Headline Developments

The WSJ reported that Salesforce (CRM) may announce a deal to acquire Slack (WORK), pushing Slack’s market cap up 38% to $23.2 billion. This implies a forward Price/Sales of 26x (v 10.8x for Salesforce). In the last couple of years, Salesforce has acquired MuleSoft for $6.5 billion (22x P/S) and Tableau for $15.3 billion (12.5x P/S). The deal makes sense in bringing Salesforce collaboration software in line with their biggest competitor, Microsoft (MSFT) Teams, which saw daily active users hit 115 million last month (v Slack’s 15 million DAUs).

Gig workers at Uber (UBER), Lyft (LYFT) and Doordash (DASH) are set to receive up to 15% of their pay in stock, under a new proposal announced by the SEC. There is also a dollar limit, capping sweat equity at $75k over three years. Uber and Lyft also got a bit of a shot in the arm from the US Government, with 4 million federal employees and their families allowed to use the platforms thanks to a five-year transportation contract.

Snapchat (SNAP) have launched their own version of TikTok, called Spotlight. The new feature will allow users to upload videos (similar to Instagram’s Reels and TikTok). To lure users, those who submit the most popular videos will share in up to $1 million per day until the end of the year. The new platform is live in 11 countries, including the US, UK and Australia.

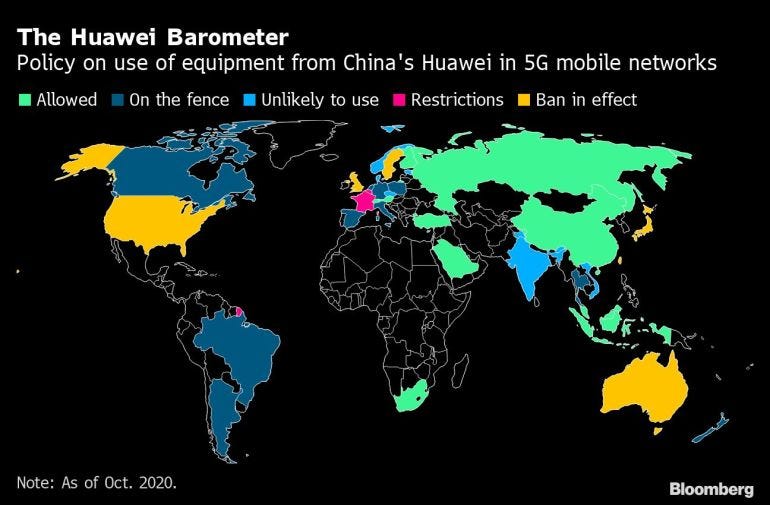

A little update on the ongoing Huawei / ZTE tussles…

The Federal Communication Commission (FCC) has rejected a petition from ZTE (763.HK) asking the agency to reconsider its decision to designate the company a national security threat. In June the FCC had designated ZTE and Huawei national security threats, saying the companies pose a risk of espionage.

Similarly, Germany is tabling draft legislation, the IT Security Law, which aims to go some way towards defining which telecom vendors may pose a national security risk. This legislation has been months in the making, with a balance sought between a more pragmatic Merkel and more hawkish colleagues.

Lastly, the UK put forward their own Telecommunications Security Bill this week whilst pledging $333 million to diversify its sources of 5G wireless equipment. British telcos who contravene a ban on Huawei equipment will face fines of up to 10% of their daily turnover (or $133k/day). We’ve attached a map below from Bloomberg which shows the current state of play regarding Huawei globally.

BT Group (BT-A.LN) has launched a new project called “AIRQKD” to test end-to-end quantum-secured communications for 5G and connected cars. This will enable the storage of significantly more information at a significantly faster rate. The technology is based on Quantum Key Distribution (QKD), a supposedly unhackable way of sharing encryption keys. Other partners include Cambridge University spin-out Nu Quantum, Angoka, Arqit and Duality Quantum Photonics.

Other Developments

SpaceX’s (private) Starship SN8 is on track for a landmark test flight next week after it’s fourth static fire this week (where the engines fire, but the rocket is bolted to the ground). The test flight will take it to a target altitude of 15kms. Starship is SpaceX's next-generation space transportation system, which the company is developing to take people and payloads to Mars and the moon and launch satellites.

The EU could produce enough EV batteries to be entirely self-sufficient by 2025, according to European Commission VP Maros Sefcovic. At present, 80% of the world’s lithium-ion cell production comes from China, however, with there are currently 15 large-scale battery factories under development in Europe from CATL (300750.SZ) and SK Innovation (096770.KS) and the Siemens (SIE.DE), VW (VOW3.DE) backed Northvolt (private).

Siemens (SIE.DE) is joining with Germany’s state-owned railed company, Deutsche Bahn (private), to develop and trial hydrogen trains. With a range of 600kms and a top speed of 160 km/h, Deutsche Bahn believes the new train unit could prevent around 330 tons of carbon dioxide pollution a year. Test runs are scheduled to begin in 2024.

Intel’s (INTC) autonomous vehicle platform, Mobileye, has expanded on their development agreement with Luminar (private) to roll out the latter’s LiDAR technology in their first-generation robotaxi operations. Luminar is backed by Volvo (VOLV-B.ST) and Daimler (DAI.DE) and has plans to list on the public markets via a SPAC.

Fresh off a deal with Apple (AAPL), EV charging leader ChargePoint (private), has announced a deal with Volvo (VOLV-B.ST) to give owners access to the network’s 115,000 North American charging stations, as well as enabling access to the ChargePoint Home Flex home charger (below).

