Headline Developments

BlackBerry (BB) will partner with Amazon’s (AMZN) AWS to develop and market its vehicle data integration and monitoring platform, IVY. In recent years BlackBerry has transformed itself into a provider of business security and information integration services. Around 175m vehicles are using BB’s QNX service, which was launched 5 years ago. The newest iteration, IVY allows automakers to read vehicle sensor data coming off of equipment from multiple vendors and provide data insights. IVY will enable road condition monitoring, driver performance and battery performance analytics.

In a world-first, California’s Eat Just (private) has been given the right to sell “lab-grown” meat to the public. Just has been working with regulators for the last 2 years according to Josh Tetrick, Eat Just’s co-founder and CEO. This is an exciting development and paves the way for others such as Memphis Meats, Future Meat, Aleph Farms, Meatable, Heuros, Shiok Meats, Finless Foods and VOW (to name just a few!). It’s been widely reported ~15% of global greenhouse gas emissions (GHG) are attributed to livestock, so the milestone we see here with Just is the start of what we hope is a significant shift towards more sustainable consumption.

China’s Chang’e-5 has successfully landed on the moon. The 23-day mission blasted off last week and plans to return to Earth in mid-December, with a collection of moon rocks from a part of the moon called Mons Rumker, thought to be one of the last places on the moon to be volcanically active. It’s highlighted ‘C5’ in the image below which also highlights prior Russian (red) and US (blue) sample return sites. If China succeeds in returning to earth (an extremely challenging feat), it will mark an incredibly significant milestone in the nation’s Moon and Mars exploration activities.

Other Developments

Nintendo’s (7974.JP) Super Nintendo Land, the living video game theme park will open its doors in Japan in February 2021. A key attraction, the Mario Kart rollercoaster is to be set inside Bowser’s castle. It uses AR and projection-mapping tech, with each rider donning a Mario cap-shaped AR headset. Each car has a steering wheel and AR will allow visitors to “compete” against each other.

Lots (more) Amazon (AMZN) news this week. Firstly, they’re teaming up with Apple (AAPL) on a new cloud computing offering using Mac OS; a move to support a growing customer audience developing apps for Apple devices. AWS will make Apple computers available in its data centres, starting with the Mac Mini. This comes as AWS looks to expand its Quantum Hardware Team, with various roles to help “design and build a quantum computer for Amazon Web Services.”

AWS will also be launching a series of industrial machine learning tools (Amazon Monitron and Lookout for Equipment) aimed at helping companies monitor factory workers and machines. Predictive analytics is used to identify potential equipment failures, product defects, worker safety and compliance violations. Amazon is targeting the “industrial internet of things,” estimated to be worth $US949 billion by 2025 and growing at 30% annually.

Reddit (private), a subsidiary of family-owned Advance Publications, revealed its Daily Active User (DAU) number for the first time - 52 million. That’s a growth rate of 44% YoY vs Twitter (187m DAU / 29% growth), Snap (249m DAU / 18% growth) and Facebook (1.82b DAU / 12% growth).

Qualcomm (QCOM) has unveiled its new smartphone System on a Chip (SoC) - Snapdragon 888. The new chip is expected to have 25% higher performance, 35% better graphics rendering and 25% better power efficiency than prior Snapdragon SoCs. The chip also integrates a 5nm X60 5G modem. It is expected that the 888 (lucky number in China) will gain substantial demand from Chinese phone manufacturers such as Xiaomi, ZTE, OPPO, Vivo “if” the US administration doesn’t ban its distribution there (as per the Trump administration’s policy against selling more advanced chips and semi-tech into China).

Dyson (private), best known for vacuum cleaners and air purifiers, will spend £2.75bn on new technologies and products over the next 5 years, which will include a relocation of the business to Singapore. The company aims to double its product portfolio and expand into new areas such as energy storage (developed during its shelved foray into EVs), software, machine learning and robotics.

