV), has received approval in Nevada to test their fully autonomous vehicles. According to Motional’s CEO Karl Iagnemma, “The coming months will see the completion of a rigorous, self-imposed testing and assessment period…...[and] include fully-driverless testing, on closed courses, this year.” Motional are circled in orange above.

NVIDIA (NVDA) launched a new product which puts their data-centre GPU - the A100 - in a desktop workstation. The 80GB version will come with 320GB of GPU memory - predominantly for use in business and scientific purposes where there’s a substantial data workload. For what it’s worth, a new Macbook Pro, with an AMD Radeon Pro GPU has 4GB of memory and a top of the line gaming desktop (i.e. Alienware) with NVIDIA’s GeForce RTX 3080 will give you 10GB of onboard memory. You can see how this all comes together in the below Terminator-style trailer.

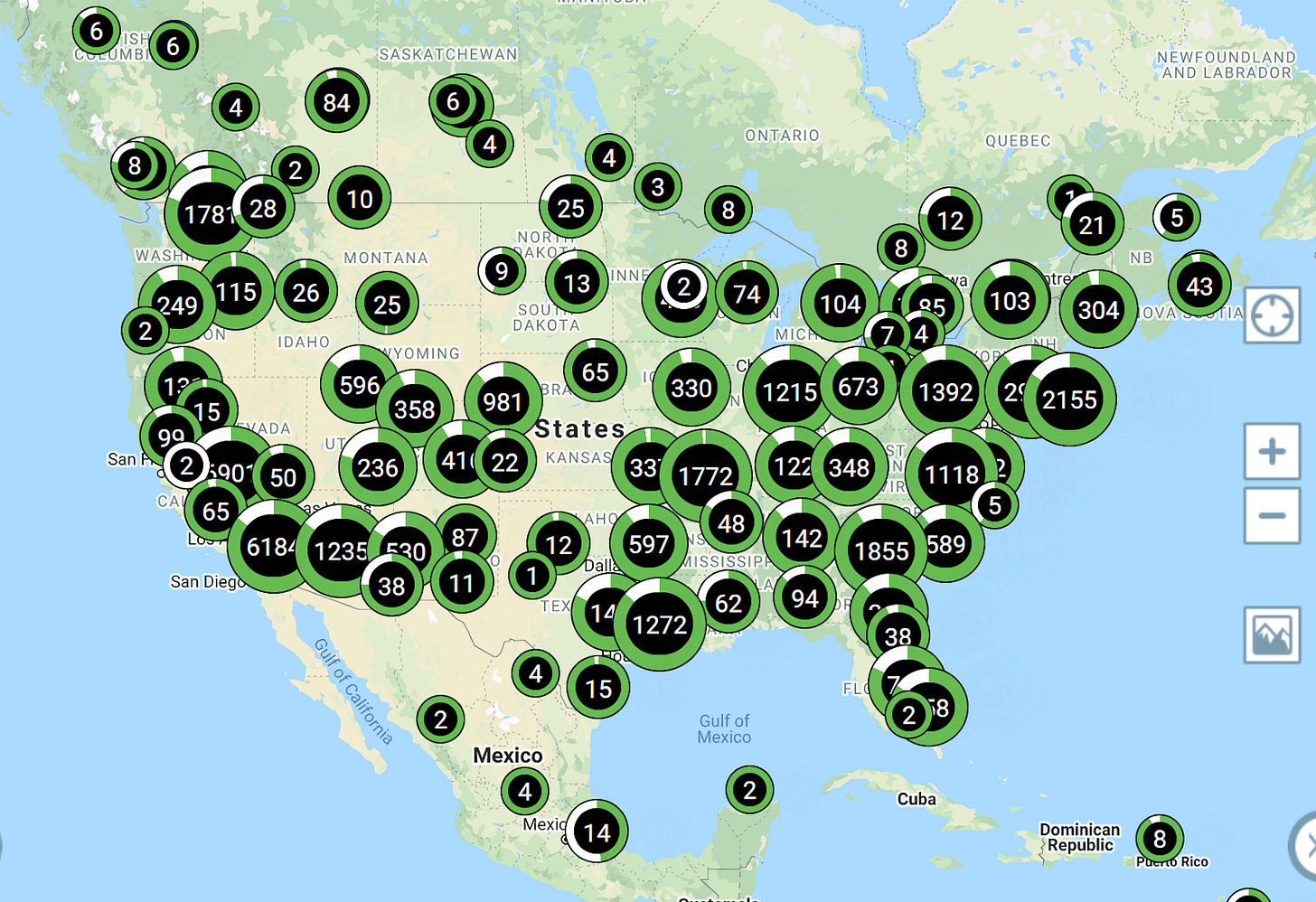

Apple (AAPL) will join forces with EV charging network provider ChargePoint (private) to offer a whole range of EV charging information in Apple’s CarPlay infotainment system. ChargePoint offers businesses and individuals hundreds of thousands of places to charge throughout the US, with an extensive patent portfolio across their EV infrastructure. They’ve received $660 million in funding to date from Toyota Tsusho (8015.JP), Daimler (DAI.DE) and Siemens (SIE.DE). Below is a snippet of EV charge points they offer across North America.

Daimler (DAI.DE) is collaborating with China’s Geely Auto Group (175.HK) to build next-generation combustion engines for use in hybrid vehicles. Geely owns a 9.69% stake in Daimler, a 99% stake in Volvo (VOLV-B.ST) and control of Proton, Lotus, Polestar and Smart.

NXP Semiconductor (NXPI) is going to collaborate with Amazon’s (AMZN) AWS to extend connected vehicle opportunities. The partnership will see the integration of AWS edge and cloud services with NXP’s new S32G vehicle network processor.

Equinor (EQNR), Nork Hydro (NHY.OL) and Panasonic (6752.JP) are exploring opportunities to establish lithium-ion battery production facilities in Norway, with a focus on supplying EVs. Norway, which is hugely dependent on oil and gas revenue, has gone even harder than the UK, setting a target of 2025 to halt the sale of fossil fuel-powered cars.