Nvidia (NVDA) will enable gamers to play Fortnite on their iPhones once again. Fortnite owner Epic Games (EPIC) is in a battle with Apple (AAPL) over the 30% commission charged on in-app purchases. Nvidia’s GeForce Now platform lets people play games through their Safari browsers rather than through apps via the app store.

Pinterest (PINS) are will soon be offering their users access to Zoom (ZM) classes. This seems a logical, incremental, innovation given their 442 million monthly active users engaged in home crafts, design and other creative endeavours. We believe Pinterest’s business will benefit substantially in future from the expansion of e-commerce functionality, connecting users with brands directly through the platform.

IPOs

Roblox (RBLX), a gaming platform with a majority pre-teen user base, has filed for an IPO. From Jan-Sep 2020, Roblox had ~31 million Daily Active Users (DAUs) generating $590m in revenue (up 68% YoY). That equates to an ARPU of ~$19. Roblox users create avatars and interact with friends in ~18m worlds, games and experiences created by ~1m mostly pre-teen/teen developers. This is all powered by a virtual economy whose currency, Robux, pays out to developers and is spent by users on experiences/items. Robux can be purchased on a one-off basis or within a Roblox Premium subscription, costing A$7 - A$29 per month.

JD.com (JD) subsidiary JD Health plans to raise $4 billion for a HK IPO in early December, according to the FT. The company offers telehealth and online pharmaceuticals (30% mkt share) to customers in China. They made $1.3 billion in revenues in 1H20 (up 76% YoY) off an average 120,000 daily consultations. Teladoc (TDOC), which just completed their merger with Livongo (LVGO), is trading at ~14x P/S ($28bn mkt cap). The JD Health listing would put the company on a market cap of $28.5 billion. However, a similar multiple to TDOC would put it’s value closer to ~$35 billion.

E-Commerce platform Wish (WISH) has filed to go public, seeking a valuation of between $25-$30 billion. The platform leverages a network of 500k merchants, mostly in China, who sell cheap goods to over 100 million MAUs on over 100 countries. Their 2020 revenues are on track to hit ~$2.3 billion which would imply a P/S of ~12x (v Amazon’s 4.2x, eBay’s 3.43x, MercadoLibre’s 19x 2020e P/S respectively). The filings show that since 2015, they’ve never hit positive EBITDA, with -$99m EBITDA for Jan-Sep 2020 this year (and a net loss of $176m). Wish talk to their extensive data science capabilities and network effect (much like Amazon) to maximise lifetime value, conversion and basked size (below).

InsureTech Metromile (INAQ) plans to go public via a SPAC, valuing the company at ~$1.3 billion. Metromile is available in 8 states in the USA, offering an alternative route to car insurance, charging a premium on a per-mile basis enabled via an on-board device and app (below).

M&A | Cap Raise

Fresh off the Plumbr and Rigor acquisitions, Splunk (SPLK) has announced another network observability acquisition - buying Flowmill (private) during the week. Tim Tully, chief technology officer, Splunk said, “We’re excited to bring Flowmill’s visionary NPM [Network Performance Monitoring] technology into our Observability Suite as Splunk continues to deliver best-in-class observability capabilities to our customers.”

Stripe (private) in talks to raise capital, putting a valuation on the company of between $70-$100 billion! To date, the company has raised $1.6 billion from Sequoia, General Catalyst and Andreessen Horowitz.

China’s ‘uber-for-trucks’, Manbang (private), has raised $1.7 billion in it’s latest capital raise from Softbank (9984.JP), Tencent (700.HK), Sequoia and Fidelity. Alphabet (GOOG) has participated in prior rounds. Manbang claims to have 10 million verified truck drivers and 5 million cargo owners on the platform. A similar platform in the USA, Convoy (private), has previously raised $666 million from Alphabet (GOOG), Jeff Bezos, Marc Benioff, Bill Gates and Bono.

Discord (private), backed by Tencent (700.HK) and AT&T (T) subsidiary Warner Media, is closing a funding round that would value the company at $7bn. Monthly active users (MAUs) have almost doubled to 120 million this year, with ~800k downloads a day recently. A large part of this growth comes as the platform shifts from a more static Slack-esque communications platform to its frequent use by online gamers, particularly within the viral game Among Us.

Mitsubishi Sumitomo Insurance (8725.JP) has invested $350 million in home insurance startup Hippo (private). The new raise will allow the company to reach 95% of homeowners in the US by the end of 2021. The platform is popular for its UX, its smart home packages (which reduce the policy-holders premiums) and its preventative home maintenance - connecting policyholders to Home Pros and vetted local service providers.

Earnings

VMware (VMW), 80% owned by Dell (DELL), delivered adjusted EPS of $1.66 (up 17%) beating estimates of $1.43. Subscription revenue rose 44% to $676 million in Q3 topping on-premise license revenue for the first time. VMW’s virtualisation software is widely used in corporate data centres. The company released a raft of innovative products at its recent VMWorld2020 including a partnership with Nvidia for an end-to-end AI platform and a new architecture for data centre, cloud and edge.

Have a great weekend.

Charlie

LinkedIn or E-Mail (cnave@granitebaycap.com)

Granite Bay Capital is an innovation focussed investment company with a deep focus on the companies at the leading edge of innovation across major themes such as AI, ubiquitous computing, sustainability, automation and longevity. Any views expressed in this article are those of the author(s) and do not constitute financial advice.