In yet another streaming service competing for your attention, Discovery (DISCA) will launch its streaming service Discovery+ in the US in January 2021. The service will focus on nature, home improvement and cooking shows (below) and cost $5/month with ads or $7/month without ads.

Black Friday-Cyber Monday total sales for Shopify (SHOP) were outstanding. SHOP saw $5.1bn in sales, up 76% YoY with 44m people buying from Shopify merchants (up 50% YoY). Amazon (AMZN), who do not release Black Friday figures, said this year's holiday shopping period has been the biggest in its history.

Stripe (private) has released a new product, Stripe Treasury, allowing platforms like Shopify (who they’ve partnered with) to offer their users (in Shopify’s case, Merchants) interest-earning accounts in minutes, with near-instant access to revenue and wire transfer/payment avenues. Stripe is enabling standardised access via APIs to its bank partner network, which includes Goldman Sachs, Evolve Bank, Citibank and Barclays.

AutoX (private), backed by Alibaba (BABA), MediaTek (2454.TW) and Dongfeng Motors (0489.HK), will roll out 25 completely driverless cars in Shenzhen this week. This will be the first time China will see full AV on its roads, and we expect considerably more traction over the next couple of years, led by AutoX and a multitude of companies including Deeproute, Toyota-backed Pony.ai, NIO’s Eve, Tencent’s Momenta, Johnson Electric/Nvidia/Renault-Nissan’s WeRide and Baidu’s Apollo.

Hyundai (005380.KS) have revealed their first pure EV platform, the E-GMP, which will serve as the foundation of some 23 upcoming models from next year, starting with the Hyundai Ioniq 5. The platform raises the maximum speed by 70% off a 600 horsepower system; enabling the company to roll out a high-performance vehicle capable of doing 0-100km/h in 3.5 seconds. The range will also be extended to 480kms, with an 80% and 20% charge taking 18 and 5 minutes respectively.

Lucid Motors (private), majority-owned by Saudi Arabia’s sovereign fund, has finished the first phase of its $700 million EV factory in Arizona. This puts the company on track to start commercial production of the Lucid Air in 1Q21. Phase one comprises 1 million sqft (17x gridiron fields) with the aim to increase this to 5m sq ft by 2028. Initial capacity will be 30k vehicles, with expansion goals for 400k vehicles p/a.

Uber (UBER), which was reported to be selling its AV unit to Aurora last month, is now reported to be in advanced talks to sell its flying taxi division, Uber Elevate, to Joby Aviation. Joby, backed by Intel (INTC), Toyota (7203.JP) and JetBlue (JBLU), have developed a flying taxi similar to Uber Elevate (below). It has six electric motors and a range of 240km (enough for a 45-minute London-Manchester trip). For Uber, the sale of Uber Elevate and its AV division provides significant cash flow rationalisation.

IPOs

According to the Wall Street Journal, Airbnb (ABNB) and DoorDash (DASH) are planning for IPO valuations that exceed previous estimates. Airbnb is targeting as much as $35B vs. a previous $30B, while DoorDash is hoping for up to $32B vs. $25B previously.

M&A | Cap Raise

Salesforce (CRM) has confirmed rumours it is buying Slack (WORK) in a $28bn cash and script deal. The deal equates to 24x FY21e forward EV/Sales. Salesforce has been trying to expand into workforce collaboration software for years both organically (with Chatter) and via M&A, buying Quip for $500m in 2016. This deal (CRM’s largest-ever) will be used to beef up its collaboration and messaging footprint and keep pace with Microsoft’s cloud dominance.

S&P Global (SPGI) agreed to acquire IHS Markit (INFO) for ~$44b in an all-stock deal (roughly 25x EBITDA). This is a landmark deal (the largest of the year) combining two of the biggest providers of data to Wall Street. The combined company will become a data behemoth across financial services, energy, transportation and commodities. Below is an indication of the pro forma combined segment revenue.