Marvell Technology (MRVL) announced new chip IP for data centre switches which doubles the bandwidth of current systems. The 112G 5nm SerDes solution has many applications to improve efficiency across networking, data centres, network traffic management, machine learning training and application-specific accelerators. This puts them in a very small group (Apple and Huawei) who are rolling out 5nm technologies.

China Telecom (728.HK) is collaborating with QuantumCTek (688027.SS) to launch a smartphone with quantum encryption security, by early 2021, according to China’s Economic Observer. By installing this special SIM and the corresponding software, a regular phone can be converted to enable ultra-secure voice calls, data transmission and storage that is protected with encryption keys.

Famed short-seller Muddy Waters has slammed Joyy Inc’s (YY) YY Live as “almost entirely fake” just as the company announced a sale of YY’s China division to Baidu (BIDU) for $3.6 billion. Muddy Waters report claims that YY Live is “about 90% fraudulent” with its business based on sham transactions supported by external bot farms.

IPOs

DoorDash (DASH), the biggest food delivery provider in the US, has filed for an IPO. The company has more than tripled its revenue from Jan-Sep this year to $1.9 billion thanks to the pandemic and a growing community of 390,000 merchants and 18 million customers. The prospectus also highlights its intent on using drones and autonomous vehicles (they’ve done trials with GM’s Cruise in the past).

Airbnb (ABNB) published its prospectus showing the impact of the pandemic on its revenues (down 32% up to Sep 2020). You can see below the dip in Gross Booking Value over the years, and the particularly steep hit in 2Q20. However, the September quarter was promising, with $500 million in adjusted EBITDA and $328 million in free-cash-flows (FCF). The company has 5.6m active listings and, as of 2019, 54 million active bookers.

Robinhood (private), the online trading platform popular with retail investors, is lining up advisors for a potential 2021 IPO, according to Bloomberg. Robinhood raised $460 million at an $11.7 billion valuation in September. It has experienced a massive boom in volumes from ~13 million registered users who have flocked to the platform amidst the volatility of 2020. Investors are a who's who of Venture Capital including DST Global, Sequoia, NEA, Index Ventures and Andreesen Horowitz.

Buy-now-pay-later group Affirm (AFRM), founded by PayPal co-founder Max Levchin, filed for an IPO during the week. Their prospectus shows the revenues doubled YoY to $509 million, with little change in their bottom line, losing $112 million. A large chunk of this revenue (28%!) comes from Peloton (PTON). Other key partnerships include Shopify (SHOP) and Walmart (WMT).

Russian e-commerce group Ozon (OZON) - called the “Amazon” of Russia - has filed for an IPO, seeking to raise close to $1 billion on the Nasdaq market, valuing the company at ~$5 billion. This works out at ~5x P/S (annualising their 9m trailing sales). Amazon (AMZN) and Mercadolibre (MELI) are trading off ~4x and 17x fwd P/S, respectively.

Leading AI software developer C3.ai (AI) has filed for an IPO. The company’s software is used by the likes of 3M, Shell and Raytheon to design, build and deploy AI applications of “extraordinary scale and complexity”, according to its prospectus. The company has 29 customers paying an average of $5.6m p.a. Valuation expected around the $3bn range. Below is an example of applications across the manufacturing industry.

M&A | Cap Raise

US regulators approved Mastercard’s (MA) $825 million acquisition of Finicity (private). Finicity provides an open banking platform and API suite to enable clients like mortgage providers to get an instant-read on a borrower's assets, income, spending, employment and cash flow.

Autodesk (ADSK), who owns the leading design platform Autocad, have purchased urban development software provider Spacemaker (private) for $240 million. The Spacemaker software leverages AI to help architects, designers and developers make more informed decisions, optimising designs to account for terrain, wind, lighting, traffic and various other conditions.

Relativity Space (private) is raising $500 million, vaulting the company at $2.3 billion, according to TechCrunch. Relativity Space, which is yet to launch an actual rocket, is aiming to substantially reduce the cost of rocket launches by 3D printing the whole thing from end-to-end. They already have contracts in place with NASA, Lockheed Martin (LMT) and Iridium (IRDM) and it’s expected the cost will be more economical than Rocket Lab’s (private) Electron and SpaceX’s (private) Falcon 9 when they take off in 2021. Investors in the current round are reported to be Fidelity and Tiger Global Management.

PingCAP (private) has closed a $270 million Series D, backed by GGV Capital, Acces Technology Ventures and 5Y Capital. The company, headquartered in Beijing, has developed an open-source newSQL database called TiDB, which is being utilised by 1,500 companies including Square, Japan’s PayPay and Dailymotion for its faster real-time analytics.

Denso (6902.JP) has taken a stake in EV startup Envoy Technologies (private). The company provides EV and charging stations to commercial properties in the US, where residents, guests or employees can borrow cars through an app-based Mobility-as-a-Service (MaaS) platform.

Earnings

Disney (DIS) has reached 73 million paid subscribers for streaming service Disney+, putting it well ahead of a pre-covid target of 60-90 million subscriptions by 2024. On the flip side, its other divisions (parks, studio) struggled during the pandemic, forcing the company to forego another dividend. Disney has executed flawlessly on its streaming service and is well on track to catch leaders Amazon and Netflix by 2024, particularly if they invest in new content and optimise content across other brands including ESPN, Fox, ABC and Hulu.

Meanwhile, the controversial data analytics firm Palantir (PLTR) showed 52% sales growth in the first earnings report since going public. The firm's software provides governments and corporations with tools to help with everything from tracking the spread of the novel coronavirus to zeroing in on terrorists.

Have a great weekend.

Charlie

LinkedIn or E-Mail (cnave@granitebaycap.com)

Granite Bay Capital is an innovation focussed investment company with a deep focus on the companies at the leading edge of innovation across major themes such as AI, ubiquitous computing, sustainability, automation and longevity. Any views expressed in this article are those of the author(s) and do not constitute financial advice.