Facebook (FB) is planning to acquire Kustomer (private), a customer relationship management start-up to help it scale up its e-commerce business. The deal is expected to value Kustomer at ~$1bn.

The WSJ reported that Amazon (AMZN) is in talks to buy podcast start-up Wondery (private) for around $300m. Amazon Music Unlimited competes with Spotify (SPOT) who last year bought podcast network Gimlet Media for $230m. Its shares reached an all-time high as investors rallied around new features (e.g. in-app quizzes, personalised playlists and successful traction with its podcasts business).

ServiceNow (NOW), a workflow management platform, is acquiring Element AI (private) for a rumoured $500m. Element AI, backed by McKinsey & Co and Nvidia, have three core products - ‘Scout’ which provides actionable insights on workflows, ‘Document Intelligence’ for onboarding/compliance/supply chain efficiency and lastly ‘Access Governor’, automating access provisioning.

The soon-to-be listed Affirm (private) has announced the acquisition of Canadian buy-now-pay-later firm Paybright (private), with over 6,000 domestic merchants, for $264 million in a cash and scrip deal.

Flock Freight (private), a platform which enables shared truckloads, has raised $113m in funding from Softbank (9984.JP), Google Ventures (GOOG) and Geely-owned Volvo (VOLV-B.ST). Flock’s software platform helps pool shipments into a single shared truckload to make carrying freight more efficient. It is also expected to reduce freight carbon emissions by up to 40%.

Earnings

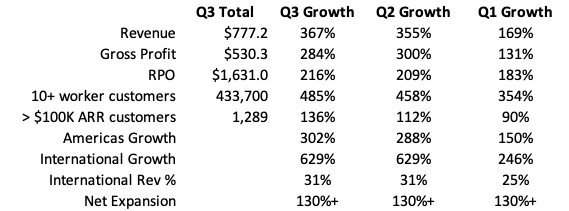

This is now the third consecutive quarter Zoom (ZM) has posted borderline obscene growth in almost every area. The numbers below show 367% YoY revenue growth, 284% growth in gross profit and 136% growth in its $100k+ customer base. Investors are grappling with the sustainability of these trends in a world where several COVID-19 vaccines are close to being approved for use.

Another beneficiary of the pandemic, Crowdstrike (CRWD), showed 85% revenue and subscriber growth; and a doubling of gross profit to $170m. Importantly, free-cash-flow margin continues to improve each quarter, currently sitting at a whopping 32.7%. The company’s incredible growth is highlighted below where it’s subscriber numbers have gone up 3.5x in just a few years. Crowdstrike is moving beyond endpoint protection (devices) to protecting apps and services across cloud providers.

Micron (MU), who produce DRAM and NAND memory products, rallied ~10% this week after raising its earnings guidance for 1Q21 from 32-46c/share to 61-65c/share, in line with revised revenue guidance of $5.7-$5.75b (from $5-$5.4b). These revenue adjustments are ~10% higher than those previously forecast by analysts.

Enterprise software platforms Elastic (ESTC) - search and observability, OKTA (OKTA) - identity access management and Snowflake (SNOW) - data warehousing, all comfortably beat earnings estimates for their respective 3rd quarters. Snowflake’s outlook was slightly disappointing with ‘only’ 100% growth projected for the 4th quarter vs 119% for the 3rd quarter, resulting in the shares pulling back (note that SNOW is up ~140% since its Sep-2020 IPO).

Data analytics platform Splunk (SPLK) shares fell a whopping 23% after posting third-quarter revenue of $559m, short of the $613m consensus estimate (and down 11% year on year). The company is undergoing a cloud transition to a software-as-a-service business model.

Have a great weekend.

Charlie

LinkedIn or E-Mail (cnave@granitebaycap.com)

Granite Bay Capital is an innovation focussed investment company with a deep focus on the companies at the leading edge of innovation across major themes such as AI, ubiquitous computing, sustainability, automation and longevity. Any views expressed in this article are those of the author(s) and do not constitute financial advice.